Chemical solutions: can bioplastics improve the sustainability of the chemicals value chain?

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

Biodegradable biopolymers could cut carbon emissions and reduce waste

Plastic is under heavy scrutiny for its environmental impact. Management of plastic waste is at the centre of the debate, but for an energy-intensive industry focused on processing hydrocarbon inputs, concerns have extended to carbon emissions and the wider environmental footprint.

In a series of Chemical Solutions insights, Wood Mackenzie assesses the key technological and material developments that could substantially reduce the plastics industry’s environmental impact. In the first insight, we explore the current state of play in bioplastics.

Inside this report:

- For and against: the key advantages and disadvantages of bioplastics

- Plastic profiles: a detailed breakdown of four key biodegradable biopolymers

- The market view: how the industry is structured

- Replacing the incumbents: can bioplastics compete with commodity polymers such as PET?

- Finding the way forward: making biopolymers cost competitive

Did you know?

Biodegradable and bio-sourced

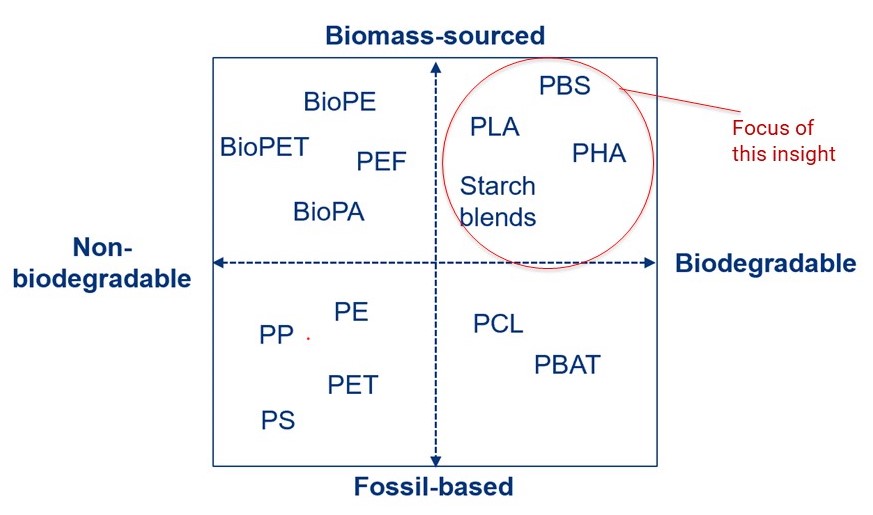

Polymers can be derived from fossil fuels, such as oil and gas, or from biomass, such as agricultural products. Post use, they can be broken down by biological processes (for example, they are biodegradable or compostable under certain conditions) or require alternative means, such as chemical or heat to ensure disposal.

This report focuses on polymers which are both biodegradable and bio-sourced: polylactic acid (PLA); starch polymers or blends; poly(hydroxyalkonates) (PHA); and poly(butylene succinate) (PBS).

New applications for naturally sourced products

Starch polymers are derived from corn, wheat, potato, and other starch-rich plants. They have been used in packaging and short-lived consumer goods for more than 30 years. A new application area being explored is in tyres. It replaces carbon black (which is made from fossil fuels) and the resulting tyre has reduced rolling resistance and greater fuel economy.

A new model for the industry to scale up

Alongside government intervention, such as legislation and carbon taxes, the industry needs to find a model which addresses high costs and scalability challenges.

We have developed an ideal model which could see bioplastics make substantial inroads into the global plastics market, placing significant emphasis on efficient logistics and integration of bio refineries.

For more detail on our four-stage integrated model, read the report.

Got a question about this report?

Guy Bailey, Head of Intermediates and Applications, and his team will be happy to answer your queries. Get in touch by filling in the form at the top of this page.

Report summary

Table of contents

- Executive Summary

- Chemical solutions: can bioplastics improve the sustainability of the chemicals value chain?

- Bioplastics: a primer

- What advantages do bioplastics bring?

- What are the key challenges for bioplastics?

- Can bioplastics play a meaningful role in improving the sustainability of the chemicals value chain?

- What could be done to increase the role of bioplastics?

- Appendix

-

Biodegradable bioplastics profile

- Polylactic acid (PLA)

- Starch polymers and blends

- Polyhydroxy alkanoates (PHA)

- Poly(butylene succinate) (PBS)

Tables and charts

This report includes the following images and tables:

- Public concern about plastic waste has increased in recent years

- Key features of the four bioplastic polymers

- Bioplastic capacities are growing at a slower rate than commodity polymers over the next four years

- High-level features of an integrated bio-refinery model

- PLA has a route to competitiveness against commodity polymers with the right policy mix

- PLA - application breakdown

- PLA - regional breakdown

- Starch polymers - application breakdown

- 5 more item(s)...

What's included

This report contains: