Discuss your challenges with our solutions experts

After 2025, when the oil majors' oil and gas production goes into decline, they will be looking for new opportunities, and the renewables market will be an area of increasing focus. Will the oil majors' entry — and deep pockets — threaten existing players, or is there enough growth to go around?

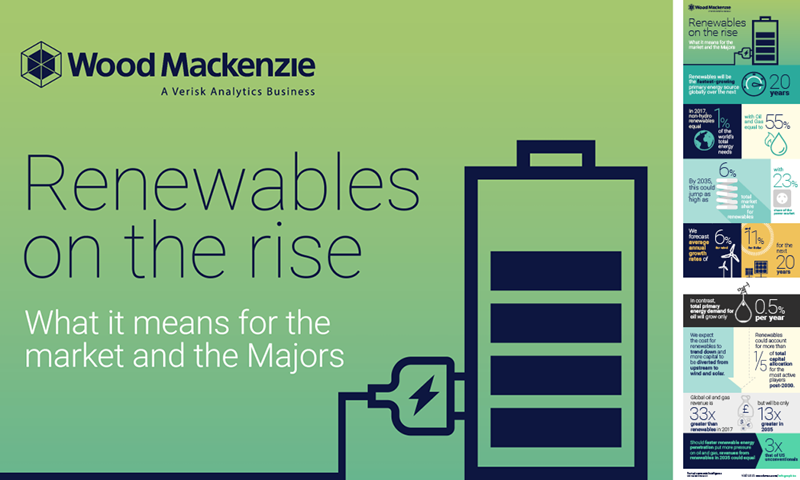

Although the entire global market for wind and solar is currently just 4% that of oil and gas, it is set to grow at a rapid rate. By 2035, annual revenues from wind and solar will be around one-twelfth those of oil and gas in our base-case scenario. Our carbon-constrained scenario sees solar and wind account for a 23% share of the global power market by 2035, and 6% of the total market for all forms of energy. The case for the oil majors to build a renewables position is growing increasingly compelling.

A potential tipping point for the shift into wind and solar is the anticipated decline in the oil majors' hydrocarbon production. Oil demand growth is slowing, but new resources are still needed to sustain supply volumes through the next decade and beyond. If a combination of discovered resource commercialisation, M&A and exploration fails to deliver, or economics weigh against continued development, wind and solar could step in to the breach. As renewables costs trend down, we expect the oil majors will increasingly divert capital from upstream projects to wind and solar projects, which offer annuity-like cash flow for decades after initial up-front capex — generally with little or no price risk.

As the oil majors enter the renewables market, we expect them to pursue opportunities with scale. In particular, offshore wind offers far greater scale and more synergies with the oil majors' project execution and engineering skills from oil and gas. Similarly, the oil majors' expansion into solar will take advantage of established relationships and infrastructure through their oil and gas operations. However, it will be harder for the oil majors to achieve scale in the competitive solar market.

The oil majors currently control 12% of the world's oil and gas production and less than 1% of the global renewables market. To secure 12% of the global renewables market, the oil majors would need US$350 billion of investment at current costs. This is around a quarter of the US$1.5 trillion we estimate they need to spend to sustain upstream volumes to 2035.

Although the oil majors' growth strategy will be restrained in the near-term, investments will gradually increase in scale as wind and solar take off. Even though the renewables market is currently dominated by smaller operators, the oil majors represent a growing threat — particularly due to their existing resources and infrastructure — as they look to expand. When it comes to the transition to 'New Energy', the oil majors are only just starting to sow the seeds for the radical changes that lie ahead.

This research was prepared in partnership with GTM Research, a Wood Mackenzie business. GTM Research is the premier market intelligence provider for the decarbonization and decentralization of energy. To download the full analysis, complete the form on this page.