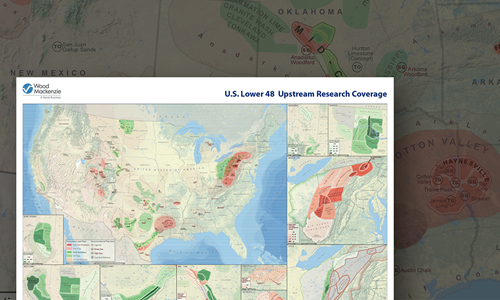

US Lower 48 Upstream Research Coverage Wallmap

This report is currently unavailable

Summary

Wood Mackenzie has produced a detailed wallmap of the United States Lower 48 detailing pertinent unconventional oil and gas plays and upstream and midstream information.

The map enables you to gain a rapid appreciation of the following:

- Play specific information:

- Location and extent

- 2019 rigs and production growth

- Percent developed and undeveloped

- Subplay specific information:

- Activity heat maps

- Production growth

- Supply specific information

- Locations of major midstream assets

- Inset map showing Gulf Coast buildout

- Cost of supply

- Supply forecast

This wall map is an invaluable reference for anyone interested in the unconventional oil and gas industry in the US Lower 48. Wallmaps bought online will be couriered to you within 5 days.

Why buy a wallmap?

Our maps bring together trusted data and research from across the globe. And we have a team of analysts and researchers committed to ensuring the continued accuracy and consistency of data across the entire collection. With a Wood Mackenzie map, you can:

- Gain an instant visual appreciation of multiple assets and markets across global locations.

- Use them as reference documents in group discussions

- Get a single, reliable overview

What will you receive?

- Printed to make a big and lasting impression, each map is 84cm x 120cm or 33 inches x 46 3/4 inches on high quality paper

- Couriered to you when purchased online

- Delivered in a tough cardboard tube to ensure maps reach you in pristine condition

Other reports you may be interested in

Repsol - Lower 48 upstream

A valuation of Repsol's assets in the US Lower 48

$22,800BPX Energy - Lower 48 upstream

Upstream valuation for bpx Energy's Delaware, Eagle Ford, and Haynesville assets.

$22,800Occidental Petroleum - Lower 48 upstream

Upstream valuation of Oxy's assets in the US Lower 48

$22,800