Discuss your challenges with our solutions experts

In the final instalment of our global trends to 2035 series, we analyse shifting supply and demand dynamics that will foster the growth of international trade.

The coming years will reshape world gas trade, with new liquefied natural gas (LNG) supplies coming online as demand growth in some major markets weakens.

Between now and 2035, the US will become an important LNG supplier and, by 2020, 60% of US LNG will find a market in Europe.

However, while demand is there, some US producers will be unable to recover the cash cost of shipping to Europe, as oversupply forces gas prices to stay low. It is likely some US LNG will be shut-in on a seasonal basis until the mid-2020s.

That said, volumes delivered to Europe will continue to increase to 2025 before falling once more as competition from other new LNG suppliers and destinations causes US volumes to be diverted elsewhere.

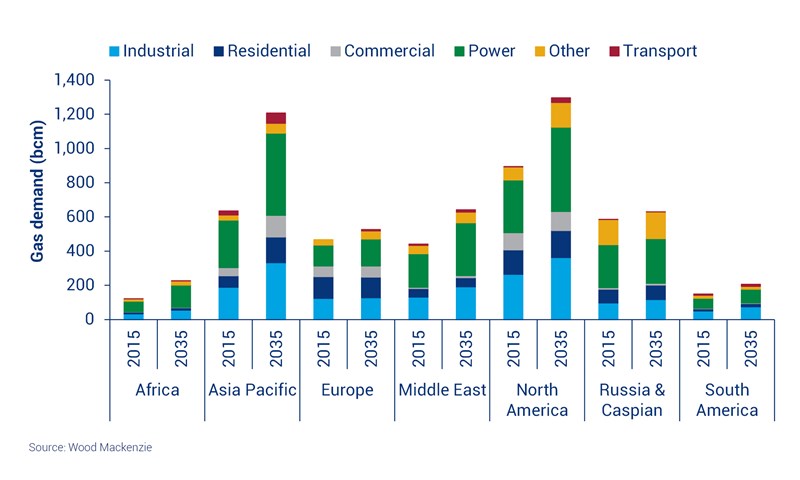

Asia Pacific and North America set to dominate gas demand

Asia Pacific and North America set to dominate gas demand

Indeed, China's long-term growth potential remains considerable, despite recent downward revisions. Chinese gas-into-power demand will grow 366% from 2016 to 2035, as the country becomes the world's largest importer of LNG, overtaking Japan whose gas-into-power demand will fall 33% as the nuclear fleet ramps up again.

In India, gas demand growth is 156% from 2016 to 2035, at 5% per annum. India will account for only 3% of the global market by 2035, but nevertheless will be the world's largest importer of LNG - a neat illustration of the increasing fluidity of the global gas market in the years to come.

Such varied growth in regional gas demand will make it difficult for supply and demand to balance without international trade. The distance between supply regions and centres of demand is fostering the growth of the global LNG market as a solution.

We expect that such significant change will herald a shift away from oil indexation in the gas market, creating more independent global hydrocarbon prices.