Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Key things to watch in North American natural gas for 2024

3 minute read

Market expansion continues for the natural gas sector, but a volatile path may lie ahead in 2024.

Wood Mackenzie recently released the North America Natural Gas: 5 things to look for in 2024 report. Key themes to watch for include the need for storage development, resilient gas demand, the growth of LNG exports and infrastructure positioning for production growth.

Price volatility highlights new storage development needs

With a significant storage surplus heading into the new year, Henry Hub gas prices collapsed over $1/mmbtu from highs posted in November 2023. The need for new storage development may be far from the market’s psyche as inventory levels are prepared to enter the new year near a 10% surplus to five-year average levels. However, Wood Mackenzie expects a conversation on expanding storage capacity to crop back up in the second half of 2024 should turbulent pricing reappear.

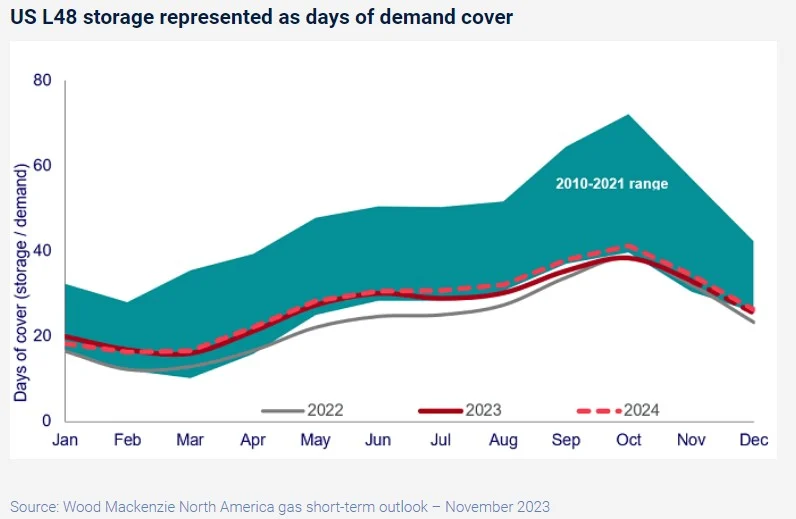

“As the size of North America’s gas market has ballooned in recent years, storage capacity expansions have not kept up,” said Daniel Myers, senior research analyst for Wood Mackenzie. “Current US gas storage levels are estimated to provide just enough gas for 25 days of full demand coverage, some of the lowest levels in the last ten years. This metric will remain in a similar place going into next year’s winter and may soon expose the market to even more volatile price fluctuations in the years ahead.”

Resilient power demand

In each of the last two years, natural gas generation has continued to set new all-time highs as it remains the lead source of dispatchable power generation in North America. Wood Mackenzie expects that natural gas power demand’s resilience will persist in 2024.

“Even as coal stockpiles have rebuilt to very high levels over the past year, low natural gas prices have incentivized continued high, economic coal-to-gas switching,” said Myers. “Although renewable’s accelerated adoption should prevent yet another power demand record, absent particularly extreme heat, natural gas will maintain its share as the leading source of power generation in North America next year.”

Materializing LNG export growth

As both US and Canadian gas production surged and storage inventories have bloated in 2023, the North America gas market anxiously awaits the arrival of the second wave of LNG export projects.

Plaquemines LNG Phase 1 in eastern Louisiana and the Corpus Christi Stage 3 expansion in Texas are both expected to receive first feedgas flows in the summer of 2024. And, while Golden Pass LNG recently pushed back the timeline of first exports to 1H 2025, commissioning flows in late 2024 are still expected.

“LNG Canada is also racing to begin start-up activities in 2024, providing upside demand potential in Western Canadian markets,” said Myers. “This, and Altamira FLNG’s startup in in Mexico in early 2024, provide a reminder that the US will not be the only North American LNG exporter for much longer.”

Infrastructure positioning for future production growth

Completion of the long-contested Mountain Valley Pipeline (MVP), expected in the first half of 2024, will mark an end to the regime of Northeast pipe development that largely guided production’s expansion between 2017 and the early 2020s

The market will next turn its attention to developing infrastructure through the friendlier regulatory environment of intrastate pipeline projects in Texas and Louisiana. In 2024 alone, over 4 bcfd of intrastate pipeline developments are targeted to unlock Haynesville supply in Louisiana. In the Permian, the 2.5 bcfd Matterhorn Express will join Whistler (0.5 bcfd) and Permian Highway (0.55 bcfd) compression expansions from late this year to ease pressure on Waha and allow for further associated gas growth out of West Texas.

RNG gaining momentum

Renewable Natural Gas (RNG), or biomethane, continues to attract high investment interest despite relatively small production volume compared to traditional natural gas. We estimate North American RNG supply at 398 mmcfd in 2023, supported by 324 projects in the US and Canada.

“In 2024, expect natural gas’ best supply answer on the path to decarbonization to continue to garner interest from developers,” said Myers. “Most importantly, we expect that next year demand-side contracting will finally gain material momentum. As RNG capacity grows, its appeal as an attractive option in hard to decarbonize sectors does as well.”