Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Australia’s emissions-intensive mines face unforeseen future under new Safeguard Mechanism Scheme Reforms

Winners and losers in mining anticipated as Australian government unveils preferred policy settings

2 minute read

The adoption of the single "industry average" as presented in the revised Safeguard Mechanism Scheme, will see some clear winners and losers in the Australian mining sector. Underground mines, which tend to be much more emissions intense compared to open cut mines, will bear the highest cost of emissions reduction, according to the latest modelling from Wood Mackenzie.

Coming into effect on 1 July 2023, the legislated limits or baselines for each mining facility will be based on a combination of each facility’s historic emissions and an industrial average component. Exactly how the "industry average" will be defined in terms of coal mines has been contentious.

The intention of the scheme is that high emissions mines will need to purchase Safeguard Mechanism Credits (SMCs) - credits which are generated by other large industrial facilities. Wood Mackenzie modelling has highlighted that a significant portion of Australia's mines will receive credits from the scheme - on average, open cut mines will be receiving credits from the scheme every year over 2023 to 2030. Meanwhile, emissions-intensive mines, which are mostly all underground, will be subject to significant costs.

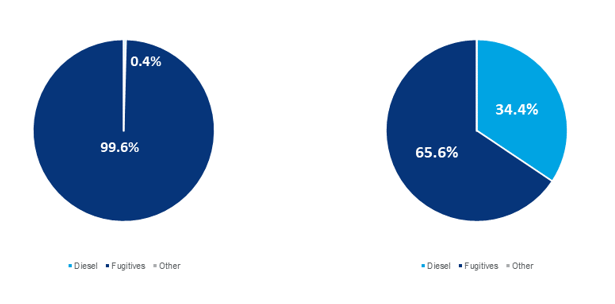

From left to right: Australian underground emissions profile CO2e vs Australian surface mines emissions profile CO2e

Source: Wood Mackenzie

Rory Simington, principal analyst at Wood Mackenzie, said: “A significant portion of Australia's open cut mines will be receiving credits from the scheme every year over 2023 to 2030. Meanwhile, underground mines will be subject to significant costs and need to purchase SMCs. Early closure of these emission-intensive facilities could significantly impact the demand and therefore prices of SMCs, which adds another layer of uncertainty to the economic assessment of abatement solutions.”

The revised Safeguard Mechanism Scheme will allow facilities to earn SMCs by surpassing their emission reduction baselines. Producers have the flexibility to purchase SMCs and Australian Carbon Credits Units (ACCUs) as offsets for their emissions. In addition, facilities have the option to surrender up to 30% of their annual emissions reduction requirements through ACCUs. While international offsets are not currently accepted for compliance, the Australian Government scheduled the further consultations for late 2023 to explore potential frameworks for their inclusion.

Wood Mackenzie analysis also shows that production-adjusted baselines play a crucial role in the Safeguard Mechanism, as they are tailored to a facility's production levels, ensuring adjustments align with actual output. However, reducing production does not reduce compliance costs, which therefore limits options for producers.

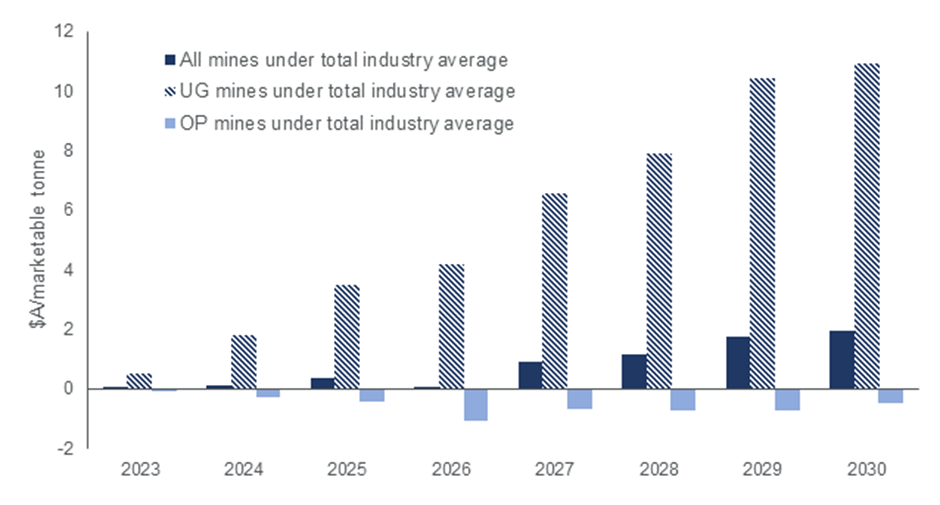

Average cost of emissions - @ A$75/t CO2e

Source: Wood Mackenzie

“Wood Mackenzie modelling shows that adopting a single ‘industry average’ will have an unequal impact on some facilities receiving benefit without any mitigation, while others will face significant financial implications,” Simington concluded.

ENDS

Notes to Editors

Wood Mackenzie conducted a modelling exercise based on its Q2 of 2023 production forecasts to assess the implications of the Safeguard Mechanism Scheme reforms.

The modeling scenario focused on producers procuring credits instead of reducing emissions, excluding certain scheme elements such as the ability to borrow and bank carbon credits and provisions for lower baseline decline rates.