Sign up today to get the best of our expert insight in your inbox.

Upside pressure mounts on US gas prices

Surging gas demand set to push Henry Hub higher

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

View Simon Flowers's full profileMassimo Di Odoardo

Vice President, Gas and LNG Research

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo brings extensive knowledge of the entire gas industry value chain to his role leading gas and LNG consulting.

Latest articles by Massimo

-

The Edge

A wild week for gas markets

-

Featured

Gas & LNG: region-by-region predictions for 2026

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Gastech 2025: when will the music stop for US LNG?

-

Opinion

Asia’s LNG affordability challenge amid surging supply

-

The Edge

Could US LNG become a victim of its own success?

Dulles Wang

Director, Americas Gas and LNG Research

Dulles Wang

Director, Americas Gas and LNG Research

Dulles delivers analysis of all aspects of the natural gas value chain.

Latest articles by Dulles

-

Opinion

North America gas: 4 things to look for in 2026

-

Opinion

How LNG and power are shaping US gas pipeline development

-

Opinion

Green gains: inside the rise of North American renewable natural gas

-

Opinion

4 things you should know about North American gas to 2050

-

Opinion

North America's RNG market set for continued growth in 2025 after historic year

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A wild week for gas markets

-

The Edge

How Venezuela complicates the oil market’s delicate rebalancing

-

The Edge

Is Greenland Venezuela 2.0?

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Five key takeaways from COP30

-

The Edge

Can copper supply keep up with surging demand?

The US Henry Hub gas price has been among the global energy market’s most stable benchmarks. Over the past 10 years, annual average prices have rarely moved outside a relatively narrow range of US$2.50 to US$3.50/mmbtu, as ample low-cost supply and high market liquidity helped manage price volatility.

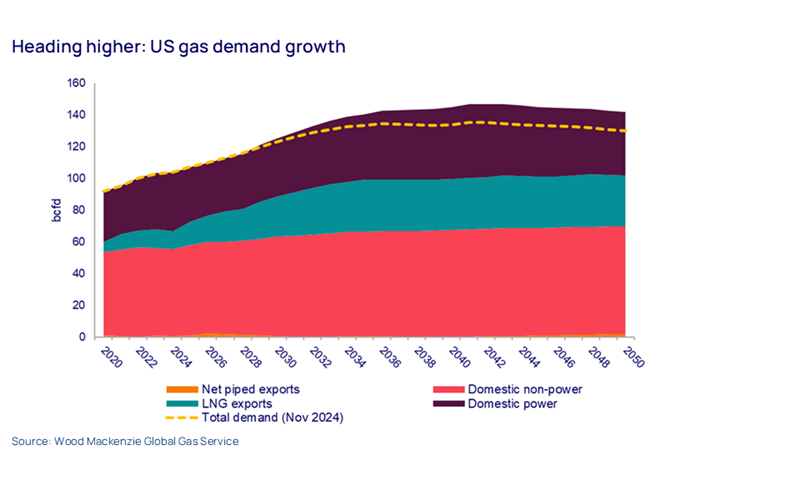

Those days could soon be over. While there’s a widespread view that US gas prices will increase as demand rises, we believe Henry Hub could be trading as high as US$5/mmbtu by 2035 and continuing upwards to US$7/mmbtu by 2050. Massimo Di-Odoardo and Dulles Wang from our gas and LNG team see four main drivers behind this.

First, the rising call for gas from the US LNG sector

Among the raft of executive orders signed by President Donald Trump in January was the lifting of the pause on new LNG export approvals, quickly followed by the first new export permits. Woodside’s 16.5-mmtpa Louisiana LNG project has already taken final investment decision this year, and others look set to follow soon. We now anticipate six US Gulf Coast projects to move ahead by 2027, adding an additional 68 mmtpa of capacit y on top of the 65 mmtpa currently under construction.

Second, turbocharged US power demand is pulling in gas from all directions as the outlook for renewables falters

The boom in data centres and manufacturing is already proving transformational for US electricity demand. After years of tepid growth, demand is now increasing by around 2.5% a year and will increase by 60% between 2025 and 2050.

Gas-to-power will take a much larger share of this growth, with solar and wind rollout hobbled. The Trump administration’s dismantling of the Biden-era tax credits from 2022’s Inflation Reduction Act was already in our forecasts, but tariffs are a sucker punch, even if this week’s US trade deal with China softens the blow. Wherever tariffs finally land, they are already negatively impacting imports of components and raw materials for the US low-carbon sector and creating uncertainty over the potential for reshoring more manufacturing.

Any significant cost premium for building new renewables capacity in the US risks depriving the power market of new low-cost generation sources. Existing gas plants with spare capacity are the biggest beneficiaries.

Third, growing risks to domestic gas supply growth

Several US tight oil producers have recently announced cuts to investment budgets as companies and investors become increasingly bearish on oil prices. Lower tight oil investment means less low-cost associated gas from plays, including the Permian. Producers in key non-associated plays are also refocusing on capital discipline in an uncertain cost environment, intensified by the potential impact of tariffs on consumable inputs like steel, fluids, chemicals and cement.

We’re closely watching the impact of upstream consolidation on supply elasticity. which is expected to make the supply curve steeper, with higher gas prices needed to incentivise drilling. Fewer, bigger players will make price response more selective.

Fourth, infrastructure constraints

As part of the “Unleashing American Energy” executive order, the Trump administration is aiming to repeal parts of the long-established National Environmental Protection Act, which would see federal permitting processes expedited for new infrastructure. Accelerating gas pipeline approvals would open more low-cost supply from capacity-constrained supply basins, especially in the Northeast. But state governments still hold real sway and are likely to challenge the proposals, along with environmental groups. If successful, then slower gas infrastructure development as demand rises will heap more pressure on Henry Hub.

Higher Henry Hub prices have important domestic and global ramifications. Offtakers of US LNG would see the cost of their contracts increasing just as a wave of new LNG supply is anticipated to put pressure on traded gas prices in global markets. For a period, US projects face the prospect of global LNG prices trading at a considerable discount to the long-run marginal cost of US LNG.

At home, a significant cost premium for building new renewables capacity in the US and a greater dependence on gas will increase electricity prices for consumers. With the affordability of electricity ever more in the political spotlight, US LNG projects could become a victim of their own success. Could a future policy shift to limit yet more domestic gas into LNG appear on the horizon?

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.