What does summer 2024 hold for North American gas and LNG?

Gas prices, production dynamics, Mexican imports and power exports to Canada could impact supply

4 minute read

Eric McGuire

Director of Natural Gas and LNG Analytics

Eric McGuire

Director of Natural Gas and LNG Analytics

Eric is a Director of Research, overseeing Wood Mackenzie’s North America S&D team.

Latest articles by Eric

-

Opinion

Dynamics shaping the European natural gas market

-

Opinion

North America natural gas summer market outlook – 2025

-

Opinion

4 critical moments for North American oil and gas trading

-

Opinion

5 factors affecting North American natural gas markets this winter

-

Opinion

What does summer 2024 hold for North American gas and LNG?

Amir Rejvani

Senior Research Analyst, LNG and Intrastate Storage

Amir Rejvani

Senior Research Analyst, LNG and Intrastate Storage

Latest articles by Amir

-

Opinion

What does summer 2024 hold for North American gas and LNG?

-

Opinion

Cold weather impacts on US natural gas

-

Opinion

US LNG maintenance forecast | On-demand webinar

Randall Collum

Senior Vice President, Commodity Trading Data and Analytics

Randall Collum

Senior Vice President, Commodity Trading Data and Analytics

Randall is an experienced analyst with more than 20 years of experience in natural gas and oil production analytics.

Latest articles by Randall

-

Opinion

North America natural gas summer market outlook – 2025

-

Featured

Oil, power, gas trading 2025 outlook

-

Opinion

4 critical moments for North American oil and gas trading

-

Opinion

5 factors affecting North American natural gas markets this winter

-

Opinion

What does summer 2024 hold for North American gas and LNG?

-

Opinion

Cold weather impacts on US natural gas

A range of factors mean North American gas and LNG production faces its most uncertain summer in 2024 since the pandemic, when negative oil prices drove gas production down significantly.

In our recent NatGas Summer Outlook 2024 webinar, we offered an in-depth view on low gas prices, production deferrals, increased Mexican imports and the recent flipping of the power market import/export dynamic between the US and Canada. Fill out the form at the top of the page to access the full recording or read on for some highlights.

The lower summer gas prices are, the lower production will be

Production levels will be the key element impacting end-of-season storage levels heading into winter 2024. Ongoing supply will very much depend on prices, as producers have been reacting to low prices over the past three months by curtailing production through well deferrals and shut ins.

Currently there is still a steep contango, however, with future gas prices higher than spot prices. This is enticing for producers, who can have wells back up and running within days if prices rise, so the impact on supply is quickly felt.

Expect a steep rise in production going into winter

Assuming lower prices drive summer production lower, winter production will almost inevitably be higher. In the Northeast region, this scenario has played out over four of the last five summers. Our current expectations are for production to bounce back somewhat through the middle of summer, thanks to a rise in the forward price curve. We then forecast more potential shut-ins during Autumn, followed by a steep rise in production as we head into winter.

Producer financials, hedging levels and liquids content also matter

Aside from deferrals and shut-ins, other factors at an individual producer level will shape production over the next 12-18 months. For example, looking at their financials, SWN may have greater incentive to produce gas for cash flow purposes, as opposed to Chesapeake generating positive FCF despite delaying wells online.

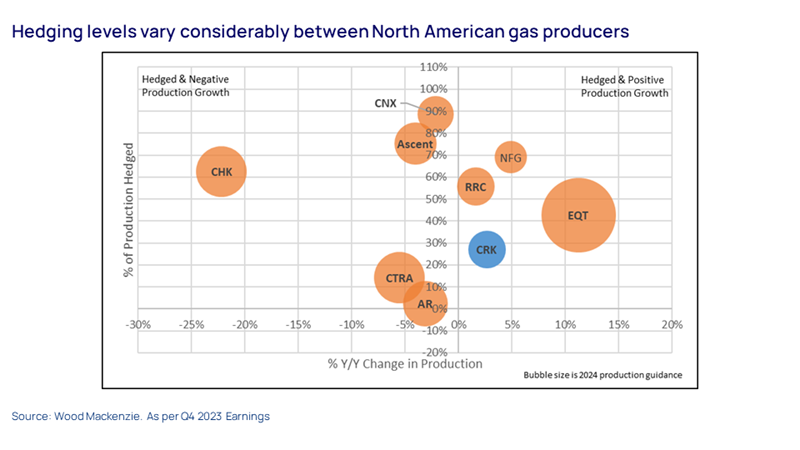

Hedging levels are another key element in the equation. Overall, US producers are approximately 40% hedged for their gas production in 2024, lower than 47% hedged a year ago. However, levels vary significantly between producers. We hear from the latest Q1 earnings, EQT and Antero have lowered hedging targets, partially offset by ample pipeline capacity to transport gas out of Appalachia, even more so after EQT acquiring Equitrans. On the other side, NFG is 74% hedged for bal-24 and CRK 50% hedged for Q4’24 after “been very busy adding some hedges” this past quarter.

Summer maintenance outages for LNG export could be hefty

Freeport LNG just became fully operational after a storm in January put a train out of action, which was followed by a second in early March, and the third on 11 April. Elsewhere, early summer maintenance outages could be hefty, with one train likely to be taken down at Corpus Christi in Texas, and one at Louisiana’s Cameron LNG currently undergoing maintenance. Two trains at Sabine Pass are due for maintenance but recent comments from Cheniere suggest shorter outage events are more likely throughout the year rather than a longer single maintenance outage.

On the upside, several new facilities are due to start operating in the coming months. NFE Altamira in Mexico should finally start production around the end of May, while Plaquemines LNG in Louisiana should have its first block of two trains up and running as soon as the end of Q3 2024.

Expect even higher Mexican from the US

Exports of gas from Mexico to the US increased significantly in 2023, driven both by weak US production and US demand growth. Already trending downwards, in early April US production was hit by the second explosion on a key domestic offshore platform in less than a year. On both occasions, loss of production was rapidly compensated for by increased flows of Mexican gas via pipeline.

Going forward, we expect Mexican exports to reach new heights, potentially exceeding 7.0 bcfd over the summer. However, downside risks could cause exports to underperform, particularly flow restrictions in West Texas due to gas quality issues.

Power exports to Canada will be key to increased gas demand for power

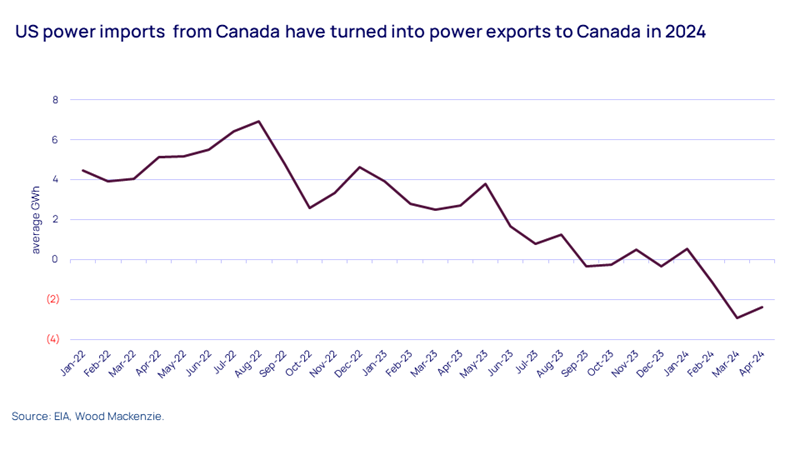

Total US power load was up around 0.5% year on year in 2023, yet gas demand for power was up 7% year on year. One reason is that coal utilisation remains low despite accelerated retirements over the last 18 months. However, our analysis shows a more surprising factor in play.

The US has historically been a net importer of power from Canada. However, power imports from Canada to the US have been on a downward trend since the summer of 2022 (see chart below). Over the last three months the dynamic has flipped, with the US now exporting to Canada. While export volumes are small compared to total power load, the shift from import to export has a measurable overall impact.

Summer to date, the reversal of power flows to Canada accounts for 40% of the year-over-year increase in demand for US power generation.