Eagle Ford Key Play

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

Report summary

Why buy this report?

Our detailed report cuts to the heart of industry trends by benchmarking sub-plays and companies across the Eagle Ford. Make strong investment decisions on opportunities in the region by using this report to:

• Understand the trends our analysts see for production in 2018 and beyond

• Identify sub-play areas with the strongest prospects

• Benchmark production against other regions in the L48

This comprehensive study reveals what is driving value across the popular Eagle Ford region. It includes:

• Detailed analysis of over 1,600 of Eagle Ford's wells, tracking changes in performance efficiencies and value

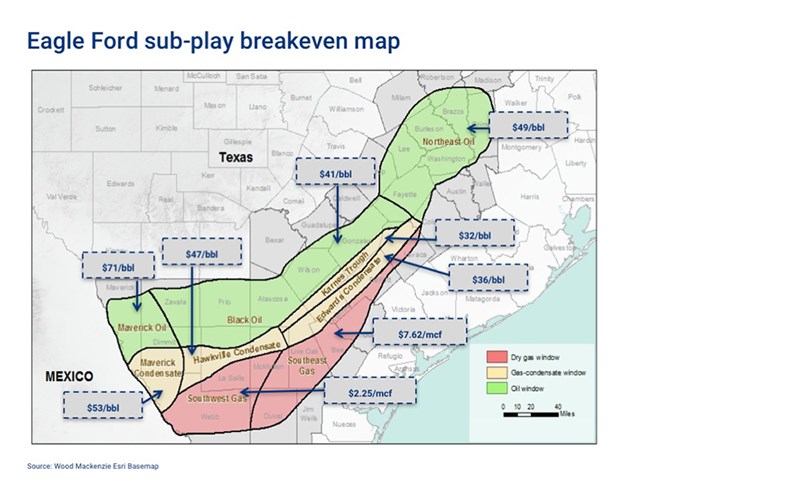

• Measurement of productivity across nine sub-play areas

• Our latest forecasts on production costs, productivity and company performance

Related subscription products

Other reports you may be interested in

Mexico Eagle Ford shale gas unconventional play

A detailed analysis of the pre-developed Eagle Ford in Mexico.

$2,800Bakken and Three Forks Key Play

Our Bakken and Three Forks type curve update showcases our latest view on well productivity, well costs, and well economics.

$22,800Montney key play

Detailed analysis of Montney production, well design, economics, operator strategy and subsurface.

$22,800