Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Oil and mining companies must adapt new strategies to deliver low-carbon transition

4 minute read

As companies in the energy and natural resource sector struggle to find the balance between satisfying shareholder returns and meeting stakeholder low-carbon demands, new strategies are emerging that could be the catalyst to drive capital allocation decisions toward growth and closing valuation gaps, according to “Fuelling Change” a new Horizons report from Wood Mackenzie.

“In the last year, energy security has trumped sustainability,” said Tom Ellacott, senior vice president, corporate research for Wood Mackenzie. “Companies too have benefited from recent commodity prices and margins to deliver record cash flow.”

“That is not to say that decarbonisations goals cannot be met and priorities cannot change. But to spur activity, there needs to be a recalibration of current risks and rewards for investment in low-carbon technologies, as well as new incentives from both government stakeholders and financial institutions. There’s no one answer, but smart oil and gas and natural resources companies will realize that protecting the status quo would be a mistake and start to manage their portfolios to reflect a balanced approach of managing legacy output and carbon management.”

According to the report, companies can address this complex dynamic in three key ways: nurturing legacy cash cows while simultaneously shifting to a transition-growth mindset, incorporating transition risks and rewards into differentiated investment hurdles rates and using new business models to enable growth and close valuation discounts.

Shifting risk-reward balance

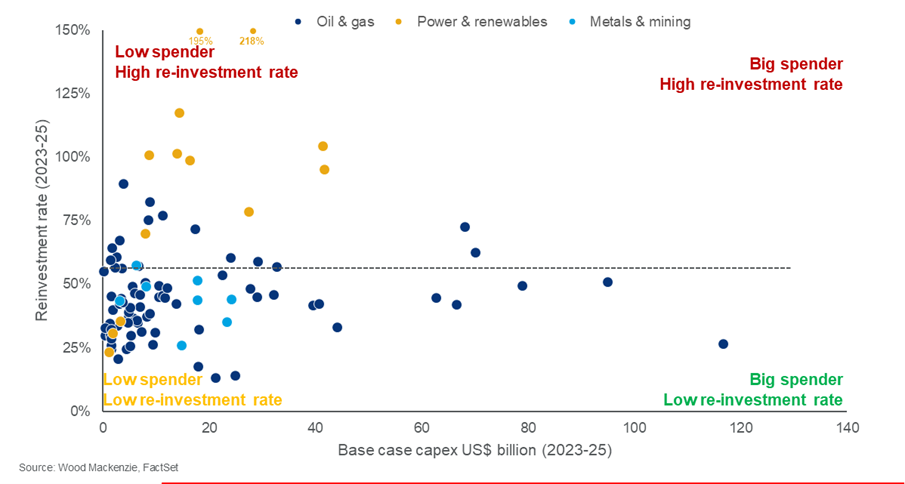

Expected reinvestment rates (investment as a percentage of operating cash flow) in oil and gas companies and miners of between 40% and 50% trail the investment rates of utilities chasing growth. Reinvestment rates in both sectors have been trending down since the middle of the last decade.

Reinvestment rates – investment as a percentage of operating cash flow

In a large part, this has been due to strategies such as capital restraint and massive buybacks that have been successful for companies and investors. The oil and gas and metals and mining sectors have outperformed the broader market by 44% and 16%, respectively, since the end of 2021.

“Realistically, the only way to change investor sentiment is to bring about further shifts in the risk-reward equation,” said Ellacott. “We will have to see this in a variety of ways. Examples are government support schemes like the Inflation Reduction Act in the US, regulations such as The European Carbon Border Adjustment Mechanism, or customer-driven market creation, such as a willingness from consumers to pay premiums for low-carbon energy. Financial institutions could also play a big part by punishing slow-to-change companies with higher borrowing rates. This will all hopefully drive new investment inflection points that will catalyse more activity for low-carbon energies.”

Managing investment inflection points

Wind and solar have passed through inflection points and are scaling rapidly, thanks to strong infusions of capital. A similar point will have to be reached for the energy transition support system – metals, CCUS, bioenergy, hydrogen and charging infrastructure.

“The evolution of policy is a big unknown. Companies may face the capital allocation dilemma of high hydrocarbon returns versus lower-risk, lower-return transition-enabling projects for decades yet,” said James Whiteside, head of corporate metals and mining for Wood Mackenzie. “Rather than chasing carrots or ducking sticks, companies need to develop robust strategies to navigate the unfolding regulatory landscape of the energy transition. The metals most exposed to the transition, such as lithium and rare earth elements, have garnered more media attention than established commodities such as nickel, copper and aluminium. But it is these base metals that need to mobilise the most growth capital to achieve climate goals.”

According to the report, there are three key routes for corporate boards to navigate this dynamic:

- Tend to the legacy cash cows while shifting to a transition growth mindset. Investors expect companies to balance the need for returns in the short term by tending to their legacy portfolio, while delivering low carbon transformation plans. Visibility of low-carbon profit centres starting to support – and supplant – the legacy cash cows could be a revaluation trigger that shifts the market to a transition growth mindset. Companies can scale back share buybacks to fund the shift. The mining majors and international oil companies allocated US$157 billion, or 30% of their operating cash flow, to buybacks in 2022. Companies could still grow base dividends and lift reinvestment rates to over 60%.

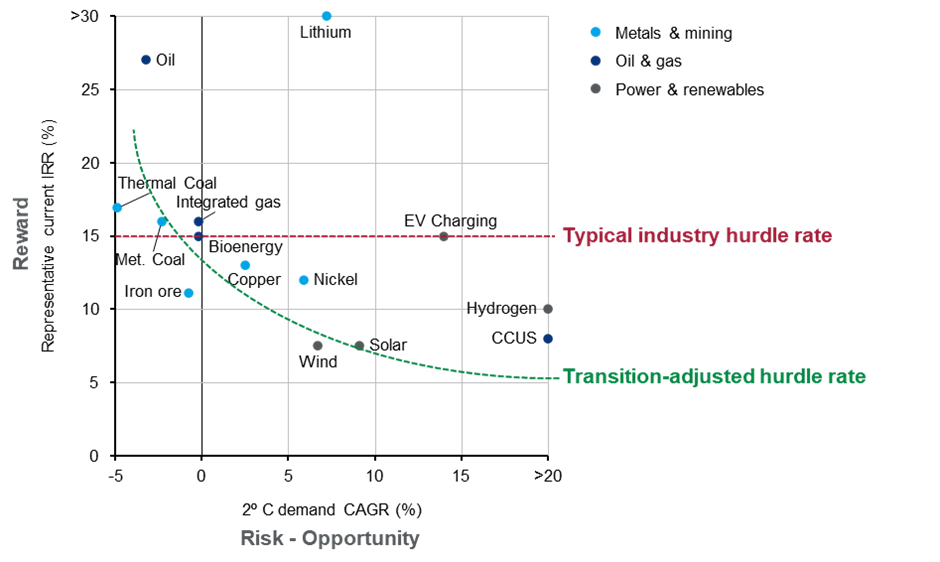

- Bend hurdle rates to reflect transition risks and rewards. Internal hurdle rates need to follow the divergence in external costs of capital, risk and long-term growth potential. Part of the low ‘return’ of transitional investment is risk avoidance and optionality. Higher returns could be up for grabs in low-carbon projects with greater commercial risk, such as CCUS developments that include carbon price risk. In times of uncertainty, companies need a bigger portfolio of options to manage risk.

Use a suitable hurdle rate for the opportunity

- Use Mergers and Acquisitions (M&A) and new business models to enable growth and close valuation discounts. Major oil companies are already using M&A to accelerate expansion into low-carbon businesses, such as biofuels, biogas and renewable power. However, overall capital allocated to low-carbon M&A remains limited. Mining majors also continue to take a low-risk approach to acquisitions of transition-focused commodities. New or modified business models can help reduce the transition valuation discount and support efficient capital allocation in businesses with quite different costs of capital and risk-reward profiles.

“A transition growth mindset does not mean abandoning capital discipline if combined with risk-adjusted and transparent hurdle rates,” said Ellacott. “There are different horses for different courses, depending on a company’s scale, portfolio make-up, geographical focus and legacy skillset. The prize is worth fighting for, bending the carbon curve to limit the world’s temperatures to well below 2 °C. And a balanced, disciplined, transition-focused investment approach could grow corporate cash flows sustainably, boosting company valuations.”