Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

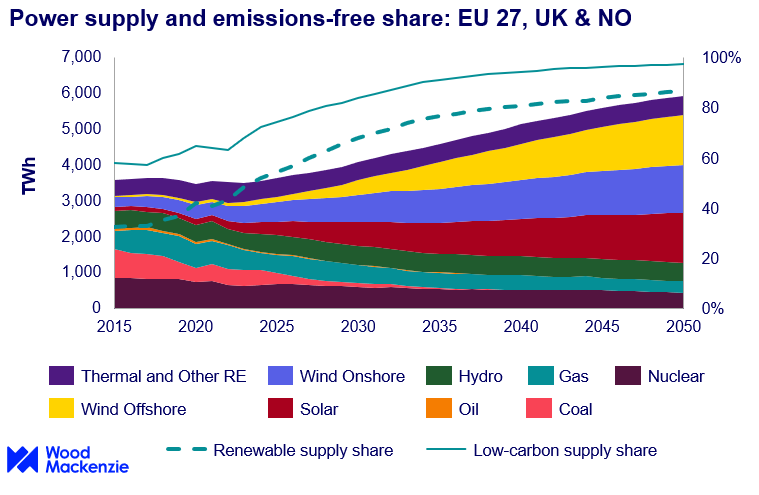

Emissions-free supply expected to rise to 85% by 2030 in Europe

Europe’s climate policy ambition presents immense opportunity, but flexibility is key

4 minute read

The European power market will see its carbon intensity plummet as the region pursues ambitious climate-energy policies but flexibility is key to enable this change, according to Peter Osbaldstone, Research Director, Europe Power & Renewables at Wood Mackenzie.

Speaking at the Enlit Europe event in Paris, Osbaldstone told delegates that emissions-free supply will climb from 65% today to 85% by 2030, with 67% of power from renewables, according to latest Wood Mackenzie analysis.

“The European market is dominated by wind and solar development and will therefore be subject to an increasingly variable supply mix,” Osbaldstone said. “This makes flexibility a critical enabler of accelerated change, in addition to efficient planning systems, infrastructure expansion, appropriate market function and the progress of electrification.”

(Source: Wood Mackenzie)

Strong focus on change by 2030 delivers a surge in renewable growth

“The current policy push to 2030, a steppingstone to 2050 net-zero aspirations, is driving a surge in activity over coming years. This presents challenges – we’ll see pressure on renewables integration and limitations in the supply chain, which will slow down the delivery of new capacity and affect overall delivery costs,” added Osbaldstone.

These challenges will influence the level of new capacity delivered in the late-2020s, activity will still be at record levels, but we’ll also see some project slippage into the early-2030s, according to Wood Mackenzie analysis.

Osbaldstone told delegates: “The market becomes more balanced in the long-term – where new supply meets new demand, and a sustainable rate of change is established. At this point, the pace and location of electrification will affect how much market space there is for new technologies, such as solar and wind capacity."

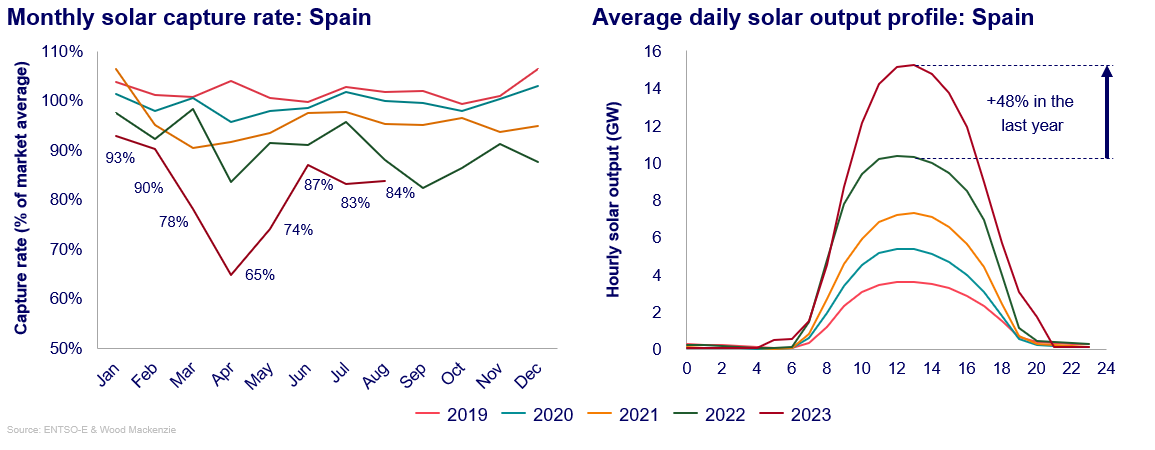

A Spanish case study: a spotlight on renewables integration

Renewables have a share of 40% in the power supply mix in Europe. Some markets have substantially more. Spain is a good example of a market with high levels of renewable penetration, it also has residual gas generation, coal generation and nuclear power, said Osbaldstone.

Spain has seen huge pressure on solar capture prices this year, as rising levels of production have tested the limits of the system’s ability to absorb that that power (see chart below). The market saw more than seven gigawatts (GW) of new PV capacity added in the last 12 months and that supported a close to 50% year-to-year increase in solar output through the midday hours. With inflexible nuclear and thermal generators still on the system, and limited amounts of storage and interconnect available curtailment risk is rising as capture rates fall.

(Source: Wood Mackenzie)

There is a massive amount of new renewable supply going into markets, not just in Spain but across the region, and all this additional, variable volume needs to be absorbed, says Osbaldstone. This is beginning to test the extent of flexibility in markets, we are seeing the limits of integration being stretched.

“Spain is a great case study for investors in other markets, particularly where continued expansion of renewables is not being matched with a build-up of flexibility options. There are other examples, with similar pressures being experienced in the Nordics. It’s crucial that investors and other industry stakeholders consider such market dynamics, and the means to mitigate associated risks,” Osbaldstone added.

Technology attractiveness varies by market

“Costs for solar in Spain are still very low and competitive. Despite the increased risk of price cannibalisation and curtailment, we continue to see an opportunity to develop merchant projects,” Osbaldstone said.

The attractiveness of different renewable technology continues to vary by market. Market conditions must be matched with appropriate route-to-market choices, be those merchant operation, contractual support or out-of-market instruments, such as Contracts-for-Difference.

Osbaldstone commented: “Offshore wind is the most expensive technology that can be readily deployed in high volumes. The role of governments is central to wind’s expansion, policymakers must support industry stakeholders and projects by matching policy requirements to action. The right commercial arrangements and incentives will be essential.”

Market flexibility is key

Market prices will become increasingly volatile as power decarbonises, according to Wood Mackenzie analysis. Despite average annual prices falling over time, significant hourly volatility will grow in all markets, which emphasises the importance of flexible resources. With wind and solar driving supply growth, weather sensitivity becomes ever more important.

Osbaldstone stated: “As supply becomes more variable, markets must adapt if climate change policies are to be delivered. This adaption will including the use of battery storage, interconnection, and flexible thermal generators, among other technologies.”

“The industry also needs a much more engaged and dynamic demand side, embedding flexible behaviours into new and existing sectors. Consumers must be willing and equipped to react to price signals, such as time-of-day tariffs and more short-term demand flexibility services,” Osbaldstone concluded.

Wood Mackenzie at Enlit Paris

The Wood Mackenzie team is at Enlit Paris 2023 28-30 November. We’re on stand 7.2.M78.

Would you like to speak to an expert at Enlit Paris? Contact Vivien.lebbon@woodmac.com and kevin.baxter@woodmac.com to set up an interview.

Please see full list of Wood Mackenzie speaking slots here.