Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

The U.S. energy storage market nearly doubled in 2018 and is expected to double again in 2019. According to Wood Mackenzie Power & Renewables and the Energy Storage Association’s (ESA) freshly released U.S. Energy Storage Monitor 2018 Year-in-Review, 777 megawatt-hours of grid-connected energy storage were deployed in the US in 2018, 80 percent more than were deployed in 2017.

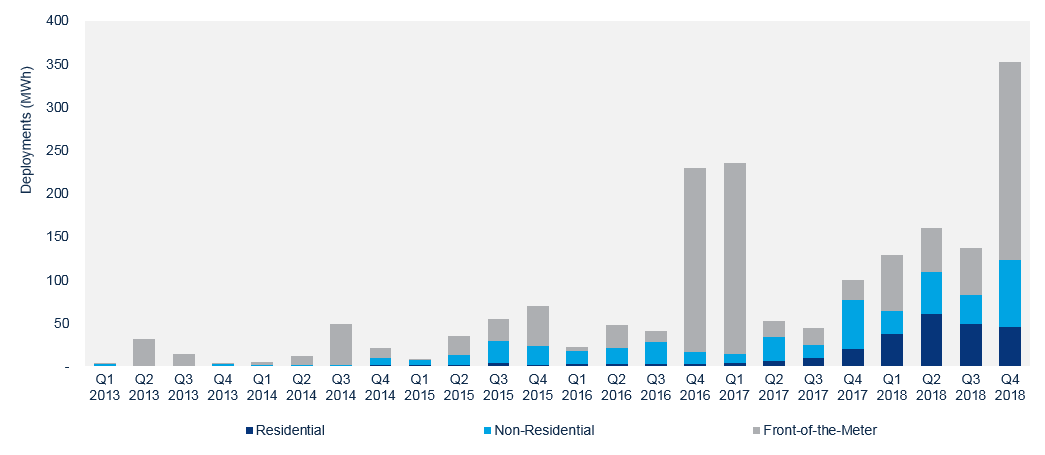

2018 saw robust growth in both behind-the-meter (BTM) and front-of-the-meter (FTM) energy storage. The final quarter of 2018 broke the previous record for megawatt hours deployed in a single quarter by 50 percent, with large FTM projects in Hawaii and Texas making up a significant portion of the total. The U.S. residential storage market quadrupled in 2018 year-over-year.

“Overall there was strong U.S. energy storage market growth in 2018, especially in the residential market which came into its own,” said Brett Simon, senior storage analyst at Wood Mackenzie Power & Renewables. “The residential market is moving beyond early adopters who are seeking out storage systems for backup power. We’re seeing the rise of opportunities for time-of-use shifting, solar self-consumption, and even some early examples of employing residential storage for grid services, such as by Green Mountain Power in Vermont and Liberty Utilities in New Hampshire.”

“Looking back on 2018, states continued to lead, with a series of gubernatorial, legislative and regulatory actions aimed at unlocking the potential of storage to serve as a central catalyst for modernizing and creating a more resilient, efficient, sustainable, and affordable electricity grid,” said ESA CEO Kelly Speakes-Backman. “Incorporating energy storage in utility planning processes proved to be a key policy theme as well, with the National Association of Regulatory Commissioners adopting a resolution calling on utilities to include storage in long-term planning efforts. At the federal level, FERC’s landmark, bipartisan Order 841 provided a critical policy signal that triggered discussions on storage deployment barriers in regional markets. Overall, 2018 was a banner year for energy storage, and 2019 is primed to repeat and expand on these successes.”

FIGURE: U.S. Quarterly Energy Storage Deployments by Segment (MWh)

Source: Wood Mackenzie Power & Renewables

The report notes that 311 megawatts of energy storage were deployed in the US in 2018, with FTM accounting for 47 percent in megawatt terms. California led the energy storage market in the US yet again and Texas, New York and Hawaii also saw significant activity. Wood Mackenzie and ESA consider every U.S. state to be an active or emerging storage market.

More BTM storage was deployed in 2018 in the U.S. than any previous year on record, accounting for 53 percent of megawatts deployed in 2018. The U.S. BTM market will pick up an increasing share of overall storage market value and is expected to account for more than half of annual market value in dollar terms by 2021. In 2018, several utilities initiated programs to explore the use of residential storage for grid services, heralding a new chapter in residential storage where market players can access diverse new revenue streams beyond backup power.

On the FTM side, Q4 2018 broke the previous megawatt-hour deployment record from Q1 2017. A range of solar-paired and stand-alone systems across multiple markets and use cases contributed to the quarter’s high FTM total.

“The value of front-of-the-meter energy storage is being recognized by an ever-expanding range of stakeholders. Its diversity and flexibility will drive the FTM market to the GW-scale by 2020, with further potential upside as non-traditional markets continue to emerge,” said Daniel Finn-Foley, senior storage analyst at Wood Mackenzie Power & Renewables

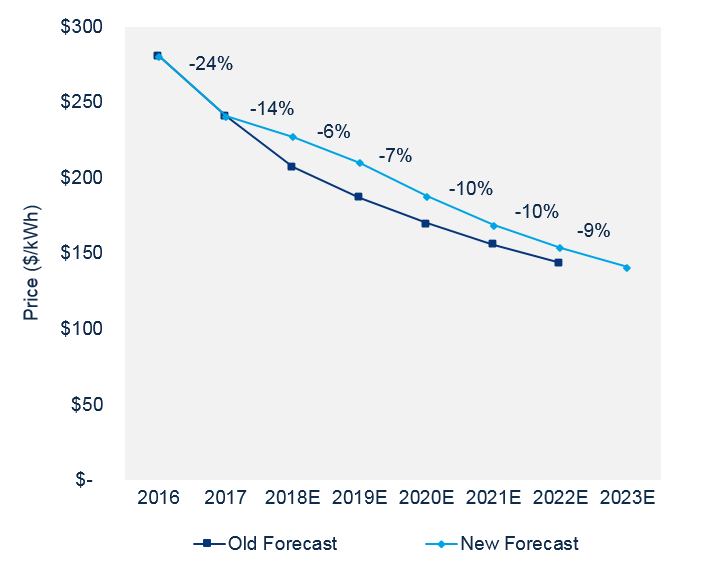

FIGURE: Battery Rack Price Forecast, 2016-2023E ($/kWh)

Source: Wood Mackenzie Power & Renewables

2018 was also marked by battery supply shortages, as manufacturers committed capacity to the South Korean market to take advantage of incentives. Consequently, U.S. storage system price declines slowed in 2018, with some products even seeing slight price increases. These shortages are set to abate by the end of Q1 2019 as several Tier 1 battery vendors bring new production capacity online.

New policy structures aiding storage will continue to push the market forward. In 2018, more states established storage mandates, targets and supportive incentive structures, with New York in particular leading the way with the state’s Storage Roadmap. Furthermore, the outcome of FERC Order 841 will create more market opportunities in 2019. The expected upside of Order 841 affects all three segments, with particularly strong growth expected for the FTM segment.

The free executive summary is available for download here.