Supply chain relief slowly arrives for US solar

The US solar industry is still constrained, but conditions are improving

3 minute read

Michelle Davis

Head of Global Solar

Michelle Davis

Head of Global Solar

Michelle leads our solar research, identifying emerging industry themes and cultivating a team of solar thought leaders.

Latest articles by Michelle

-

Opinion

What could further trade actions mean for the US solar supply chain?

-

Opinion

Sunny skies ahead: the solar market and supply chain in 2024 and beyond

-

Opinion

Our top takeaways from the Solar & Energy Storage Summit 2024

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

Is the IRA paying off for the US solar supply chain?

-

Opinion

US solar shattered records in 2023, but will this continue in 2024?

The first quarter of 2023 was a strong one for the US solar industry. The market installed 6.1 GWdc of capacity, a 47% increase from the first quarter of 2022. Granted, these volumes are bolstered by delayed projects from last year finally coming online, and the industry is still supply chain constrained. But it appears that relief is slowly arriving to the US.

In our US solar market insight Q2 2023 report, created in collaboration with the Solar Energy Industries Association (SEIA), we highlight the most recent supply chain dynamics and our current forecasts. Fill in the form for a complimentary copy of the 15-page executive summary. Or read on for some key highlights.

Solar equipment is moving through US customs, bringing some hope for continued relief

The Uyghur Forced Labor Prevention Act (UFLPA) has prevented solar equipment from reaching project sites since last summer. Customs and Border Protection (CBP) understandably detained any shipments suspected of including materials produced with forced labor. This meant that solar developers had steep requirements for demonstrating that the polysilicon in their solar modules or cells was not sourced using forced labor.

It is taking time, but importers are making progress on providing the proper documentation to CBP. Import data shows that more than 12 GWdc of solar modules were imported in the first quarter of this year, compared to 29 GWdc for all of 2022.

While pricing remains elevated, we expect prices to start declining later this year as suppliers continue to move equipment through customs.

IRS guidance complicates the pursuit of the domestic content tax credit adder

The last several months have also brought multiple pieces of guidance from the IRS on various incentives in the Inflation Reduction Act (IRA). Since our last report, guidance was published on the low-to-moderate income (LMI) adder for projects under 5 MWac (Notice 2023-17), the energy communities adder (Notice 2023-29) and the domestic content adder (Notice 2023-38).

The domestic content adder in particular is getting a considerable amount of attention in the solar industry. The industry had been eagerly awaiting guidance on whether module assembly in the US would be sufficient to qualify a project for the additional 10% tax credit.

The short answer is that it does not. The IRA has stipulated that the subcomponents of the solar module must also be made in the US (to a degree). The rules to qualify are complex, but it is Wood Mackenzie’s view that it will be quite challenging for a project to qualify without modules that are made with domestically-produced solar cells (the main subcomponents of a module). And even with domestic solar cells, there will need to be sufficient domestic manufacturing capacity of multiple other components (glass, frames, junction boxes, encapsulants and components of inverters for example) for developers to meet the requirements.

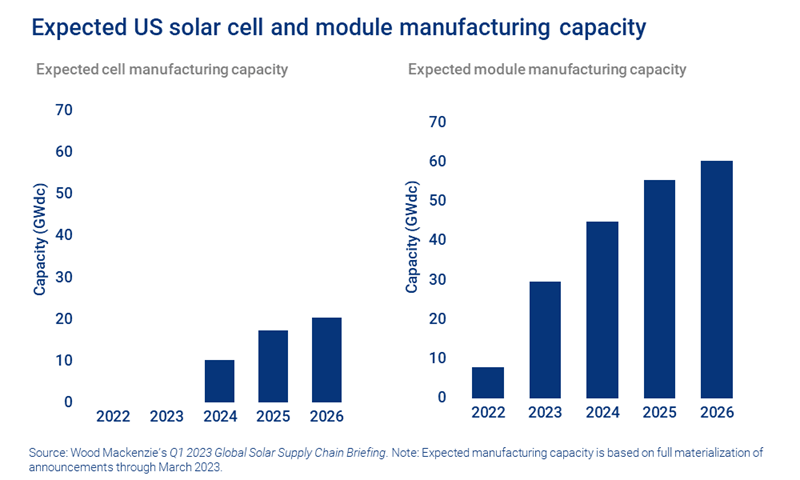

There are 20 GW of announced solar cell manufacturing facilities in the US, but no operational capacity online today. But this is a small share of the 60 GW of operational, under construction and announced module manufacturing facilities in the US to date. For more details, read US solar: the long and winding road to domestic module production. Since these facilities take at least two to three years to be built and to ramp up production, it is highly unlikely that any solar projects will come online in the near-term that take advantage of the domestic content adder.

Wood Mackenzie doesn’t assume what share of solar installations will qualify for certain types of tax credit adders. But we do assume a slow increase in the weighted average tax credit for solar projects, which drives deployment in our outlook.

US solar growth continues as the industry works through challenges

Despite near-term challenges related to supply chain constraints and tax credit qualification, growth in the US solar industry is expected to be strong. In 2023, we expect the industry to install 29 GWdc compared to 21 GWdc in 2022. From 2024 to 2028, we project growth rates to be consistently in the low teens. Solar continues to be cost competitive, whether that’s compared to other forms of power generation or customers’ retail rates.

Nearly 236 GWdc of total solar capacity is expected to come online in the next five years. This will almost triple the installed fleet from 142 GWdc as of year-end 2022 to 377 GWdc by year-end 2028.

The full report explores each segment in greater detail, including relevant considerations around the guidance on various tax credit adders. Fill in the form at the top of the page for a complimentary copy of the 15-page executive summary.