Discuss your challenges with our solutions experts

7 solar trends utility companies need to know

Our solar analysts put some numbers behind their 2018 predictions

1 minute read

It's going to be a big year for solar around the world.

The global solar market grew by 26 percent last year, with 99 gigawatts of grid-connected PV capacity installed. According to our new Global Solar Data Hub, 2018 will be the first-ever triple-digit year for the global solar market, with an anticipated 106 gigawatts of PV coming online.

Amid all of that growth, several notable shifts are expected to take place. Our solar analysts have highlighted 7 trends that utilities should be following this year.

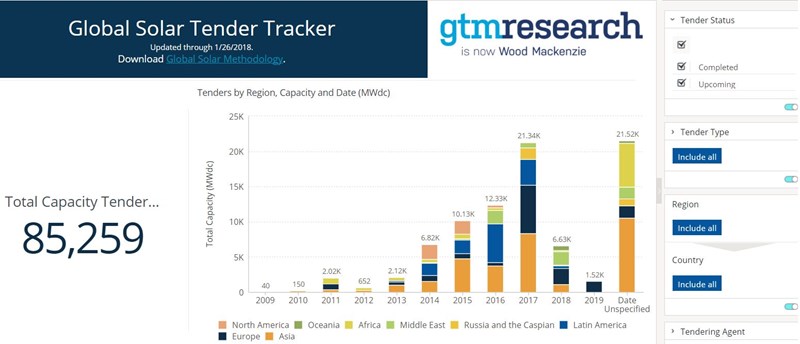

Global solar tenders continue to proliferate

Our team counts 53 national markets where a tendering or auction scheme is currently in place, up from 32 in the second half of 2016. Furthermore, there are an additional 29 national markets where a tendering or auction scheme has been discussed or planned.

Source: Solar PV Markets Service

More than 3 gigawatts' worth of solar tenders will be announced in the first quarter of 2018 alone.

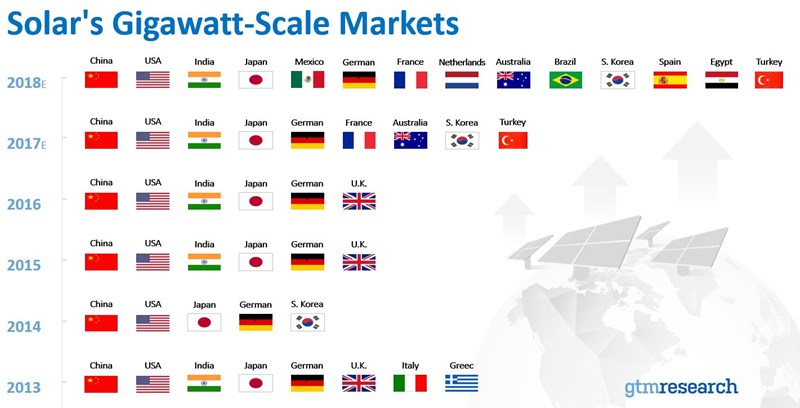

The global market is diversifying, but large countries still dominate

China, the US, India and Japan will continue to dominate demand in 2018, but their share of overall global market will shrink from 82 percent in 2017 to 72 percent in 2018. The number of countries installing 1 gigawatt or more annually will grow from nine to 14 over the course of these two years.

Source: Solar PV Markets Service

The five countries poised to cross the 1-gigawatt annual threshold for the first time in 2018 are Brazil, Egypt, Mexico, the Netherlands and Spain.

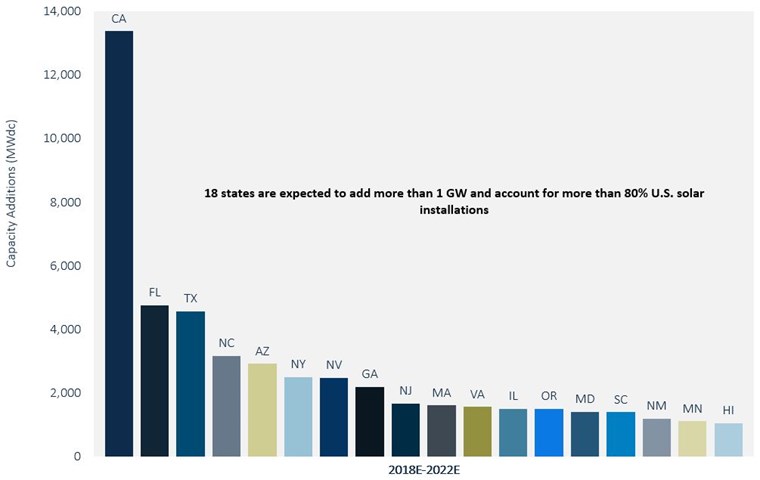

The U.S. is diversifying, too

New data shows that 18 U.S. states will install 1 gigawatt or more of PV between 2018 and 2022.

Source: Solar PV Markets Service

Combined, these states will account for 80 percent of U.S. installations during the same time period.

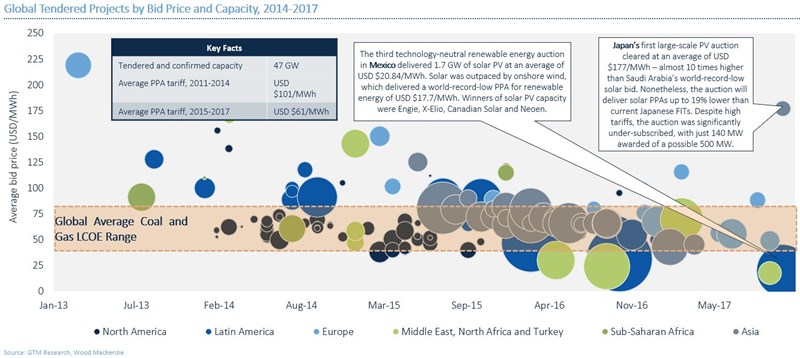

PV continues to compete with (and beat) coal and natural gas

Recent bids are pushing average PPA tariffs past the cost-competitive range with coal and gas.

Source: Solar PV Markets Service

“It is important to note that nearly all global low-bid projects have long lead times and are still unbuilt and unproven,” cautions Solar Analyst Ben Attia. “Three to five years is an eternity in the solar space. It remains to be seen how market- and country-level risks will erode the tendered pipelines.”

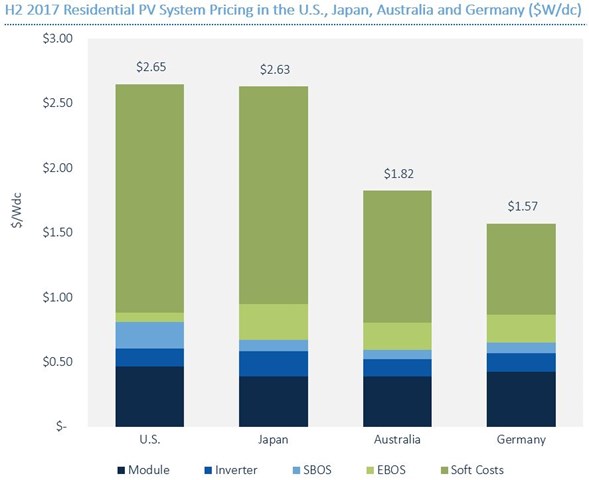

U.S. residential solar pricing is the highest in the world

Despite falling prices globally, residential solar system pricing is higher in the U.S. than in any other major Organisation for Economic Co-Operation and Development (OECD) solar market.

Source: Solar PV Markets Service

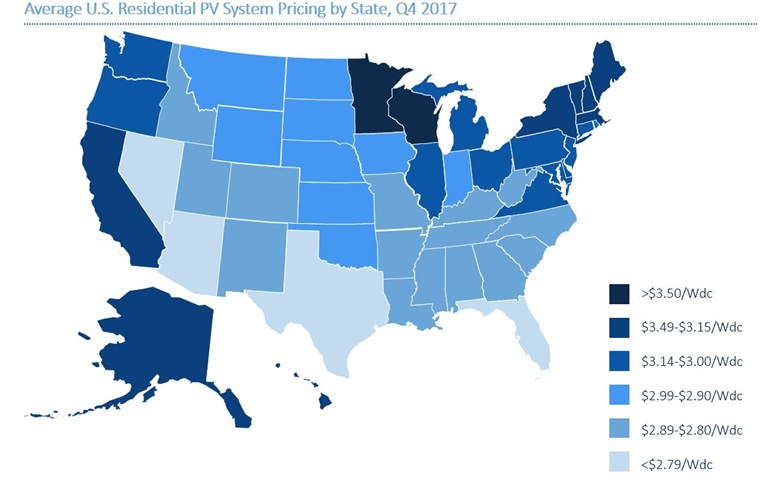

Within the US, pricing varies significantly by state. According to solar analyst Ben Gallagher, “variations in hardware costs, wages, taxes, permitting and market fundamentals produce as much as a 68 cents per watt difference in pricing between states.”

Source: Solar PV Markets Service

Companies will continue to look for ways to reduce customer-acquisition costs, and even more so now due to the recent Section 201 decision on tariffs.

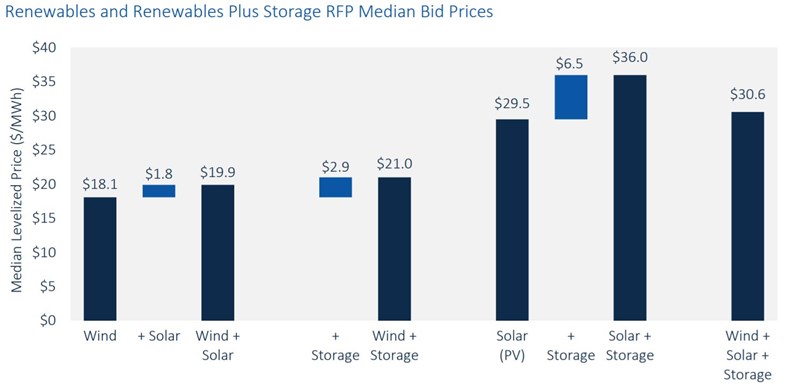

Storage continues to be integrated into solar projects

Public Service Company of Colorado (an Xcel Energy subsidiary) launched an all-source solicitation in 2017 as a component of its 2016 Electric Resource Plan. While the bids haven’t yet been evaluated, the released details provide a window into the future of utility resource planning.

"Over 350 of the bids (83 percent) were for renewables or renewables paired with storage," states Energy Storage Director Ravi Manghani in a report on the topic. "In terms of megawatts, [renewables represent] an even more astonishing 91 percent of all proposed projects."

Source: Solar PV Markets Service

"These bids highlight utilities' interest in solar-plus-storage, and they provide a real-world benchmark for how price-competitive these systems are," said Senior Energy Storage Analyst Dan Finn-Foley.

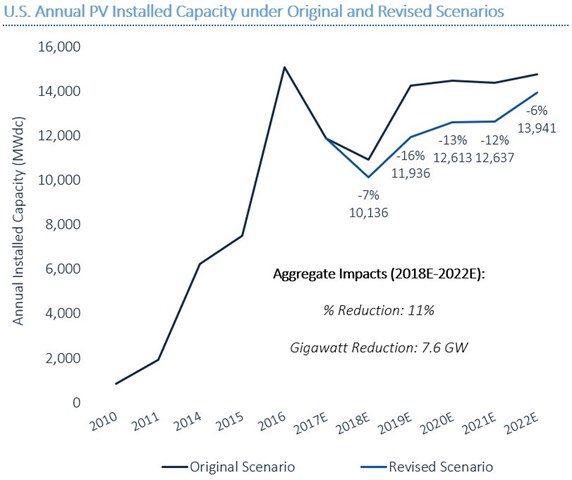

Tariffs damper U.S. solar market

According to recent analysis, the tariffs on imported solar cells and modules set forth by the Trump administration will result in an 11 percent decrease in U.S. solar PV installations over the next five years. This represents a reduction of 7.6 gigawatts of installed solar PV capacity between 2018 and 2022 versus previous forecasts.

Source: Solar PV Markets Service

Projects under construction or with modules already in inventory will temper the impact on 2018 installations, with the effect of tariffs hitting the downstream market more heavily in 2019. The utility-scale solar segment will be more heavily affected than the residential and commercial solar segments, taking 65 percent of the expected 7.6 gigawatts of reductions over the next five years.

“The overall effect is a meaningful but not destructive reduction to expected solar installations, along with modest improvements to a still-challenging environment for domestic solar cell and module manufacturing,” said Head of Americas MJ Shiao.

Despite some speed bumps, we anticipate the global solar market to eclipse the cumulative 500-gigawatt mark in the second half of 2018.