Discuss your challenges with our solutions experts

Will changing demand hamper North American refiners?

Measuring OPEC production cuts effective vs emerging trends within refining

1 minute read

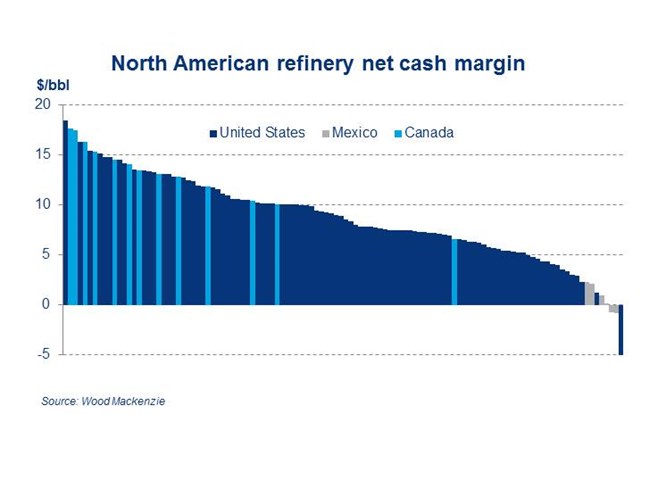

Despite the prolonged low-price oil market over the past year, North American refiners have largely remained in good financial health — but changes in the supply and demand landscape are creating uncertainties. OPEC production cuts, the lifted ban for US exports, and decarbonisation legislation are triggering push-me-pull-you scenarios making it more difficult to see how refiners' bottom lines will respond in the near term.

Refining has enjoyed healthy measures for a couple of years running, countercyclical to the lows in the oil markets. In our latest Insight, our analysts take measure of the effectiveness of the OPEC production cuts versus the emerging and prevailing trends within refining. The industry is faced with a number of questions, risks and uncertainties on whether margins will remain healthy.

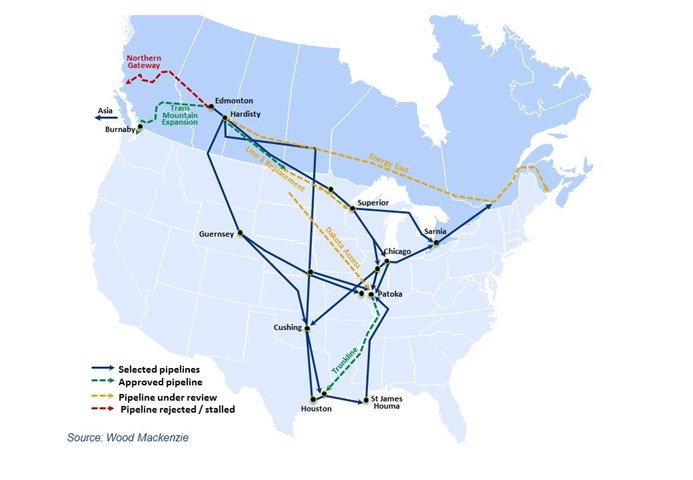

From an oil supply perspective, OPEC's discipline through this round of cuts has pushed the US supply response to the fore as prices are proving more supportive. These same prices and upcoming changes around pipeline infrastructure in North America has Canadian supply implications as well. North American refiners will see new barrels at the same time there are more international options for these barrels now that the export ban is lifted and new pipe looks destined to be commissioned.

Taking stock of upcoming changes in demand is proving tricky. Fuel economy remains the prevailing theme, but transport fuels are seeing decarbonisation trends and substitution threats from an ever more competitive, and legislated, electric vehicle market. The trends and forces at play are putting certain assets at risk while others may find themselves thrust to fore of the global competitive stage as they vie for market share.

One cannot forget regulatory hurdles facing the refiner. Upcoming changes in the global bunker market may prove a supportive and positive force for the North American refiner who traditionally destroys these fuels en route to making higher valued distillates. And the recent headline high prices in the renewables markets has many calling for changes in the point of RIN obligations.

These are a rich and diverse set of issues facing the North American refiner. Join us at AFPM 2017 where we will take on these topics.