Sign up today to get the best of our expert insight in your inbox

CCU – from decarbonisation to defossilisation

Catalysts required to kickstart development

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

India’s energy challenge

-

The Edge

Is there still life in decarbonising hard-to-abate sectors?

-

The Edge

A wild week for gas markets

-

The Edge

How Venezuela complicates the oil market’s delicate rebalancing

-

The Edge

Is Greenland Venezuela 2.0?

-

The Edge

Five themes shaping the energy world in 2026

John Ferrier

Senior Research Analyst, Carbon Management

John Ferrier

Senior Research Analyst, Carbon Management

John works to provide expert insight and strategic analysis on developments in CCUS across EMEA to support his clients.

Latest articles by John

-

Opinion

5 key takeaways from Wood Mackenzie’s CCUS Conference 2025

-

Opinion

CCU – from decarbonisation to defossilisation

-

Opinion

Defossilizing industry: considerations for scaling-up carbon capture and utilization pathways

-

Opinion

Ready, steady, store: delivering on the EU’s CO₂ storage obligation

-

Opinion

Video | Three FIDs, one day: a turning point for CCUS in the UK and Denmark

Carbon is a valuable element and a key ingredient in almost every product in society. The problem is too much of it ends up in the wrong place – the atmosphere. Currently, there are two main options for dealing with emitted carbon: carbon capture and storage (CCS) or carbon capture and utilisation (CCU). Both are nascent technologies but, so far, investment in the former is leaving the latter in its wake.

Wood Mackenzie, in collaboration with the World Economic Forum, released a White Paper on CCU at last week’s Climate Week in New York. I asked co-author John Ferrier, Senior Analyst CCU, how he views the prospects for the technology.

What is CCU?

Essentially, it involves replacing carbon currently sourced from fossil fuels with captured carbon in multiple products such as fuels and intermediates (including methanol), chemicals, building materials and those needed to make pure-carbon materials like graphite. Each of these solutions offers different emissions reduction benefits.

The challenge is that all are higher cost than their conventional alternatives, requiring large amounts of renewable electricity and the development of early-stage technologies – all without the benefit of the supply chains and economies of scale that conventional production enjoys.

How big is the opportunity, and which sectors offer the most potential?

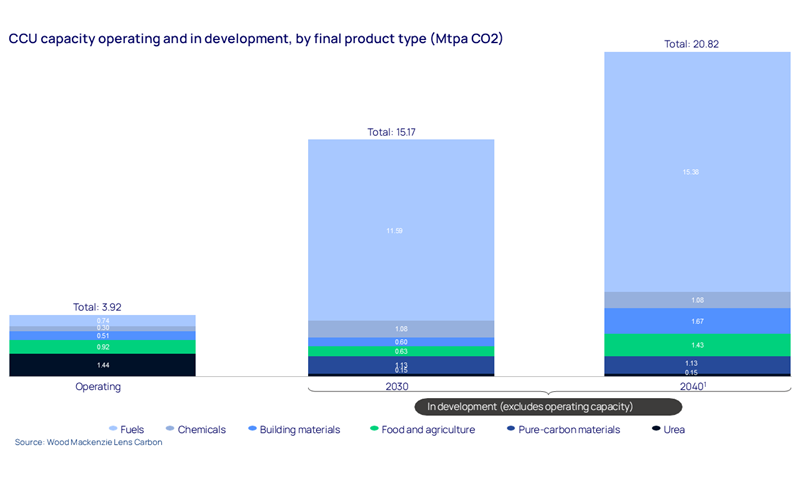

CCU could make a sizeable, incremental contribution to global decarbonisation. The Oil and Gas Climate Initiative’s 2024 study forecast between 0.4 Btpa and 0.8 Btpa of captured carbon could be utilised by 2040, or 1% to 2% of current global greenhouse gas emissions.

With demand for liquid hydrocarbons from petrochemical feedstocks alone expected to grow from 17 million barrels per day in 2025 to around 26 million by 2050, CCU should be part of the solution.

Methanol represents a significant market opportunity, given the wide range of downstream applications across olefins, e-fuels and maritime transport. Current forecasts see e-methanol demand of around 40 Mtpa, out of a total 227 Mtpa of overall global demand, by 2050.

Plastics are another huge opportunity. We currently see demand for ethylene and propylene derivatives as high as 519 Mtpa. CCU could contribute to this demand through methanol and ethanol production, as well as the emerging CCU technologies that can synthesise plastic precursors directly.

Why is CCU in the shadow of CCS?

Every CO2 molecule utilised is a fossil molecule that remains buried. Yet CCU currently receives very little in government support compared to CCS. Our outlook expects around 940 Mtpa of capture capacity for storage by 2040, driven primarily by government subsidy and carbon pricing.

In contrast, the current CCU pipeline out to 2040 sits at a meagre 25 Mtpa – less than 3% of the total. All this despite CCS inherently creating no economic value and being wholly dependent on revenue from regulatory sources, whereas CCU offers additional revenue for projects’ CO2 income stream.

What are the challenges for CCU projects?

There are significant logistical challenges, from creating entirely new value chains to collect carbon to manufacturing the product. Upfront capex for projects is high while the end-products are more expensive than conventional ones. Costs can be expected to fall, and technologies will improve but if the first projects can’t get off the ground, little progress will be made.

Policy must play a crucial role but, to date, that’s been limited. Carbon pricing regimes globally are too low to incentivise capture, and where they are the most developed, such as in Europe, many CCU applications aren’t covered. Exceptions are those that deliver permanent carbon storage, such as within CO2-treated building materials. For any applications that result in less than permanent storage, including chemical products, there is no carbon price incentive in place globally.

Do we expect policy to kickstart CCU development?

The signals are mixed – no jurisdiction currently has a clear vision for what role CCU could play in its carbon management strategies. The EU, arguably the global CCU frontrunner despite an imperfect regulatory regime, is considering revisions to the EU emissions trading scheme that could see carbon pricing extend more broadly to CCU. This would be a valuable step towards levelling the playing field with conventional fossil-derived production routes, though not sufficient in isolation.

To drive investment, meaningful demand-side measures – such as content mandates, combined with public funding support – can help derisk first-of-a-kind projects and unlock essential capital. We have seen coherent and credible policy frameworks unlock performance and cost improvements in energy decarbonisation. Perhaps those same lessons could be applied to industrial “defossilisation.”

Connected: Bringing predictability to the increasingly uncertain world of energy.

Diving deep into the themes of an increasingly interconnected world, we’re proud to launch Connected: Bringing predictability to the increasingly uncertain world of energy, a new book I co-authored with Wood Mackenzie CEO, Jason Liu. It brings together the ideas, challenges and solutions shaping the future of energy and captures the reality that our world and our industry are no longer siloed. Everything is connected. Markets. Commodities. Geopolitics. Data. Technology. And decision-making.

Find out more: Connected | Energy, Data & Analytics Book from WoodMac | Wood Mackenzie

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.

Sign up today using the form at the top of the page.

Business as usual is over

Introducing the latest insight from our thought leaders, the book Connected: Bringing predictability to the increasingly uncertain world of energy.

As climate change accelerates and geopolitical tensions reshape global markets, the energy landscape has become increasingly interconnected. Connected explores why those interconnections have developed, and how they bring clarity to the most important decisions we make about the future of energy.