Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Lower 48 well costs expected to decline 10% in 2024

Efficiency gains push costs lower, even as OFS pricing is unlikely to fall; rig count to gradually increase through 2025

1 minute read

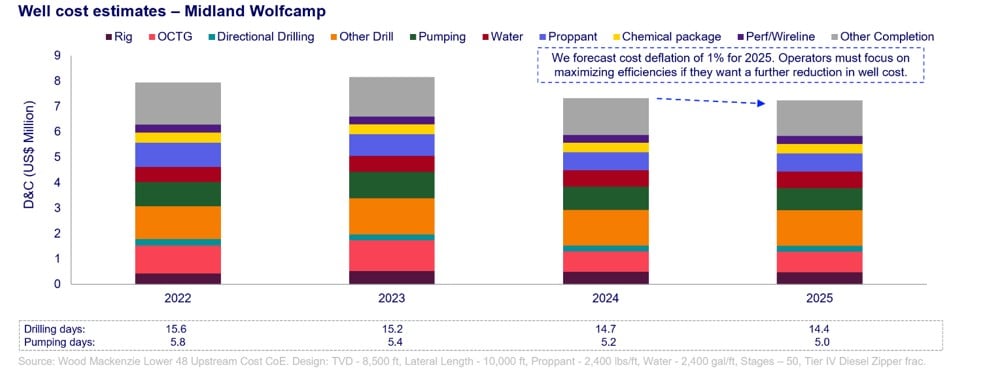

After peaking in 2023, Lower 48 well costs are expected to decline 10% in 2024 and 1% in 2025, according to a recent report from Wood Mackenzie.

According to the report “2024 tight oil costs: the push and pull between efficiency and OFS rates” lower pricing for OCTG, proppant and diesel, combined with substantial drilling and completion efficiency gains, have helped reduce E&P costs. However, additional reduction will be difficult in this environment, as oilfield equipment and services companies (OSF) seek to keep margins high.

“Both E&Ps and service providers are emphasizing significant efficiency improvements, albeit for different reasons,” said Nathan Nemeth, principal analyst for Wood Mackenzie. “More efficient operations are helping E&Ps drill and complete wells faster, cutting costs. At the same time, OFS firms are utilizing more efficient kit and workflows to sustain elevated prices. If E&Ps look to reduce costs more, it must come from additional efficiency improvements, as OFS pricing is unlikely to fall.”

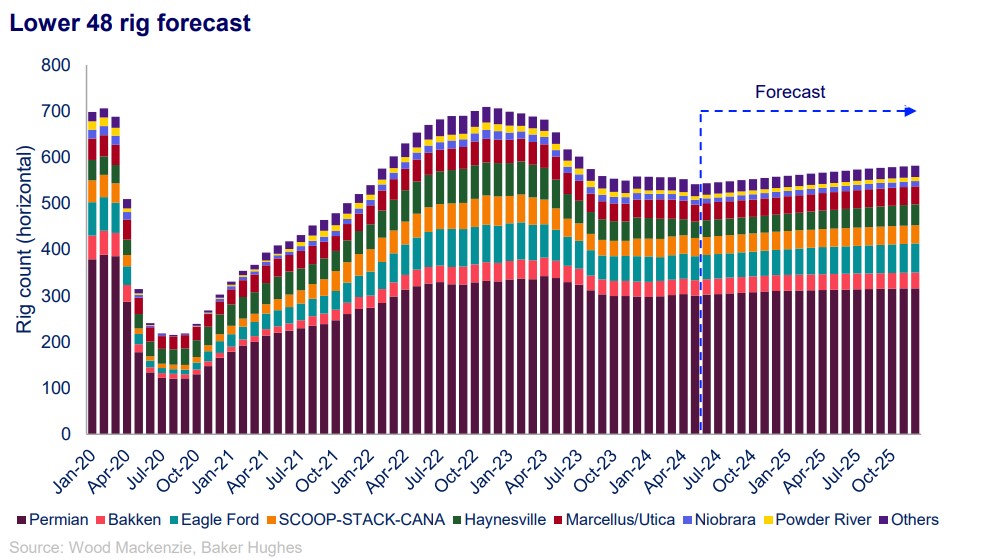

Rig count to gradually increase

Wood Mackenzie forecasts that by the end for 2025, an additional 40 rigs will be active relative to current levels, led by gas plays and the Permian. However, faster drilling operations mute the need for more rigs and Wood Mackenzie estimates a 5% improvement in drilling efficiency equates to about 28 fewer rigs needed in the market.

“With Lower 48 activity relatively flat, rig operators will look to keep utilization rates high to preserve prices and margin,” said Nemeth.

Small producers exposed

According to the report, future cost trends depend on the outcome of the battle between efficiency and gradually rising unit pricing, meaning price trends will be operator-dependent based on the technology and equipment used.

For example, the deployment of “simul-frac” and the adoption of new electric pumping units have accelerated the trend of faster, cheaper, and more reliable operations with fewer emissions. Since 2020, pumping efficiency has increased between 30% and 100%, depending on the technology used.

“The largest producers with the scale to commit to longer-term contracts (one to three years) for new equipment and technologies will realize additional efficiency gains and keep costs lower,” said Nemeth. “Smaller producers will be most exposed to inflation headwinds — arguably motivating even more M&A activity in the region.”