Newmont divests Mexican gold assets to Fresnillo

This report is currently unavailable

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

Report summary

Table of contents

- Executive summary

- Deal summary

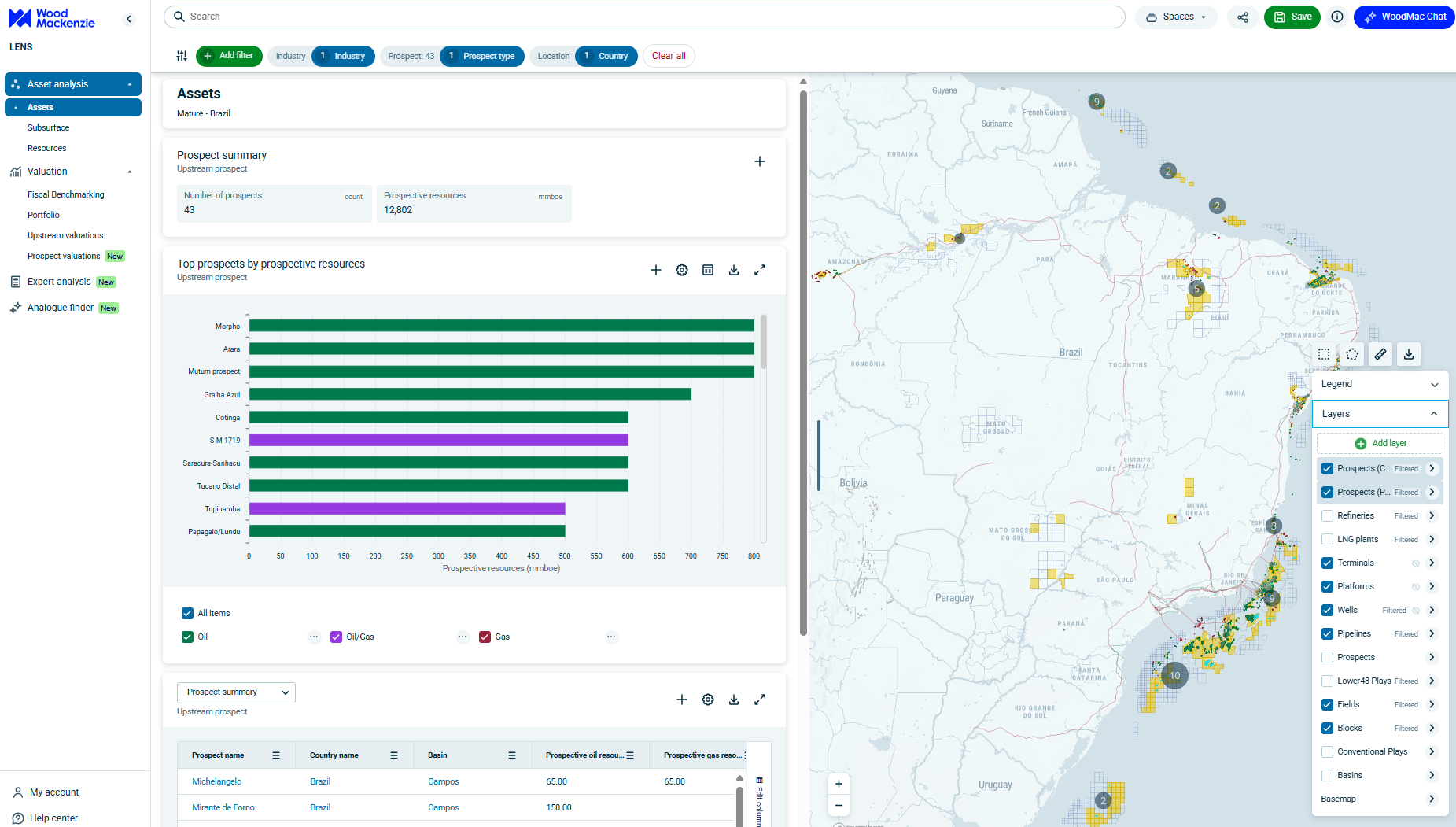

- Location map

-

Key assets

- Reserves and Resources

- Production

-

Cost Analysis

- Newmont

- Fresnillo

Tables and charts

This report includes the following images and tables:

- Newmont divests Mexican gold assets to Fresnillo: Table 1

- Newmont divests Mexican gold assets to Fresnillo: Image 1

- Gold equivalent production from PJV mines

- Newmont divests Mexican gold assets to Fresnillo: Table 4

- 2014 Asset cost curve ranked on total cash cost plus sustaining capital

- 2014 Company cost curve ranked on total cash cost plus sustaining capital

- Newmont divests Mexican gold assets to Fresnillo: Table 2

- Newmont divests Mexican gold assets to Fresnillo: Table 3

What's included

This report contains:

Other reports you may be interested in

McPhillamys gold project

A detailed analysis of the McPhillamys gold project

$2,250Taking global deepwater assets from good to great

Which deepwater assets will be the most coveted portfolio options in the 2030s?

$1,350Spring arrives … and so do the blackouts

Analysis of the recent widespread blackout in the Yucatan Peninsula region

$950