The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

To accelerate Europe’s energy transition, investors need to leverage opportunities to diversify the region’s energy mix

3 minute read

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray is responsible for Wood Mackenzie’s global coverage across the hydrogen value chain.

Latest articles by Murray

-

Opinion

Our top takeaways from the World Hydrogen Summit

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what utilities and developers need to know

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what industrial players need to know

-

Opinion

eBook | Investing in hydrogen from now to 2050: what you need to know

-

Opinion

What lies ahead for hydrogen and low-carbon ammonia?

-

Opinion

Ebook | Overcoming the challenges around hydrogen deployment

Gail Anderson

Research Director, North Sea Upstream

Gail Anderson

Research Director, North Sea Upstream

Gail focuses on the North Sea Upstream industry and its gas and power sector.

Latest articles by Gail

-

Opinion

North Sea upstream: 5 things to look for in 2025

-

Opinion

Video | Shell and Equinor announce UK asset merger to create new JV

-

Opinion

End of an era looms as Chevron seeks UK exit

-

The Edge

Why the transition needs smart upstream taxes

-

Opinion

North Sea upstream: 5 things to look for in 2024

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

Mhairidh Evans

VP, Global Head of CCUS Research

Mhairidh Evans

VP, Global Head of CCUS Research

Mhairidh leads our global research on carbon capture, utilisation and storage (CCUS).

Latest articles by Mhairidh

-

Opinion

Can CCUS help achieve Net Zero?

-

Opinion

Can CCUS momentum overcome headwinds to the industry?

-

Opinion

Carbon management frequently asked questions part 3: CCUS

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

-

Opinion

Our top five takeaway messages from the CCUS conference 2023

-

Opinion

The UK’s journey to net zero: an uncertain path ahead

Neivan Boroujerdi

Director, Corporate Research

Neivan Boroujerdi

Director, Corporate Research

Neivan leads Wood Mackenzie's global corporate NOC coverage.

Latest articles by Neivan

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

ADNOC doubles net hydrogen production through stake in ExxonMobil’s Baytown project

-

Opinion

ADNOC acquires stake in Rovuma LNG from Galp

-

Opinion

Benchmarking the Middle East NOCs against the supermajors

-

The Edge

How and why big oil is strengthening its oil and gas exposure

To accelerate Europe’s energy transition, investors need to leverage opportunities to diversity the region’s energy mix. However, for the strategy to be effective, each individual sector needs to work together under an integrated approach.

Following the SPE Offshore Europe 2023 event, its overarching theme of ‘accelerating the transition to a better energy future’ has further highlighted the need for Europe to not only reduce its carbon emissions, but to achieve energy security.

Our report draws on data and insights to understand these sectors in greater detail and explore how they will need to interact as the energy transition gathers pace.

Fill in the form to download the full report, or read on for an introduction to the challenges and opportunities across each sector.

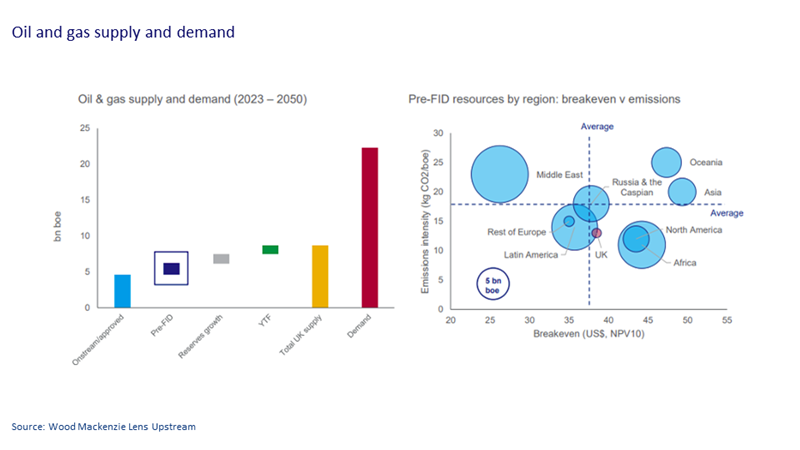

A spotlight on the UK oil & gas sector

With energy security high on the political agenda, the spotlight is on the UK to increase its oil and gas production.

From an economic, carbon, and energy security perspective, there is an argument to prioritise domestic opportunities. Given that the UK still has 4-5 billion barrels of oil equivalent (boe) available in pre-FID projects, the region’s existing reserves could double.

However, economic viability is a primary issue. Political uncertainty and the extension of the Energy Profits Levy (EPL) has raised the marginal rate to 75% in the UK, prompting the cancellation of rigs.

Investors face further uncertainty with a general election expected at the end of 2024, where the opposition party is proposing the removal of the EPL and taxing the United Kingdom Continental Shelf (UKCS) at the same rate as Norway.

Hydrogen’s potential to displace refining processes

Across Europe, there is growing interest in low-carbon hydrogen displacing carbon-intensive hydrogen in ammonia, methanol and refining processes. It could also be used in high-temperature heat industries, and as marine and aviation fuel.

As countries strive to reach net zero targets, there could also be opportunities for low-carbon hydrogen to power turbines when renewable reserves are low. There a number of green and blue hydrogen projects in the pipeline, particularly for ammonia production.

In response to the invasion of Ukraine, the European Union has targeted 20 Mtpa of low-carbon hydrogen demand by 2030. However, such volumes seem overly ambitious.

Despite these opportunities, the processes for producing low-carbon hydrogen are inefficient and the costs are high. It remains to be seen if low-carbon hydrogen can be produced cost-effectively at scale.

The success of hydrogen projects will also be determined by how ‘clean hydrogen’ is defined and how funding is delivered.

Decarbonising industrial sectors with CCUS

As Europe’s energy gathers pace, there is an increased urgency for industrial sectors like cement and steel to achieve carbon capture, utilisation and storage (CCUS) at scale.

Despite being a third-choice option for decarbonising industrial processes behind zero-carbon electricity and less polluting substitutes, all three approaches are likely to be employed to some extent.

In 2021, the UK was one of the first countries to link CCUS to net zero targets, but it has since failed to deliver clarity on funding. However, other countries, including the USA, Canada, Netherlands and Denmark have announced substantial incentives for CCUS.

Even with funding, it will take time to build the necessary infrastructure and establish a viable market for CCUS. The technology is still at an early stage of development and a capable supply chain will be required to execute projects.

Paving the way for Europe’s energy transition

In addition to its offshore wind potential, the North Sea presents investors with opportunities to leverage existing gas infrastructure to establish hydrogen and CCUS industries.

At the same time, linking domestically produced hydrogen with long duration energy storage could enable European countries to establish energy security and become less dependent on imports.

However, to ensure investment in clean hydrogen and CCUS continues, a stable and reliable fiscal energy regime will be paramount.

Download the full report

To learn more about the challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors, fill out the form at the top of the page to download our full report.