Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Brazil power market to install 115 GW of new capacity by 2034

Onshore wind and solar to spearhead growth, adding 84 GW in next decade

1 minute read

The Brazilian power market is expected to install 115 gigawatts (GW) of new capacity by 2034, primarily driven by the rise of free market demand. Wind and solar energy will spearhead growth, with 61 GW of utility and distributed solar and 24 GW of onshore wind projects due to be added in the next 10 years, according to latest analysis from Wood Mackenzie.

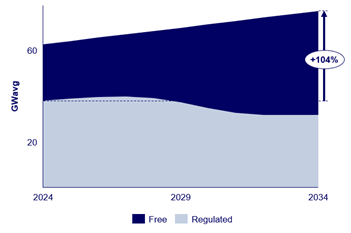

Power demand market migration in Brazil

Source: CCEE, Wood Mackenzie

Free market demand is expected to increase more than 100% in the next decade, stated Wood Mackenzie’s report. The opening of the market is creating competition between solar utility and solar distributed generation that is being built under the new compensation scheme brought by Law 14,300. However, from 2028 onwards, residential offtakers’ full eligibility to access the free market will subsequently slow distributed generation growth.

“As long as the market is not fully opened to residential consumers, solar distributed generation remains an increasingly lucrative business model, sustained by high electricity tariffs,” said Marina Azevedo, senior power analyst for Wood Mackenzie. “But over the longer term, solar utility gains room to expand, driven by battery growth and new demands, such as green hydrogen.”

Looking ahead, hydro will continue to shape Brazil’s power system while wind and solar energy are forecasted to account for 71% of new supply growth by 2050. Notably, solar distributed generation stands out with a 10% Compound Annual Growth Rate (over the next decade. This scenario makes natural gas crucial in supporting system reliability, particularly after solar hours, and increases the system’s average marginal costs. With legacy PPAs expiring, existing gas-unit prices will become indexed to LNG benchmarks, stated the report.

Azevedo added: “The increase in variable renewables will bring major challenges for operators. The power system will require faster dispatch technologies, which can be brought quickly into use to provide additional load on demand as and when required. . One of the main impacts is increased price volatility. From 2030 onwards, hourly prices exceeding 100 USD/MWh are reported over 20% of the time.”