Discuss your challenges with our solutions experts

North America’s crude oil storage problem

Market fundamentals are pushing storage to its limits

1 minute read

Oil demand hit record lows. Combine that with volatile prices and a global supply glut, and you have all the ingredients for a perfect storm.

With the oil market in turmoil, all eyes have now turned to storage. And North America’s primary crude storage destination, Cushing, is being pushed to its limits.

As inventories headed higher, how much usable capacity does Cushing have left? How quickly could it be filled? And where else could America’s oil be stored when Cushing is full to the brim?

John Coleman and Hillary Stevenson identified four key things you need to know today about North America crude in the short and long-term.

1. Cushing played a central role in WTI’s negative price dive.

As the delivery point for the NYMEX Light Sweet Crude contract, Cushing is a focal point of the most actively traded crude oil contract in the world. Concerns over dwindling capacity to take physical delivery of WTI futures contributed to the price dropping below zero on 20 April for the first time in history.

2. When will Cushing reach maximum capacity?

That’s the question at the forefront of everyone’s minds right now. And the last oil price crash provides few clues. In 2014, Cushing inventory levels were near minimum. But in 2020, Cushing was already half full – so there’s much less available runway. Recently, Cushing storage capacity filled at record-high rates: much faster than they did during the last crisis.

We know from tracking data over time that Cushing’s maximum capacity is 81% utilization. And a ‘no vacancy’ sign is on display, with remaining available storage capacity for May already leased out.

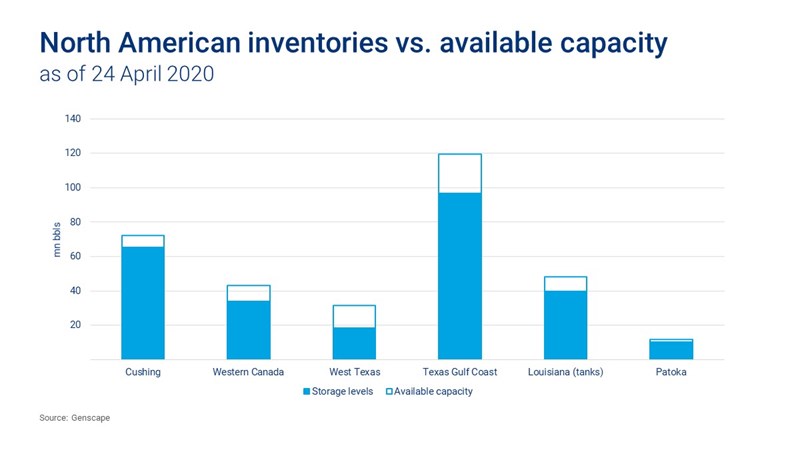

3. With Cushing filling fast, where else could excess oil be stored?

The market needs to pivot to alternative methods and storage locations – and quickly. Texas coastal storage hubs have become a go-to option for those in need of physical storage for their barrels. And while there are fears about what will happen when these alternative locations reach tank tops, US commercial storage still has some running room.

4. The midstream sector is finding creative solutions to the storage problem

By necessity, and incentivized by the higher cost of storage, US midstream players are finding other ways to hold onto their oil in the short term. For example, Energy Transfer Partners is considering idling two NGL pipelines to turn them into crude storage; elsewhere, newly built pipelines are being converted to long-term commercial storage in the next few months. And we can expect to see more of the same as companies explore alternative solutions.

Want to know more?

Our customers look to us for depth and breadth of insight into North America Crude Markets — over the long term with modeling and analysis and in the short term through proprietary real-time data — giving you critical, timely intelligence on crude oil production and pipeline flows in this quickly changing market. We also provide granular, location-level storage data in advance of any aggregated government or official public reporting. Find how to subscribe.