Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Cumulative US community solar installed capacity expected to break 14 GWdc by 2028

New opportunities for community solar are emerging, but growing pains persist in existing state markets

3 minute read

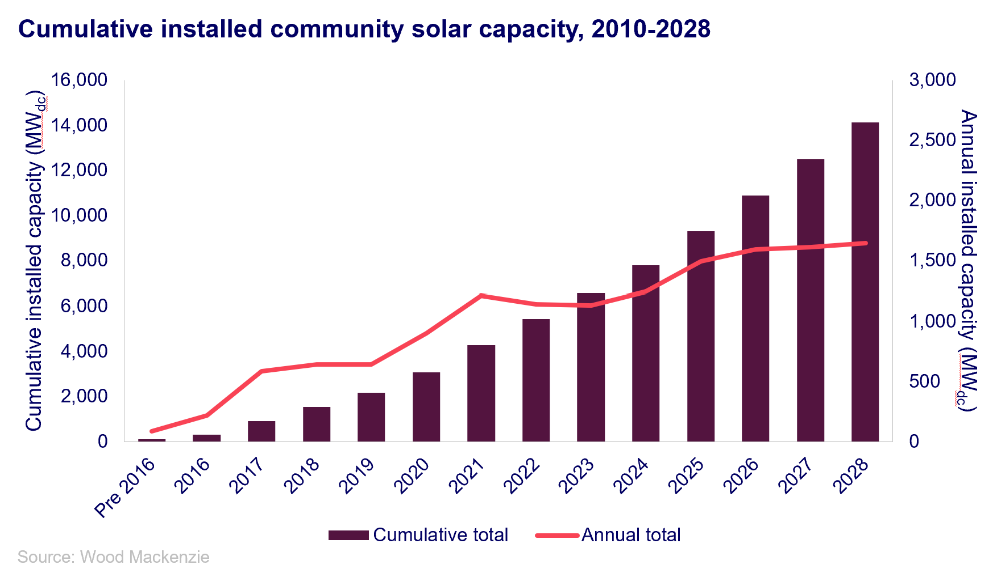

US cumulative community solar installations are forecasted to break 14 gigawatts direct current (GWdc) in existing state markets by 2028, according to the latest report released by Wood Mackenzie in collaboration with the Coalition for Community Solar Access (CCSA). Annual installation volumes landed around 1 GWdc for the third consecutive year in 2023, and 8% average annual growth is expected through 2028.

“Near-term growth in Wood Mackenzie’s national outlook is driven by robust pipelines in existing state markets like New York and Illinois. Longer-term, newer state markets support lasting growth as mature markets saturate. Additionally, developers will begin to benefit from the incentives within the Inflation Reduction Act as soon as this year,” said Caitlin Connelly, research analyst and lead author of the report.

Wood Mackenzie forecasts that 7.6 GWdc of new community solar will come online in existing state markets between 2024 and 2028. The national market is expected to break 10 GWdc of cumulative capacity by 2026.

Community solar installations totalled 827 MWdc through Q3 2023, an 8% increase compared to the first three quarters of 2022. Last year, community solar made up 40% of total US non-residential solar. Non-residential solar made up 9% of total US solar capacity in 2023.

The share of community solar capacity serving residential customers is increasing rapidly, highlighting an important shift in focus for the industry. The share of community solar serving LMI subscribers has grown from 2% in H2 2022 to 10% in H2 2023, with the cost to subscribe LMI customers declining 30% year-over-year.

“The early years of community solar served almost exclusively commercial anchor customers; however, stricter LMI requirements in state programs and the availability of LMI-focused federal incentives are beginning to reveal a more well-rounded, community-focused subscriber profile,” added Connelly.

Wood Mackenzie and CSSA’s reporting also includes alternative forecasts to benchmark key market uncertainties. Because community solar is highly dependent on state and federal legislation, analysis reveals there is more room for downside than upside in existing community solar state markets.

Under a bull case scenario, the national five-year forecast increases by 13% compared to Wood Mackenzie’s base case. In a bear case scenario, the national outlook decreases by 38%. However, the establishment of new state markets will create at least an additional 10% upside to Wood Mackenzie’s base case forecasts if legislation to enable new programs is passed.

“In addition to the continued growth in existing markets, more than a dozen states are considering bills to create or expand community solar programs, and there are billions of dollars in federal support to accelerate the pace of community solar deployment,” said Jeff Cramer, CEO of CCSA. “I’m increasingly confident that we can leverage the transformational innovation of community solar products and the flexibility of programs to meet a diverse set of grid and policy goals in states across the country. And what’s really exciting is that we’re seeing a significant uptick of residential and low-to-moderate income subscribers that will only grow exponentially as markets focus on these crucial customers.”

As more states continue to prioritize grid flexibility, energy storage is likely to make its way quickly into the community solar space. Most state-level incentives and rate structures are not yet conducive to storage additions, but interest is growing. Storage attachment rates reached 62% and 7% in 2022 in Massachusetts and New York, respectively – markets that see the most community solar-plus-storage activity. National community solar-plus-storage deployments are expected to increase by 219% by 2028.

The community solar industry will start to experience the impacts of the IRA as soon as this year. Awards are trickling out for the energy communities and low-income communities (LMI) tax credit adders, but competition is fierce. For the LMI adder, applications totalled over eight times the available capacity for sub-categories 1 and 4. Stakeholders are also awaiting awards from the $7 billion ‘Solar for All’ fund within the Greenhouse Gas Reduction Fund (GGRF), which are expected by summer 2024.

Ends

Notes:

Community solar refers to local solar facilities shared by multiple community subscribers that receive credits on their electricity bills for their share of the energy produced. In most cases, customers subscribe to community solar projects and receive a bill credit from the utility. The size of the bill credit is determined by the program. Programs can provide a full retail-rate bill credit or some alternative rate.

Community solar has a diverse customer base. Homeowners, renters, and apartment tenants unable to install rooftop solar are typical subscribers to community solar systems. Additionally, non-residential entities like commercial and industrial companies, non-profits, or municipal and government entities often serve as “anchor tenants.” An anchor tenant signs a longer-term contract for offtake from the project and tends to use a significant amount of the electricity supplied by the project.