Red Sea crisis: what crisis? Not for US refiners as refining margins boom

US product exports to Europe advantaged as Middle East/West Coast India exports are challenged by Red Sea disruption

4 minute read

Emma Mitchell (née Fox)

Principal Analyst, EMEA Refining

Emma Mitchell (née Fox)

Principal Analyst, EMEA Refining

Emma is a Principal Analyst in the oils and chems research team.

Latest articles by Emma

-

Opinion

Trump’s tariff plan: implications for the future of global liquids trade

-

Opinion

Assessing the refineries at risk of closure

-

Opinion

Red Sea crisis: what crisis? Not for US refiners as refining margins boom

-

Opinion

Part 3: unlocking the value of refinery-petrochemicals integration

The Red Sea is critical to the global oil market. Wood Mackenzie’s Vessel Tracking, Crude Trade and Refined Product Trade services show that an average 8.5 million b/d of crude oil and refined products use this route. However, the disruption around the Bab el-Mandeb strait looks set to persist, with over 20% of oil tanker trade now taking the long detour around the Cape of Good Hope. Jet fuel is the most impacted, with almost 50% of total diesel flows now avoiding the Red Sea. With more than two weeks added to voyage times, freight rates have naturally increased, along with European refined product cracks. The domino effect of this change to trade flows is likely to affect the global refining sector for some time to come.

In this insight, we highlight the current market dynamics and assess how the global refining system may have to adapt, should regional tensions escalate further. Fill in the form to download the full report and read on for an introduction.

Changing trade flows

Since sanctions were imposed on Russian oil in early 2023, crude and refined product trade flows have significantly reshuffled, with both northbound and southbound flows through the Red Sea impacted. Russia’s exports are now particularly vulnerable to disruption, since almost 80% of its crude and product exports use the Red Sea to reach the Middle East and Asia.

Northbound crude oil flows towards Europe have been in decline for the last year following extensive OPEC+ supply cuts. European refiners have responded by switching to processing more US crude. European suppliers have also had to replace Russian barrels with middle distillates from the Middle East and India.

Despite a decline in oil tanker movement through the Red Sea, a significant number are still using the route in both directions, and as trade flows adjust over time, we expect the recent spike in both refined product cracks and freight rates to ease. The biggest impact will be felt on middle distillate trade, particularly jet fuel. European distillate cracks need to remain elevated to draw sufficient imports from the Middle East and West Coast India, to cover higher freight rates as some suppliers opt to travel considerably further around the Cape of Good Hope.More than half of middle distillate flows to Europe travelled via the Cape in January, but total East-West flows have dropped. This was largely due to Indian diesel loadings pivoting to Asia, while they awaited the re-basing of European prices required for their exports to Europe to be commercially viable. With the East-West spread rebalancing, these flows are set to return in the coming weeks. Jet cargoes have been impacted the most, with 55% of volumes undertaking the lengthy diversion, compared to only 45% of diesel/ gasoil flows.

Most flows eastward are of Russian origin, and these have continued largely uninterrupted. European gasoline and Algerian naphtha have diverted. Combined with Ukraine’s recent drone attacks on Russian refiners, the supply of naphtha/gasoline from Europe to Asia has fallen.

The biggest winners from the boost to European distillate cracks are USGC complex refiners.

We expect these trade flows to continue to evolve, with US distillates increasingly clearing to Europe, while Middle East products will redirect to the Americas and Asia.

The market impact

The refined product market will respond relatively quickly to the current turbulence, adjusting to changing trade flows in the near term. In general, though, product markets this quarter will be under more pressure than previously forecast. If the disruption and higher global freight rates continue, European refiners are likely to be forced to run more US crudes, reducing European diesel/jet yields even more.

Pulling in more USGC distillate volumes may be necessary to make up the shortfall, so there is upside risk to European distillate crack spreads.

What if the Red Sea closes?

We have used our proprietary Refining Supply Model (RSM) to get a sense of how the global refining system and trade flows may re-equilibrate to a full closure of the Red Sea. This model evaluated the impact of completely shutting off crude and product trade flow through the Red Sea. As well as forcing trade to flow via the Cape of Good Hope, or via the Panama Canal, our scenario increases VLSFO demand by 250 kb/d.

Our model shows that European refiners will replace Middle Eastern crude oil with barrels from Caspian and Africa, increasing the pressure on regional middle distillate yields. Stronger product cracks will help Atlantic Basin gross margins, but Asian refiners will see crude delivery costs increase. In our assessment, then, North American refiners stand to benefit the most.

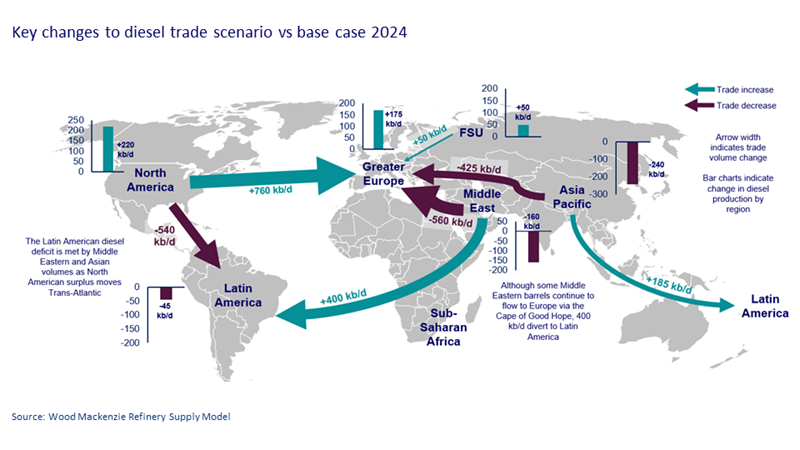

Without access to the Suez Canal, Middle Eastern diesel will increasingly flow to Latin America. Meanwhile, North American surplus will cross the Atlantic to Greater Europe. The Atlantic basin will increase production, and Middle Eastern and Asian outputs will fall. This is outlined in the chart below: