Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Solar and wind uptake to reach 5.4 TWac from 2024 to 2033

Global solar deployment to add 3.8 TWac of new project capacity by 2033 compared to 1.6 TW of wind power, while 640% growth is forecast for energy storage

4 minute read

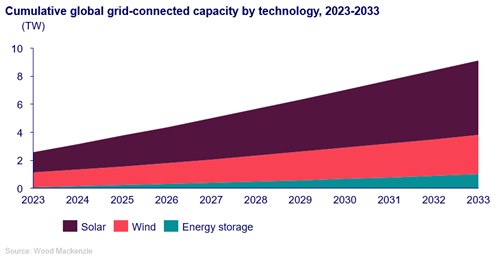

From 2024 to 2033, developers will bring more than 5.4 terawatts (TWac) of new solar and wind capacity online, increasing the cumulative global total to 8 TWac, as the world endeavours to electrify economies and meet decarbonisation targets, according to latest analysis by Wood Mackenzie.

Energy storage capacity (excluding pumped hydro) will grow by more than 600%, with nearly 1 TW of new capacity expected to come online in the same period. This makes energy storage one of the fastest growing markets in the power industry as renewable integration challenges rise.

“Global demand for renewables has reached unprecedented levels, driven by country-level policy targets, technology innovation, and concerns over energy security. Integrated power technology solutions will continue to evolve, evidenced by a significant increase in storage-paired capacity growth, despite inflation, grid constraints and permitting challenges,” said Luke Lewandowski, vice president, global renewables research at Wood Mackenzie.

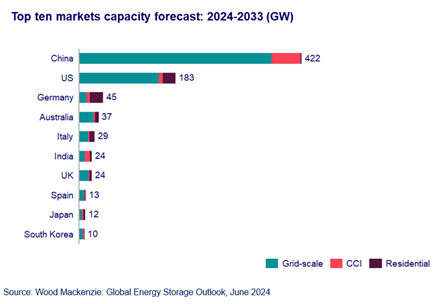

Annual capacity will increase from approximately 500 GW of new solar and wind capacity installed in 2023, and average 560 GW annually over the 10-year outlook. China will continue to dominate solar, energy storage, and wind uptake, with 3.5 TWac forecast to be grid-connected between 2024 and 2033.

Lewandowski added: “Solar PV leads the deployment race, accounting for 59% of global capacity due to come online between 2024 and 2033. Energy storage will have the most balanced geographic footprint over the outlook due in part to its important role in helping to make renewable power available.”

Solar: Cumulative installed global solar PV capacity to nearly quadruple from 2024 to 2033

“Ultra-low module prices intensified the rate of solar deployments last year in Europe and China and will continue to do so in the near-term. But grid constraints and a return to lower power prices and subsequently lower capture rates will impact markets and other regions,” said Juan Monge, principal analyst, distributed solar PV at Wood Mackenzie.

Wood Mackenzie’s global solar PV forecast projects 4.7 terawatts direct current (TWdc) will be built between 2024 and 2033, with China accounting for 50% of that capacity growth.

Monge added: “Ultimately, maximising solar PV capacity, and wind power capacity for that matter, in the next 10 years will depend on additional technology developments: from expanding grid infrastructure to incentivising flexibility solutions, transportation and heating electrification.”

In 2023, drastic drops in Chinese module prices and tight deadlines to interconnect tendered projects triggered 150% annual growth for installations across all solar PV segments. Year-on-year increases in annual installed capacity will continue until 2026, when Wood Mackenzie forecasts a two-year slowdown due to an expected pause in development activity before the next round of planned procurement drives higher deployment.

For installations in the first quarter, developers in the US installed more solar in the first quarter of 2024 than in all of 2019, installations in China were up 36% year-on-year, and new capacity in India through Q1 amounted to 85% total capacity installed in 2023. However, Europe’s distributed PV boom has started to weaken, with first quarter residential installations contracting more than 30% in Germany and over 50% in the Netherlands as retail rates come down.

Energy storage: Global cumulative capacity will increase sixfold by the end of 2033, passing 1 TW/3 TWh

“Global energy storage deployment in 2023 achieved record-breaking growth of 162% compared to 2022, installing 45 GW/100 GWh. While impressive, the growth represents just the start for a multi-TW market as policy support in terms of tax exemption and capacity and hybrid auctions accelerate storage buildout across all regions,” said Anna Darmani, principal analyst, energy storage, at Wood Mackenzie.

The global energy storage market is on track to reach 159 GW/358 GWh by the end of 2024, according to Wood Mackenzie’s Q2 global energy storage market outlook update. Looking ahead, 926 GW/2789 GWh will be added between 2024 and 2033, marking a 636% increase.

China remains the global leader of the energy storage market, due to its booming solar market, with an average of 42 GW/120 GWh annual capacity additions forecasted in the next 10 years.

In Europe, grid-scale projects are booming as developers aim to seize opportunities from emerging contracted revenues. Demand from the distributed segment has decreased by 23% in 2024 as retail rates stabilise. With lower system costs and regulatory changes, however, distributed market growth is expected to resume from 2026.

Wind: Global wind power industry to add more than 1.7 TW over the next 10 years

According to Wood Mackenzie’s Q2 global wind market outlook update, policy support from China’s central government drives the world’s largest wind market, with China forecasted to install 91.5 GW on average annually.

Lucas Stavole, senior research analyst at Wood Mackenzie: “China’s central government announced a plan in May to promote the energy transition and ensure the country meets carbon-neutral targets. Project development has been accelerated in the short-term and renewable energy investment will be a long-term economic driver.”

Challenges with permitting, grid access, financing, and supply chain availability impact the 2024 to 2026 outlook, pushing capacity into 2027 to 2033 and beyond the 10-year horizon. These dynamics impacted countries primarily in North America, Western Europe, and Asia.

Outside of China, wind additions globally will average 85 GW per year, a robust increase compared to the prior 10-year average of 37 GW. Additions in the Americas region will total 230 GW through 2033, as the offshore wind sector gains a foothold in the region and government incentives continue to drive growth.

The offshore wind sector, after connecting 11 GW globally in 2023, will average 39 GW of connected capacity annually from 2024 to 2033, (386 GW total), culminating in 54 GW in 2033. More than 50% (199 GW) of the total offshore wind capacity installed over the outlook period will be installed in China.