Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

US Grid-Scale Energy Storage Installations Surge, Setting New Q2 Record

3,000+ MW of storage installed across all segments, 74% increase from Q2 2023

2 minute read

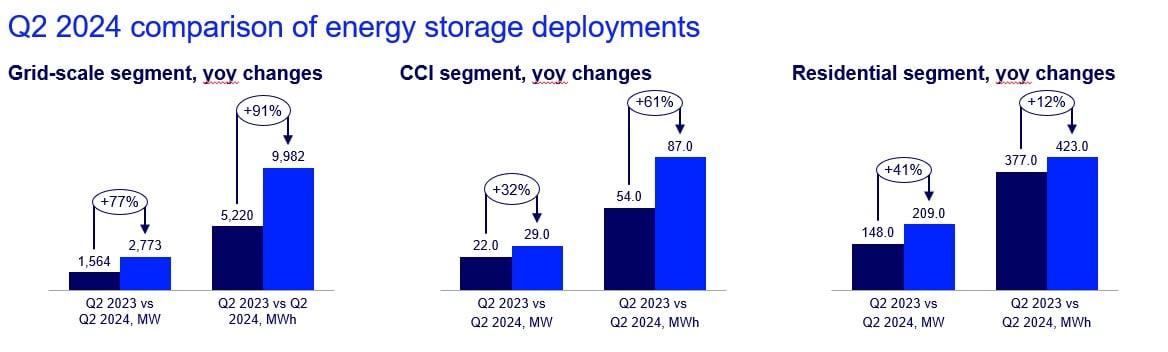

The U.S. energy storage market experienced significant growth in the second quarter, with the grid-scale segment leading the way at 2,773 MW and 9,982 MWh deployed.

According to the American Clean Power Association’s (ACP) and Wood Mackenzie’s latest U.S. Energy Storage Monitor report released today, every segment of the market experienced growth in Q2 over year-ago totals, with community (CCI) increasing 61% to 87 MWh and residential increasing 12% to 423 MWh. In total, the market saw 3,011 MW and 10,492 MWh deployed, the second-highest quarter on record behind Q4 2023 at 13,437 MWh. California, Arizona, and Texas were responsible for 85% of installations.

“Energy storage is becoming a mainstay of the power grid, delivering a more resilient and affordable grid,” said John Hensley, SVP of Markets and Policy Analysis for ACP. “Additional storage capacity across U.S. markets is helping to provide a cost-effective and reliable solution to serious problems such as rising energy demand, a timely need for more overall capacity, and more volatile and extreme weather events. To keep the trend going, it’s important to find solutions for development challenges such as lengthy interconnection queues and permitting and siting.”

“This quarter showed massive growth compared to year-ago levels and the grid-scale segment continues to be the main driver,” said Vanessa Witte, senior analyst with Wood Mackenzie’s energy storage team. “Community performed strongly as well. And while residential did expand, it was still a somewhat slow quarter as California's meteoric growth faltered, combined with low installations in Hawaii and Puerto Rico, which continue to be affected by incentive changes.”

Strong growth in 2024 sustained in subsequent years

According to Wood Mackenzie’s five-year outlook for the U.S. energy storage market, total U.S. storage deployments will grow 42% between 2023 and 2024, but capacity additions will level out as deployments increase with an average annual growth rate of 7.6% between 2025 and 2028. Across all segments, the industry is expected to deploy 12.7 GW/ 36.7 GWh in 2024.

The grid-scale segment is projected to increase 32% year-over-year with 11 GW/32.7 GWh deployed by year-end, and 62 GW cumulatively from 2024-2028. Over the next five-years,12 GW of distributed storage will be deployed. The residential segment will constitute 80% of distributed power capacity installations, with 10 GW of storage capacity additions between 2024-2028. The CCI segment is forecasted to install 2.5 GW of storage between 2024 and 2028, a modest reduction from previous forecasts.

“Growth flattens in 2025 and 2026 as project capacity is pushed into later years of the forecast largely due to early-stage development challenges,” said Witte. “The CCI segment continues to experience high barriers to growth including the complexity of developing these projects and the limited availability of financial value streams.”