Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Woodside announces Trion field FID, Mexico’s first deepwater oilfield development

Development considers US $7.2B to recover 479 mmboe

1 minute read

Addressing Woodside’s announced final investment decision (FID) of Trion field, Diego Alviso Becerril, Senior Research Analyst, Upstream Research LATAM, said “This will be Woodside’s first incursion into Mexican waters and Mexico’s first deepwater oil field development. With first oil scheduled for 2028, the development concept considers a US$7.2 billion investment to recover 479 million barrels of equivalent (mmboe).”

Based on the FID presentation, Wood Mackenzie’s Trion model shows the economics of US$2,291.77 million (NPV10, 2023) and a breakeven price of US$ 38.47/bbl. Infrastructure engineering, procurement and construction (EPC) will commence as early as this year and drilling of the 24 planned wells will commence in 2026, with Wood Mackenzie’s model suggesting that 80% of the required capex will be spent by 2033, when the field will be on its production plateau.

Added Alviso, “The Trion development reignites whether Pemex will eventually move forward with the deepwater development Maximino-Nobilis located 35 km away. The absence of existing infrastructure made the economics of the project challenging. However, Trion’s future infrastructure may be an opportunity for synergies.”

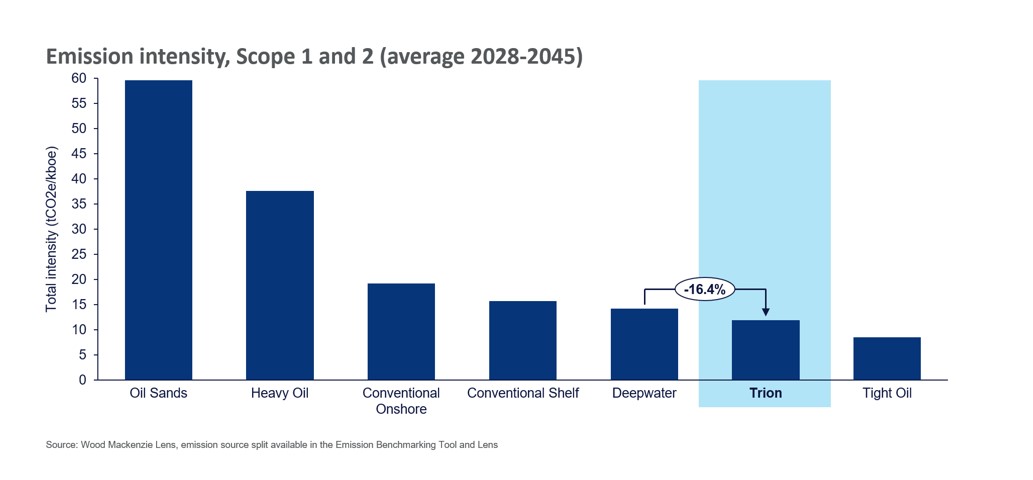

Wood Mackenzie’s Emission Benchmarking Tool points to another driver that led to the project’s FID – low emission intensity compared to other oil resource projects. The project has an average intensity of 12 tCO2e/kboe, below the deepwater average.

“Most of the emission intensity is attributed to production and processing infrastructure, where Woodside will implement reduction initiatives such as high-efficiency compressors, heat recovery mechanisms, and low-pressure vapor capture,” said Alviso.