Diamonds in the rough - identifying exploration potential in Asia Pacific

How to find your own hidden gem in a sea of opportunity

1 minute read

Asia Pacific holds under-explored areas with potential for large oil and gas discoveries. Although regulatory and fiscal policy issues continue to hamper development in the region, and access to infrastructure is preventing otherwise sound-looking opportunities, there is a sweet-spot to be found for those keen to secure blocks.

With oil and gas exploration in Asia Pacific falling in line with global trends, where are the opportunities for counter-cyclical investors and is the downward trend set to reverse?

Discover the exploration blocks to watch in Asia Pacific

Using PetroView® and the Upstream Data Tool, we've identified over 100 blocks awarded over the last five years where no drilling has taken place. We've also compared yet-to-find (YTF) volumes and expected monetary value (EMV) at block level, looked at farm-out activity, existing oil and gas discoveries and current platform, pipeline and downstream infrastructure.

From 129 blocks, we've narrowed it down to five potential farm-in opportunities in Indonesia, Thailand, Malaysia and Australia.

How we evaluated the exploration blocks to watch

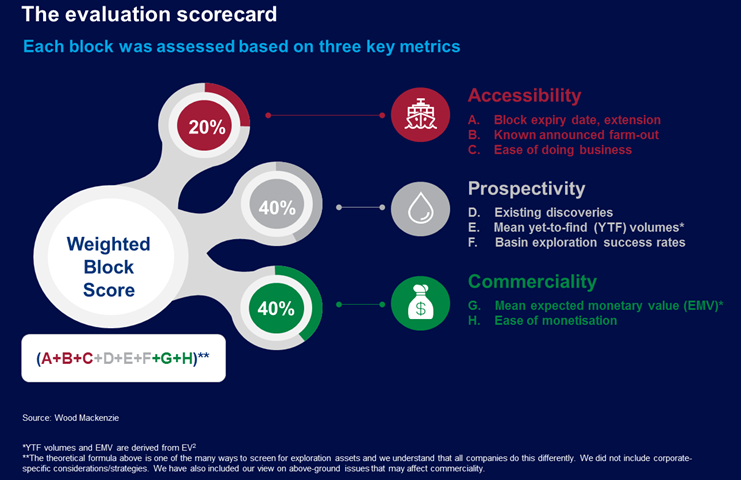

To screen for oil and gas exploration potential, we used an evaluation scorecard based on three key metrics: accessibility, prospectivity and commerciality. Accessibility scores identified which exploration blocks were most likely to be available for farm-out and which blocks have long exploration periods, as well as how easy it was to do business in a specific location. Prospectivity looked at the location of recent successes and higher yet-to-find volumes while commerciality identified which blocks offered the highest potential returns. Our report will enable you to avoid the exploration blocks that offer large yet-to-find volumes coupled with lower returns.