Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Global wind turbine order intake breaks record in Q2

Wind market sees 43 GW in global orders in Q2 2022, with China procuring 35 GW

2 minute read

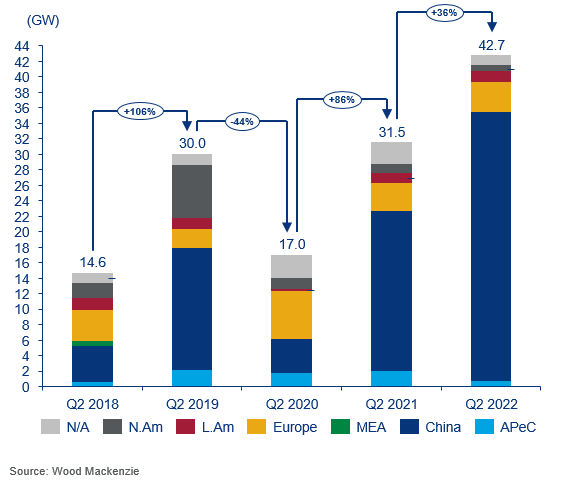

Strong activity in China pushed global wind turbine order intake to 43 gigawatts (GW) in quarter two of 2022, a new record, and up 36% from year-ago levels. This equates to an estimated $18.1 billion, according to new analysis from Wood Mackenzie.

With ambitious decarbonization targets, China aims to support an estimated average build of more than 55 GW per year over the next 10 years. In Q2 alone, China accounted for a record 35 GW of activity and is at 45 GW year-to-date.

Europe showed growth for order intake with 3.8 GW, doubling its Q1 activity. Order intake activity in the US remained slow, with less than 2 GW through H1.

The global order intake for offshore wind exceeded 6 GW in Q2 of this year. This is only the third time offshore orders have exceeded that number. Developers in the Chinese market galvanized the largest ever H1 firm orderbook for the offshore wind sector, comprising 74% global offshore order capacity. Offshore order intake in China has now increased consecutively for three quarters, following a nearly year-long lull.

Total global firm orders by region, Q2 2022

“Goldwind, Mingyang and Envision were all very active in Q2 with projects in China, accounting for more than 26 GW of activity between them,” said Luke Lewandowski, Wood Mackenzie Research Director.

Seven Chinese turbine OEMs – with Envision, Mingyang, and Goldwind in the first three positions – recorded enough firm order capacity to rank in the global top 10 for order intake through the first half of 2022.

“Rapid technology adoption and government support have catapulted China to this leading position,” Lewandowski added.

Buoyed by China, global activity is on a record pace through the first two quarters of 2022, with 61 GW ordered. This is 13% higher than H1 2021 and is the highest half-year ever recorded.

“China is surging and we are seeing strength in Europe too. The US is where demand has been sluggish. This is due to tough market conditions, such as labor cost increases, inflation and supply chain disruptions. As a result, securing new orders in the US has been difficult, which has had a negative impact on OEMs dependent on the market, primarily Western-based OEMs.”

“However, with the passage of the IRA bill in the US, Wood Mackenzie anticipates a boost in activity over the second half of the year. With these new incentives, wind power projects have become more economically viable and thus more competitive compared to conventional technologies. If procurement of wind turbines in China continues at its current pace and intake activity picks up in the US, the wind turbine market could be set for a record year.”