New frontiers: order intake by Chinese wind turbine OEMs advanced beyond domestic dominance in H1 2024

As the global energy landscape continues to evolve, the wind energy sector is experiencing unprecedented transformation. Drawing from data from Wood Mackenzie’s rich Wind Services offering, our experts explored the causes and impacts of this pivotal shift in a recent webinar.

3 minute read

Luke Lewandowski

Vice President, Global Renewables Research

Luke Lewandowski

Vice President, Global Renewables Research

Luke heads our Global Renewables Research team, which includes wind, solar and energy storage.

Latest articles by Luke

-

Opinion

eBook | Navigate power market uncertainty with confidence: the essential guide to profitable energy investments

-

Opinion

New frontiers: order intake by Chinese wind turbine OEMs advanced beyond domestic dominance in H1 2024

-

Opinion

Distributed solar and storage: a beacon of security and hope

-

The Edge

COP28 key takeaways

-

Opinion

The power of the sun: supporting energy security in Puerto Rico

-

Opinion

Inflation Reduction Act propels the global wind outlook

Yuan Ren

Managing Consultant, China Wind Power Research

Yuan Ren

Managing Consultant, China Wind Power Research

Yuan provides analysis covering China’s wind market

Latest articles by Yuan

-

Opinion

New frontiers: order intake by Chinese wind turbine OEMs advanced beyond domestic dominance in H1 2024

-

Opinion

Expansion opportunities beckon for China’s wind companies

Endri Lico

Principal Analyst, Global Wind Supply Chain and Technology

Endri Lico

Principal Analyst, Global Wind Supply Chain and Technology

Latest articles by Endri

-

Opinion

Liberation Day tariffs threaten to disrupt US wind and solar industries

-

Opinion

New frontiers: order intake by Chinese wind turbine OEMs advanced beyond domestic dominance in H1 2024

-

Opinion

Wind from the east gathering strength: the outlook for OEMs

-

Opinion

Wind turbine technology evolution is diverging quickly between China and the rest of the world

-

Opinion

Western wind turbine manufacturers are prioritising profit over volume, opening the door for Chinese market share growth

-

Opinion

Goldwind captures the top spot for global wind turbine supply

In the first half of 2024, Chinese wind turbine manufacturers not only solidified their domestic dominance but also expanded their global footprint, marking a significant shift in the industry.

This pivotal moment was the focus of our recent webinar, where industry experts drew data from our Wind Services offering to share critical insights on how Chinese OEMs are reshaping the global wind turbine market.

During the presentation, we examined how Chinese OEMs’ expansion is affecting supply chains and discussed the long-term market projections for the wind energy sector.

Fill out the form at the top of the page to watch the webinar recording and download the accompanying presentation slides, and read on for a quick overview of some of the key takeaways:

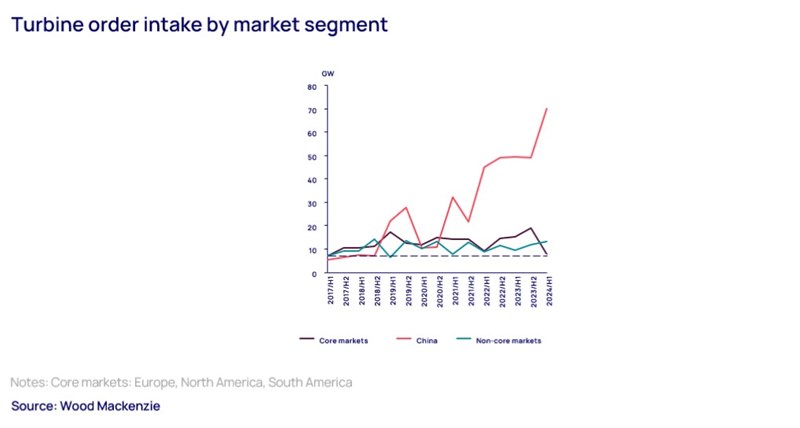

Record-breaking global order intake

In H1 2024, global wind turbine order intake hit a record-breaking 90 gigawatts, driven largely by China’s remarkable contributions. Chinese turbine OEMs, leveraging strong domestic demand, accounted for over 80% of this total—solidifying their position as global leaders in the sector.

While Western manufacturers once held over 60% of the market share before the pandemic, they have since dropped to less than 20% in 2024. This decline is compounded by increased competitiveness from non-Western manufacturers, especially from China and India.

Suzlon breaks into the top 10 for most in-demand models, while Goldwind expands globally

Suzlon stands out as the only non-Chinese manufacturer to break into the top ten for most in demand turbine models, largely thanks to its S144 model, fully deployed within the Indian market.

Goldwind has also successfully expanded outside of China, claiming the third position in global orders in H1.

When excluding China, Western turbine manufacturers like Vestas continue to lead, but Chinese and Indian manufacturers, such as Envision and Suzlon, are making substantial inroads, reflecting a shift in market power.

China’s dominance in higher-capacity turbines

China's push for higher-capacity onshore and offshore turbines has been a key driver of global growth. For instance, 36 gigawatts of turbines in the 5-6.99 MW range were ordered in China in H1 2024, compared to 20 GW ordered globally outside of China. The country also saw 12 gigawatts ordered for onshore turbines in the larger 7-9.99 MW range, underscoring its aggressive push towards higher-capacity installations.

This trend highlights China’s growing leadership in deploying larger, more efficient turbines—a significant factor reshaping global supply chains and market dynamics.

China contributes 82% of global orders

The numbers speak volumes about China's rising influence: the country contributed 82% of the 91 gigawatts of wind orders in H1 2024, reflecting a 42% year-on-year growth. Over 90% of these orders were for onshore wind, with key regions like Inner Mongolia and Xinjiang driving growth.

While offshore wind continues to grow, the market faces challenges, particularly around permitting conflicts that have delayed construction in provinces such as Guangdong and Jiangsu.

Chinese OEMs lead international expansion

Despite facing intense competition at home, where fierce price competition has driven down turbine prices, Chinese OEMs maintain a competitive edge internationally. Their turbines are 25-32% less expensive than those from Western manufacturers, giving them an advantage in markets like Central Asia, the Middle East, and Latin America. However, challenges such as local content requirements and concerns around quality and bankability in Western markets remain barriers to further expansion.

Watch the webinar and download the presentation

To dive deeper into the data and analysis surrounding this remarkable shift, watch the full webinar and download the accompanying slide deck by filling out the form at the top of the page.