Discuss your challenges with our solutions experts

North America crude markets, the outlook for oil and the Russian gas route to market

What are some of the hottest topics in store this week?

1 minute read

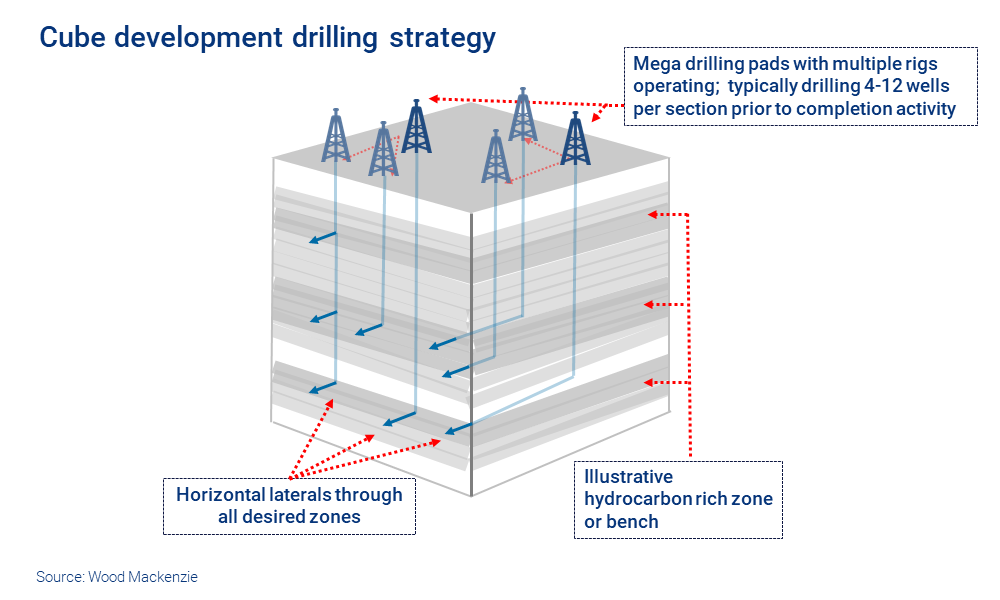

Cube development: will the Majors make it the norm in the Permian?

By 2025 the Majors will make up 20% of Permian production. With them comes the economies of scale, infrastructure and logistics to move the Permian to cube development – an approach that focuses on longer-term resource management and stable productivity.

In our analysis, while infill drilling can result in up to a 30% hit to economics, operators choosing cube development can see that drop to 5%. However, it’s a capital-intensive strategy that aims to increase overall acreage productivity through time, rather than boost individual well results.

The logistical prowess needed for this shift is something we see the Majors bringing to the table.

Get this and more in the H1 2019 North America Crude Markets long-term outlook. It includes:

- The US Lower 48 supply in focus: core inventory continues to be limiting factor

- Why we’re upgrading our Permian forecast – but calling out several risks

- USGC and Crude Export overview

- North America Midcontinent overview

- Cushing and Bakken and Rockies infrastructure and pricing

Our latest long-term outlook unveils data and analysis from our new North America Nodal Network model. This cutting-edge enhancement allows us to more comprehensively forecast crude flows through all major pipelines, hubs, and export terminals.

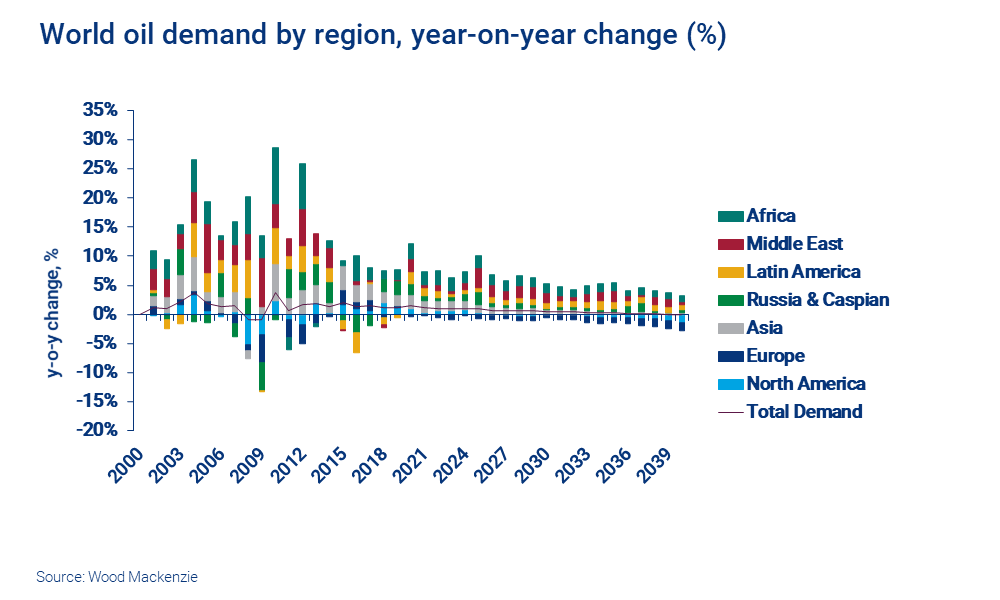

Macro oils: tracking trends and risks to 2040

Our H1 2019 outlook shows a significant upward revision to the forecast for non-OPEC supply, with the largest adjustment to the US Lower 48 where tight oil continues to outperform. This is supported by upgrades to mature producers such as China and Norway, and emerging entrants, including Guyana.

World oil demand reaches a high of 112 million b/d in the mid-2030s and declines only marginally to 2040. To meet this demand, production from new sources of supply are critical – and make up half of global supply by 2040.

While demand for petrochemical feedstocks grows steadily, demand for transport fuels grows only slowly or even declines – a dichotomy that sharpens after 2030.

Buy the report to find out more: "Macro Oils long-term outlook H1 2019: Assessing risks and trends to 2040"

Buy the report to find out more: "Macro Oils long-term outlook H1 2019: Assessing risks and trends to 2040"

How does Russian gas get to market?

Capitalising on Russia’s vast – and often remote – gas reserves poses technical and logistical challenges. Read our report for insight into today’s infrastructure and to understand:

- How Russian gas gets to markets in Europe and Asia

- How that will evolve over the short-to-medium term

- The costs of building export pipelines and LNG plants in this region

- The future production hotspots for Russian gas

Visit the store to find out more about this report: "How does Russian gas get to markets and where does it come from?"

reports and forecasts for assets, companies and markets

Get access to trusted natural resource intelligence

Our dedicated oil, gas, power and renewables, chemicals, metals and mining sector teams are located around the world. They deliver research based on our assessment and valuation of thousands of individual assets, companies and economic indicators such as market supply, demand and price trends.

At every stage, we apply a unique and rigorous analytical approach to provide objective analysis and trusted advice that is valued around the world.

Visit the store to find insights into your area of business.