Demand generation

Now that people know we exist and what kind of services and solutions we offer, it's time to start being a bit more specific. Our prospects have a problem, and we want to be the one who solves it

Valuations and market assessment in seconds

At this stage, prospects want to get to understand our services and solutions in more detail and how you can solve their actual issues. The goal at this stage is to make it as clear and easy to users how we answer their questions or solve their issues. Keep your content informative and useful but look to offer more in-depth guides, demos, industry news, and similar content. Thistage s is when your educational content can get a bit more in-depth. Longer white papers, mid-level guides and even webinar series can help advance the prospect through the funnel.

Gain first-to-market advantage through near real time insight

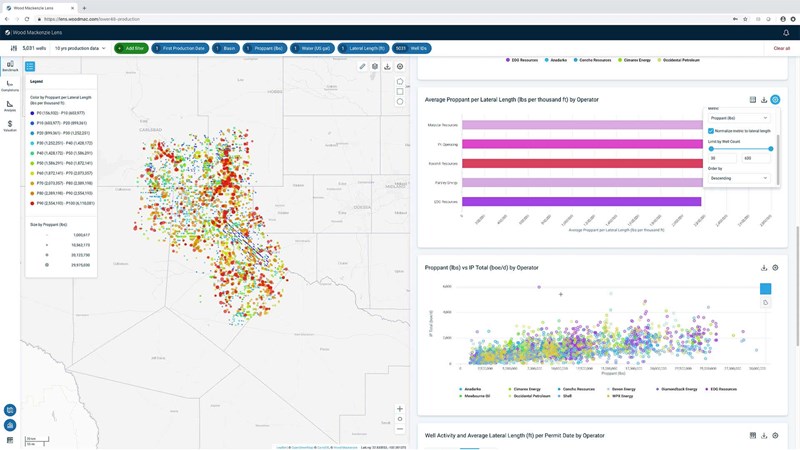

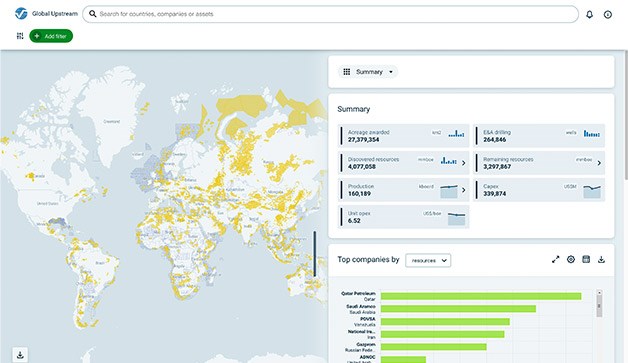

Use Lens Upstream to value, analyse, or quickly re-model investment scenarios on a regional or global scale.

Create your pitchbooks from start to finish, all in one place

Create your pitchbooks from start to finish, all in one place

One integrated solution means no need to jump between different tools and data sets and no separate processes of searching or filtering through complex data. Lens consolidates valuations analyses as one integrated workflow, allowing you to be more productive, remain agile, and develop invaluable insights.

Filter and visualise company and asset valuations at the touch of a button

Filter and visualise company and asset valuations at the touch of a button

View and customise multiple company and asset valuation parameters, then use filtered results to solidify your acquisition or investment decisions with analytics-ready visuals.

Generate valuation summaries using your economic assumptions

Generate valuation summaries using your economic assumptions

Test 'what if' scenarios and understand how price sensitivity affects the overall valuation of companies or assets by interrogating Lens analytics-ready data with critical performance metrics such as production, CAPEX, OPEX, and NPV in just a few clicks.

Collaborate with colleagues across your organisation

Collaborate with colleagues across your organisation

Share views, portfolios and price decks* in real time within the platform using Lens Spaces or fine-tune presentations and streamline off-line analysis by exporting Wood Mackenzie base case calculations and fiscal models at the asset, regime, or company level to Excel. Then share those critical findings with your colleagues to aid collaboration and decision-making.

*Price deck sharing coming soon

See Lens Modelling in action

With Lens Upstream you can ask your most complex valuation questions and get answers in seconds.

Upstream Asset Valuations

Generate valuations of multiple assets in seconds to identify the best strategic opportunities for your portfolios.

Upstream Company Valuations

Value companies at a consolidated level, including subsidiaries.

Analyse investment opportunities with precision and pace

Leverage Lens to automatically generate presentation-ready analysis for confident decision-making.

Efficient Operations

2x more time to perform deeper analysis

Improved accuracy

100s of pre-populated proprietary fiscal markers

Faster Business Results

Run multi-company and multi-asset valuations in minutes, not hours through parallel processing

Increased Confidence

Get unmatched insights and valuation expertise from Wood Mackenzie's 200+ Upstream analysts

Unlock the power of Lens

Lens Upstream is your single source for accessing Wood Mackenzie’s upstream oil & gas data, with modelling insights designed to enable improved capital allocation