Interested in learning more about our gas & LNG solutions?

The US natural gas market wakes up

North American gas prices were quiet for more than a decade. Now changing market conditions are creating increased volatility

1 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

-

Opinion

What the US attack on Iran’s nuclear installations means for energy

The Kraken, the monstrous giant squid in Alfred Lord Tennyson’s poem, lies for long ages at the bottom of the ocean in “ancient, dreamless, uninvaded sleep”, until suddenly it wakes and rises roaring to the surface. The US natural gas market has been a bit like that. Since 2009, benchmark Henry Hub gas has averaged about $3.30 per million British Thermal Units, and has only rarely spiked above $5. But this week, the front month futures price went above $8 / mmBTU, for the first time since 2008.

Although gas prices quickly fell back — the futures were back below $7 / mmBTU on Thursday evening — the price spike has highlighted the new dynamics in the market. Changes on both the supply side and the demand side for US gas are combining to reduce flexibility and increase price volatility. There are good reasons to think that the current (relatively) high prices will not last in the long term. But for a while at least, further spikes are definitely possible.

On the demand side, the inflexibility in the market is being created in part by the loss of coal-fired power generation capacity. There has been a wave of shutdowns of coal-fired plants that have reached the end of their economic lives, often hastened by environmental regulations and corporate emissions goals. The US lost an average of 11 gigawatts of coal-fired generation capacity every year between 2015 and 2020.

That means coal is less able to act to put a cap on gas prices. Traditionally, if gas prices rose high enough, generators would switch to burning more coal, bringing the market into balance. The loss of coal capacity means that buffer has been eroded. Low thermal coal stockpiles have weakened it further.

At the same time, North America’s gas market is becoming increasingly connected to the rest of the world. Once largely sealed off in splendid isolation, it has been linked to global trends by the growth of LNG imports since Cheniere Energy shipped its first cargo from Sabine Pass Louisiana in 2016. When the global gas market is oversupplied, as it was in the summer of 2020, US LNG exports drop, driving down prices in North America.

When global markets are tight, as they are today, US LNG exporters run at full capacity. That has been stoking concerns over whether gas in storage in the US will be adequate going into next winter, contributing to the upward pressure on prices, says Eugene Kim, a research director on Wood Mackenzie’s Americas gas team.

On the supply side, meanwhile, producers’ responses to high prices are being constrained in many cases by companies’ commitments to maintaining capital discipline, paying down debt and returning cash to investors. There was a good example of this last week from Comstock Resources, which produces gas in the Haynesville Shale. It is generating free cash at current gas prices, even though it has hedged about 50% of its production. It is planning a steep reduction in its debt, from 3.8 times adjusted earnings in 2020 to 1.5 times this year, and announced last week that it would use some of its cash flow to redeem US$245 million of 7.5% senior notes, due 2025. Once its leverage ratio target has been achieved, the company says, it will aim to return capital to shareholders. Meanwhile it is planning for average overall production growth of roughly 2-7% this year.

That capital discipline among E&P companies means that US gas production this month is running only about 3% higher than in April 2021.

The reason to think that current market conditions will be time limited is that the US still has very large gas reserves that can be produced at relatively low cost. “What sets the long-term price of US gas fundamentally is the marginal gas molecule required to be brought into the marketplace to meet demand,” Eugene Kim says. “Blessed with plentiful low-cost gas resources, the fundamental price of Henry Hub is closer to $3/mmBTU, rather than the current market prices that have been as high as $8/mmBTU.”

Still, now the gas market has been woken up, it may be a while before it goes back to sleep again. The availability of coal as an alternative to gas is only going to decline. The US today has about 200 gigawatts of coal-fired generation capacity. Wood Mackenzie forecasts that by 2030, that will have dropped to only about 90 GW. Over the same period, wind and solar power are expected to grow rapidly, creating a threat of additional gas market imbalances caused by variations in their output. Investments to help manage gas price volatility, including underground storage, may look increasingly attractive.

In brief

The lockdown in Shanghai has gone into its fifth week, with new enforcement measures announced, as the authorities struggle to control the city’s Covid-19 outbreak. Shanghai is normally the world’s busiest container port, and difficulties in moving freight to and from the docks have contributed to widespread disruption in international trade. The shipping congestion off Shanghai is adding to the strain on global supply chains and the upward pressure on global inflation. Foreign businesses are struggling to bring staff back to work in Shanghai, despite the Chinese government’s call for work to be resumed at 666 major businesses.

Germany has been one of the EU’s strongest opponents on a ban on energy imports from Russia. But this week, foreign minister Annalena Baerbock pledged to end imports of Russian oil by the end of the year. The German government has made no such commitment for gas, however. Employers and trade unions this week issued a joint statement warning that “a rapid gas embargo would lead to loss of production, shutdowns, a further de-industrialisation and the long-term loss of work positions in Germany.” Martin Brudermüller, chief executive of BASF, said a shut-off of Russian gas imports to Germany would cause the “worst crisis since the second world war”. Finance minister Christian Lindner told the BBC: “We are willing to stop all energy imports from Russia, it's just a matter of time.”

Halliburton, the oilfield services group, reported a 24% jump in revenues and a 44% increase in adjusted earnings for the first quarter, and gave an upbeat view of its prospects for the rest of the year. Chief executive Jeff Miller said: “We see significant tightness across the entire oil and gas value chain in North America. Supportive commodity prices and strengthening customer demand against an almost sold-out equipment market are expected to drive expansion in Completion and Production division margins.”

Oil producers in the Federal Reserve district that includes Oklahoma, Colorado and Wyoming say they need on average a crude price of $62 per barrel for drilling to be profitable, but $86 per barrel for a substantial increase in activity, according to the latest energy survey from the Kansas City Fed.

Other views

Security alert: five lessons from the energy crisis

Simon Flowers — How the energy crisis is a boon for hydrogen exporters

Julian Kettle — Will a recession stall or just pause the great energy transition gold rush?

Texas can get to net zero by 2050 and simultaneously bolster the economy

Emil Dimanchev and others — Health co-benefits of sub-national renewable energy policy in the US

Binyamin Appelbaum — Enough about climate change. Air pollution is killing us now

Quote of the week

“The key thing that people want to see — and that I think is going to allow us that social licence to continue to operate — is that net zero by 2050… Until we get there and until we’ve developed that track record, I think it’s going to be hard to convince others that we should be exporting our products elsewhere.” — Derek Evans, chief executive of Canadian oil sands producer MEG Energy, explained the need for the industry to focus on emissions, in an interview with the Globe and Mail.

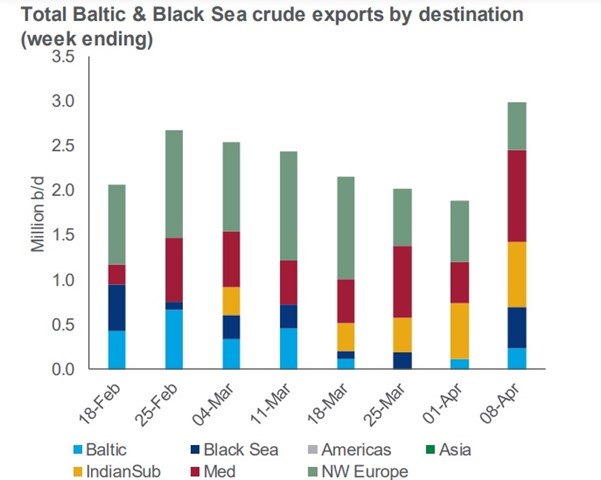

Chart of the week

This chart comes from the latest in Wood Mackenzie’s new regular series of briefings on the implications for energy of Russia’s invasion of Ukraine. It shows Russian crude exports from the Baltic and Black Sea in recent weeks. (The data come from Wood Mackenzie’s Russian Waterborne Crude Service and our Vesseltracker service.) Two conclusions are immediately apparent. One is that, despite all the disruption caused by financial sanctions and “self-sanctioning”, Russian crude exports were actually stronger in the first week of April than they had been immediately before the invasion. The second is that the Indian subcontinent and the Mediterranean have become more important as destinations, while northwest Europe has declined. It is worth noting, however, that some of the oil initially bound for the Mediterranean and northwest Europe will ultimately end up somewhere else, possibly after transshipment to a different tanker.