Discuss your challenges with our solutions experts

What's old is new again

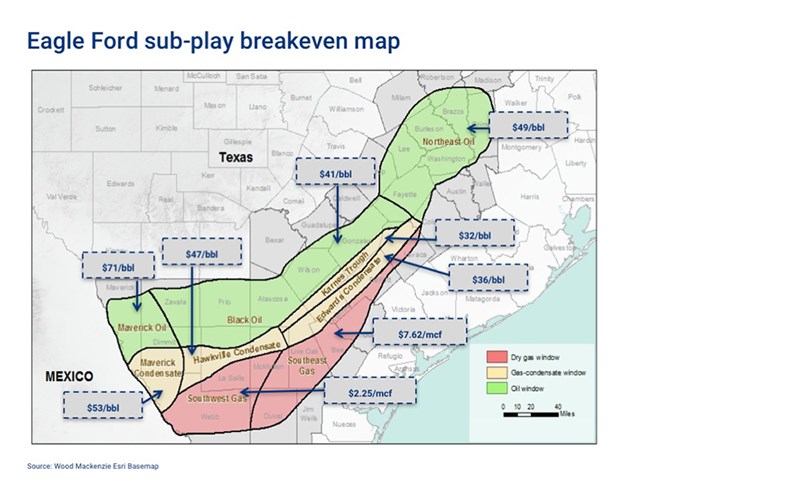

Eagle Ford breakevens on par with Permian

1 minute read

Benefitting from its legacy infrastructure, the Eagle Ford is a mature tight oil play that remains well positioned for continuing operator development. With capex up 8% in 2017 over 2016, the play is showing signs of renewed interest as rig count trends up and DUCs are drawn down. But what about project economics?

DUC and recover

Although the Eagle Ford doesn't have the shine and excitement of Permian plays, it has the second-largest inventory of wells breaking even below US$50/bbl. This metric puts it just behind the Delaware and Midland Wolfcamp combined. Breakevens continue to trend down, with half-cycle figures coming in near US$30/bbl for the Karnes Trough Condensate and US$2.25/Mcf for the Southwest Gas sub-play.

In a stronger price environment, drilling through DUCs can be a low-risk, high-return strategy. Pioneer, Cabot and Sanchez are among the many operators that have added frac crews to complete DUC backlogs. We expect the Eagle Ford rig count to grow by about 8% in 2018, chiefly from activity in the Black Oil, Edwards Condensate and Karnes Trough sub-plays.

Can the Austin Chalk walk the talk?

The Austin Chalk continues to generate operator interest and testing for stacked pay potential, but results have been inconsistent. Using our North America Well Analysis Tool, we took a deeper look at drilling overlays in the sub-play, which revealed comparable results to core Eagle Ford plays.

High-density stimulation has resulted in higher productivity in Karnes County, but operators have yet to see consistent result across the play.

Wide open spaces

Downspacing wells hasn't increased inventories as hoped; in fact, it's had an adverse affect on productivity. Although it's been a fairly popular strategy to use technological advancements and tighter spacing to maximise leaseholds in the mature play, the risks are leading some, such as Devon and DeWitt, to revert to wider spacing. Fracture overlap, well interference and depleted pressure from stacked or staggered wells has inhibited production economics.

The Eagle Ford has an astounding amount of undrilled acreage given its maturity—even its core acreage is less than one-third drilled up under current spacing assumptions. Operators are far from exploring all it has to offer, and new learnings from rig technology and the geology of the land itself are adding insight into its potential return on investment.