Discuss your challenges with our solutions experts

Permania’ continues into May as Centennial Resource Development (CDEV) announced the acquisition of 11,860 net acres with production of 2,100 boe/d in Lea County, New Mexico from GMT Exploration. With a US$350 million price tag, what will it take for CDEV to create value?

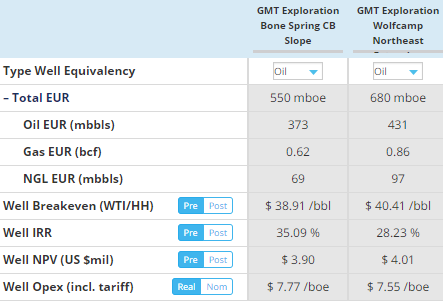

We used Contour to value the acquired assets at US$300 million (NPV-10). For this analysis, our assumptions include:

- Strong ‘per-well’ economics, with breakevens in the US$39-$40/bbl range

- CDEV will use one rig to drill out the remaining 107 net Bone Spring and Wolfcamp locations

In order to match the deal consideration of US$350 million under our base case price assumption, CDEV would need to add another 17 net locations or accelerate the drilling program. Adding 17 additional net locations isn’t unreasonable, given the relatively early stage of development in the area, but tighter spacing does have challenges.

There is downside potential for the deal as well. While we have included moderate well cost inflation for 2017 in our US$300 million valuation, it is possible we will see further inflation in 2018 and beyond if Permian activity remains high. If costs were to increase 5% more in 2018, our valuation drops to US$280 million (NPV-10). Cost control is critical in the Permian, as our analysis shows just a 5% increase in 2018 costs more than offsets the gains from an additional 17 net locations.

What will it take from CDEV’s operations to create value? Strong cost control, additional locations, and aggressive development of the acreage will support the valuation under our base price assumptions – but CDEV will need all the pieces to come together, which could be a tall order.