The impact of China’s 2024 solar PV manufacturing guidelines

We explore the impact of China's new rules on solar PV overcapacity, pricing and market dynamics

5 minute read

Yana Hryshko

Senior Research Analyst and Head of Global Solar Supply Chain

Yana Hryshko

Senior Research Analyst and Head of Global Solar Supply Chain

Latest articles by Yana

-

Opinion

The impact of China’s 2024 solar PV manufacturing guidelines

-

Opinion

How are companies managing excess capacity in Asia Pacific’s solar supply chain amid a solar boom?

In November 2024, China’s Ministry of Industry and Information Technology released revised guidelines for the photovoltaic (PV) industry. The new guidelines are set to reshape the solar manufacturing industry, addressing overcapacity, pricing volatility and inefficiency across the value chain.

While existing polysilicon, wafer, cell, and module manufacturing capacity largely aligns with the new regulations, emerging manufacturers and new expansions will be the most impacted. These changes will catalyse consolidation, market shifts and ultimately lead to a more efficient and sustainable solar industry.

What are the key changes?

1. Stricter efficiency standards

- Cell and module performance: P-type cell efficiency increased to 23.7%, and N-type cells introduced with 26% efficiency, favoring next-generation technologies.

- Degradation rates: Lower degradation rates (N-type: ≤1% over 25 years) encourage higher-quality manufacturing and reduced warranty risks.

2. Increased capital investment requirements

- The minimum capital ratio for new and expanded PV projects increased from 20% to 30%, raising entry barriers and discouraging speculative expansion.

3. Tighter energy and resource consumption standards

- Stricter power consumption thresholds force manufacturers to adopt advanced, cost-efficient production processes.

4. Enhanced reporting and compliance

- Manufacturers must meet stricter compliance and quality assurance requirements, ensuring only competitive players remain in the market.

The 200+ GW expansion that likely won’t happen

The 2024 guidelines are primarily aimed at new facilities and expansion plans rather than existing manufacturing capacity. Existing production lines for polysilicon, wafer, cell, and module manufacturers are largely compliant with the new efficiency standards. The main impact will be felt by the emerging manufacturers and new entrants who are struggling to meet the capital investment threshold and technological demands of the guidelines.

At the same time, the expansion plans of the most prominent manufacturers are not affected as they can meet the new module efficiency demand.

Approximately 200 GW of new PV module manufacturing capacity planned in the next few years will likely not materialise, as the guidelines target new capacity expansions and speculative investments. These plans, driven by recent entrants, face hurdles due to capital requirements and technology standards. The existing 1.6 TW of capacity will mostly remain intact, but the pace of new growth will slow significantly.

The shift toward N-type modules will favour larger, financially resilient manufacturers who can absorb the upfront costs of transitioning to high-efficiency technologies. Smaller, emerging manufacturers who cannot meet the new capital and technology requirements will face increased financial pressure and will likely be forced to exit the market. This will accelerate market consolidation, leaving the industry dominated by a smaller number of large players who control premium module production.

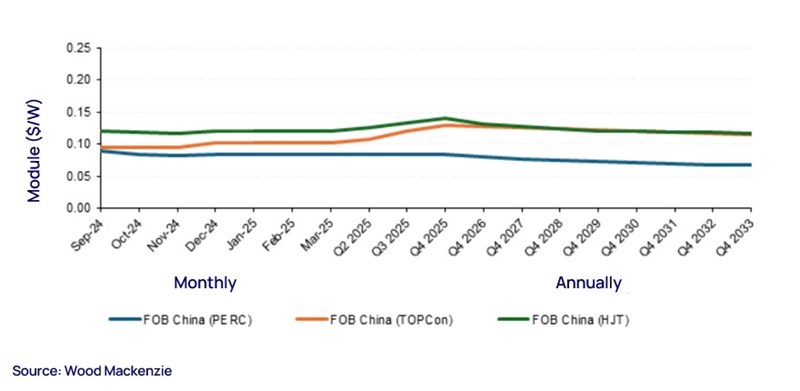

N-type module prices: short-term price premium, long-term stabilisation

The shift to higher-efficiency N-type modules (TOPCon, HJT) will push PERC prices lower due to declining demand. PERC technology, which has already met earlier efficiency standards, will be phased out in favor of N-type technologies that offer superior performance and durability. As a result, PERC module prices will experience a steady decline. The guidelines raise technical and capital requirements, forcing out low-cost producers and outdated facilities that cannot meet new standards. This reduction in inefficient production capacity will likely help rebalance supply and demand, alleviating pressure on prices.

TOPCon and HJT modules will initially see price increases due to higher production costs associated with these advanced technologies. In the short term, manufacturers will charge a premium for high-efficiency modules. However, as production processes scale, prices for N-type modules will stabilise and eventually decrease, with a long-term trend toward price normalisation.

By focusing on advanced technologies (e.g. N-type cells with higher efficiencies), the guidelines encourage the production of premium products with higher price points. This transition reduces the reliance on mass production of low-margin products and supports a shift toward sustainable pricing.

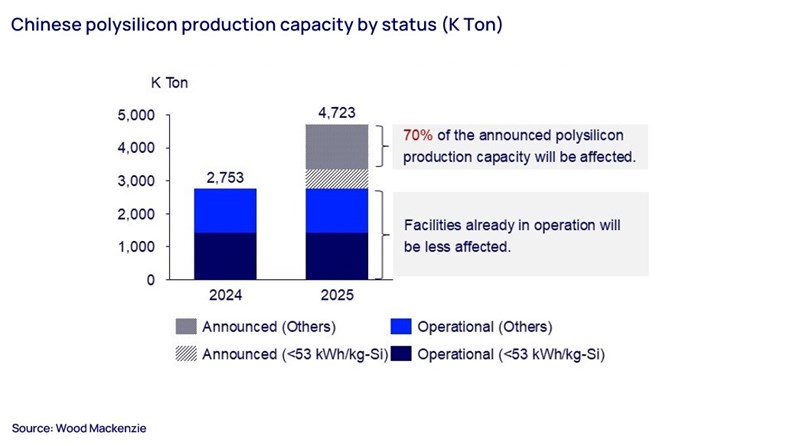

New manufacturing guidelines will impact 70% of announced polysilicon expansions

The guidelines’ energy consumption standards for polysilicon production (≤53 kWh/kg) will impact polysilicon producers as current regulations require ≤60 kWh/kg of energy consumption, and most of the existing facilities can meet these standards.

However, the newly built facilities will have to lower the energy consumption to ≤53 kWh/kg, which will require the suppliers to invest in technological upgrade or decrease the utilisation rates which consequently will result in polysilicon supply shortage.

Even though now there is oversupply of polysilicon with existing operational capacity of >1 TW, most of these facilities require upgrades, which will fall under the new regulations. In addition to that, the announced expansion of existing suppliers will be affected by new regulations, and according to our calculations about 70% of announced capacity will not meet the new standards (i.e., might not materialise). This will consolidate the polysilicon industry, making the supply chain more efficient and stable.

Short-term price volatility, long-term market stability

It is expected that polysilicon prices will increase in the short-term, however, the market will ultimately stabilise as production becomes more concentrated among large, efficient players. Over time, this will lead to lower costs and more predictable pricing for polysilicon, benefiting the entire solar supply chain.

Increased R&D and higher production costs for N-type cells

Cell manufacturers will be heavily affected by the new efficiency requirements for N-type technologies (TOPCon and HJT). The transition from PERC cells to N-type cells will require significant investments in R&D and production upgrades. Manufacturers that already produce N-type cells will benefit from increased demand, while those who remain reliant on PERC technology will face declining margins.

In the long run, the guidelines will foster a more sustainable, competitive, and efficient solar industry, ensuring that only the most technologically advanced and financially robust manufacturers thrive.

While the short-term effects may include higher costs and supply chain disruptions, the industry is set for a long-term transformation that will lead to greater efficiency, market stability and cost reductions.

To get more detailed insights into the impact of regulatory changes on the PV and solar industry, click here to explore our global power and renewables offering.