North America gas: could LNG project delays dampen prices further?

1 minute read

Low prices may be the best cure for North American gas markets.

Near record levels of April and May storage injections due to mild weather have put downward pressure on Henry Hub gas prices, yet a floor may have been set.

Northeast production growth is slowing down while Permian associated gas again battles negativity. Expected production growth is stalling just as the mercury increases to triple digits during peak summer cooling demand months. However, additional LNG export project delays are also being announced and put a damper on Henry Hub gas prices.

What will be the impact of LNG export project delays?

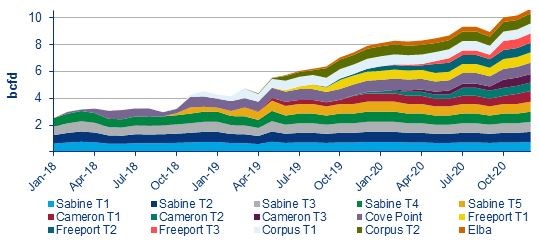

This year started strong with new LNG liquefaction trains coming on line at Cameron, Elba Island, Corpus Christi and Freeport with current LNG feed gas levels expected to near 6 bcfd soon. Still, our 2019 LNG forecast has been revised down by nearly 0.2 bcfd, and down about 0.5 bcfd next year due to delays at the next round of trains at Cameron and Freeport.

However, the recent Port Arthur LNG purchase deal between Sempra Energy and Saudi Aramco points to the continued attractiveness for forthcoming US LNG liquefaction projects.

“If the deal is completed, this is likely to mean the Port Arthur facility can proceed to FID by the end of 2019 or early 2020," said Giles Farrer, Wood Mackenzie Research Director. “With the facility now looking more likely to go ahead, other buyers may now choose to sign up to buy LNG from the project, too."

This is a preview from the Wood Mackenzie North America Gas Service. Want to learn more about our US natural gas price and LNG export forecasts? Contact us today or download a sample by completing the form on this page.