Discuss your challenges with our solutions experts

The Permian Basin has attracted nearly one-quarter of global M&A spend 2016. No tight oil play has ever seen such a constant buzz of activity. So how did US$20 billion in deals happen in a down market?

Permian tight oil has presented a unique attraction to investors: breakevens as low as US$40 per barrel, stacked pay potential, large volumes, upwardly trending well economics and the flexibility to adapt to a changing market. A deep pool of well-funded buyers and a notable amount of private equity sellers have made Permian tight oil the world's most liquid upstream M&A market.

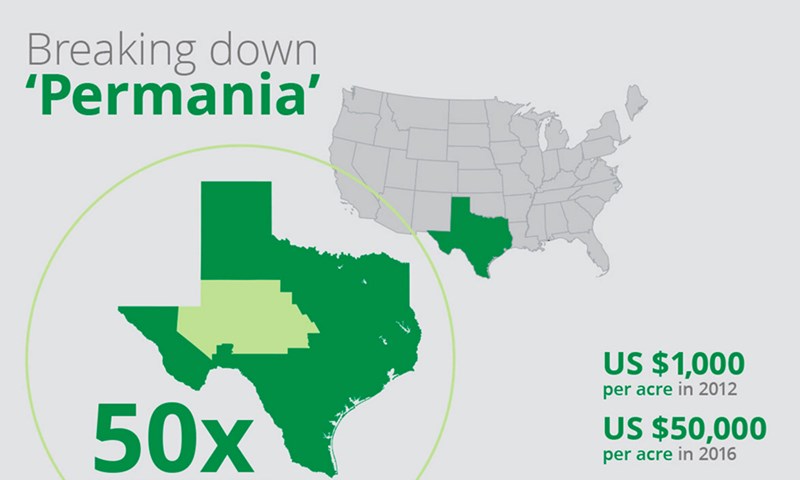

Breaking down 'Permania'