Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Global PV inverter shipments grew by 56% in 2023 to 536 GWac

China accounted for 50% of all global inverter shipments, as the country’s solar demand doubled in 2023

1 minute read

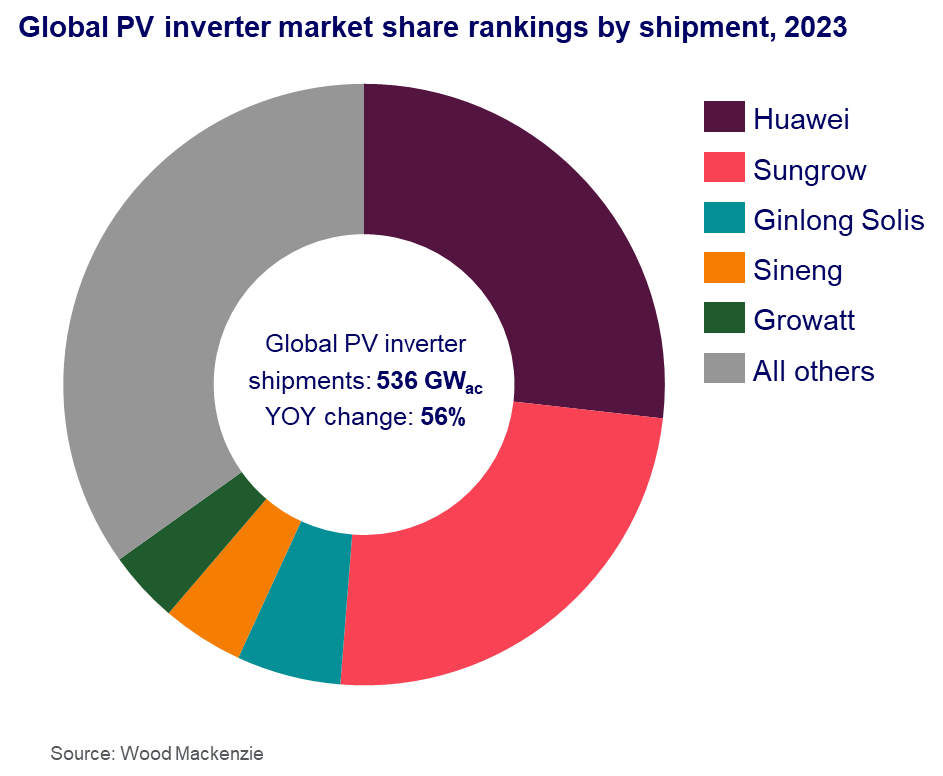

Global PV inverter shipments grew by 56% to 536 gigawatts alternating current (GWac) in 2023, reflecting a strong year for the broader solar industry. The top 10 global PV inverter vendors accounted for 81% of the market, according to Wood Mackenzie’s ‘Global solar inverter and module-level power electronics market share 2024’ report.

China was responsible for more than half of all global shipments, as the country’s solar demand doubled in 2023. Industry leaders Huawei and Sungrow extended their market dominance and retained their first and second positions in the rankings, respectively. Together they captured more than 50% of the global market, largely through the popularity of their utility-scale inverters.

Joseph Shangraw, research associate at Wood Mackenzie, said: “In an industry growing as quickly as the PV inverter market, it’s remarkable that Huawei and Sungrow have been able to expand production capacity to maintain their market share year after year. Behind these two companies, we still continue to see a diversification of the market, with 11 other manufacturers exceeding 10 GWac of shipments in 2023.”

Ginlong Solis ranked third for the second consecutive year, while Sineng moved up four spots into fourth place, propelled by 133% shipment growth in 2023. Overall, nine of the top 10 inverter shipment leaders from 2023 were headquartered in China, where manufacturers capitalized on national investments in solar to meet both domestic and global demand.

In comparison, North America and Europe also experienced double-digit PV inverter market growth, but it was largely concentrated in the utility-scale sector as residential inverter manufacturers faced slower demand growth and excess inventory from oversupply beginning in 2022.

The US market was led by central inverter manufacturers Sungrow and Power Electronics, while Europe was led by string inverter shipments from Huawei, Sungrow, and SMA.

ENDS

Reporting metrics:

Wood Mackenzie ranks vendors by quantity of shipments in megawatts-alternating current (MWac). Only shipments with revenue recognized in the reporting year are counted towards the market share. Only hybrid inverters that are DC-coupled to PV installations are included in the rankings.

To view the full shipment rankings of top global manufactures, as well as regional and product-category rankings, please refer to the ‘Global solar inverter and module-level power electronics market share 2024’ report, accessible here.