President Tinubu’s radical reforms are set to transform Nigeria’s economy

A month into the role and Nigeria’s new president, Tinubu is already having a significant impact on the economy

3 minute read

Gail Anderson

Research Director, North Sea Upstream

Gail Anderson

Research Director, North Sea Upstream

Gail focuses on the North Sea Upstream industry and its gas and power sector.

Latest articles by Gail

-

Opinion

North Sea upstream: 5 things to look for in 2025

-

Opinion

Video | Shell and Equinor announce UK asset merger to create new JV

-

Opinion

End of an era looms as Chevron seeks UK exit

-

The Edge

Why the transition needs smart upstream taxes

-

Opinion

North Sea upstream: 5 things to look for in 2024

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

Tinubu’s opening message to local and foreign investors

In his inauguration address on 29 May, newly appointed President Tinubu of Nigeria had a message for local and foreign investors:

"Our government shall review all their complaints about multiple taxation and various anti-investment inhibitions. We shall ensure that investors and foreign businesses repatriate their hard-earned dividends and profits home.

The Central Bank must work towards a unified exchange rate. This will direct funds away from arbitrage into meaningful investment.

We commend the decision of the outgoing administration in phasing-out the petrol subsidy regime which has increasingly favoured the rich more than the poor."

Progress so far

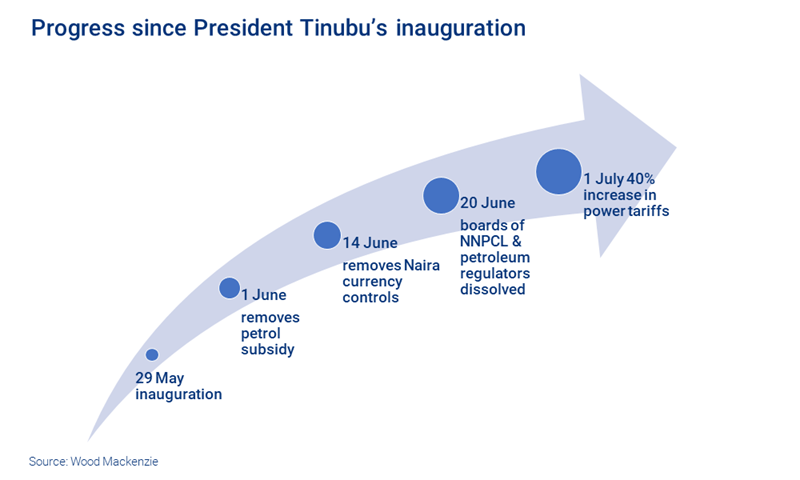

A month into the role and President Tinubu means business. Subsidies on petrol were removed on 1 June. A litre is now selling for 500-600 Naira (US$1.00-US$1.30) compared to 180-200 Naira (US$0.38 to US$0.43). This will save the federal government over US$10 billion this year.

This was followed on 14 June by the removal of state controls on Nigeria’s currency, the Naira, including allowing depositors more access to forex held in bank accounts.

Previously, the Central Bank of Nigeria (CBN) operated multiple exchange rates. Propping up the Naira ate into foreign exchange reserves and acute dollar shortages were common. The disparity between the official and unofficial rates allowed back-market trading to balloon.

After the float, the Naira depreciated steeply, falling to as low as 775 Naira/USD before stabilising at around 750 Naira/USD, a drop of 63%.

The chart below summarises the progress in Nigeria so far, since the inauguration last month:

Could this agenda finally kick-start upstream investment, particularly for gas?

The change above is highly significant for gas producers. Domestic gas prices are quoted in US dollars, but paid in Naira, at official central bank of Nigeria (CBN) rates. This meant producers were operating with significant currency losses in addition to the volume and payment risks from the power sector. Full removal of currency controls should eliminate this problem, although it is unclear how and when it will be implemented.

This policy will by extension also impact the power sector. Tariffs along the gas-to-power value chain are regulated at below the cost of supply. If the Naira cost of gas increases for generators, then Nigeria’s power sector regulator would need to pass these costs down to end users. On cue, it is reported that electricity tariffs will increase 40% in July.

Since Nigerians are already struggling with higher costs of imported necessities such as food and now petrol, both worsened by a free currency market, a massive hike in electricity tariffs would be too much to bear. The government would need to do something to soften the blow.

The new president’s policy advisory council on Nigeria’s energy and natural resources sector, proposes funding direct cash payments of US$0.8 billion this year to the poorest 10 million households, reaching 55 million Nigerians.

While targeted aid will be welcomed, any cash transfer scheme comes with a massive caveat: it would need to be smart enough to avoid replacing one expensive and corrupt subsidy scheme with another. And it will need to be part of a comprehensive package of measures to tackle a cost-of living-crisis and keep the public onside. Easier said than done.

Despite the high risks of Tinubu’s economic shock therapy, his demonstrated willingness to make the big calls on the economy will immediately improve the federation’s finances and make Nigeria more attractive to foreign capital, and more competitive for inward investment.

Notably, ending subsidies for petrol, which is used extensively in distributed generation, will arguably do more than any other measure to help Nigeria's transition to a low-carbon economy. This will encourage consumers to source cleaner, cheaper alternatives such as gas or solar, or even use the electricity grid more often.

Looking ahead

It’s early days, but quite suddenly Nigeria’s long-term fortunes are considerably brighter with the balance of risk firmly to the upside.