Discuss your challenges with our solutions experts

Global steel demand growth is now showing firm signs of slowing. In the US, government policy has started to smother the domestic market. In Europe, signs of deceleration are becoming apparent as automotive registrations have been easing through the first quarter.

As domestic demand loses momentum, automotive exports are having to play an increasingly important role in driving production. Ultimately, European automakers’ ability to offset slowing exports to the US with rising exports to China will determine the market balance.

Given the uncertainty in the global steel market, we forecast weaker steel prices across most products and regions through the third quarter of the year and into the fourth.

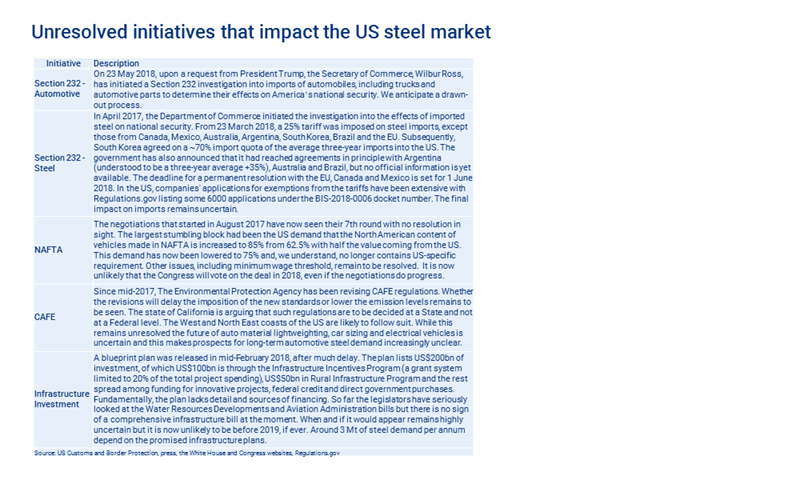

On top of last night’s imposition of tariffs on imports from the EU, Canada and Mexico, a raft of policies pertinent to steel demand still remain unresolved (see our list below), including a Section 232 investigation into imports of automobiles and their parts.

This adds to the uncertain policy environment in the US automotive sector, which has seen investment decisions already brought to a standstill due to protracted NAFTA negotiations and the potential revision to the CAFE emission standards.

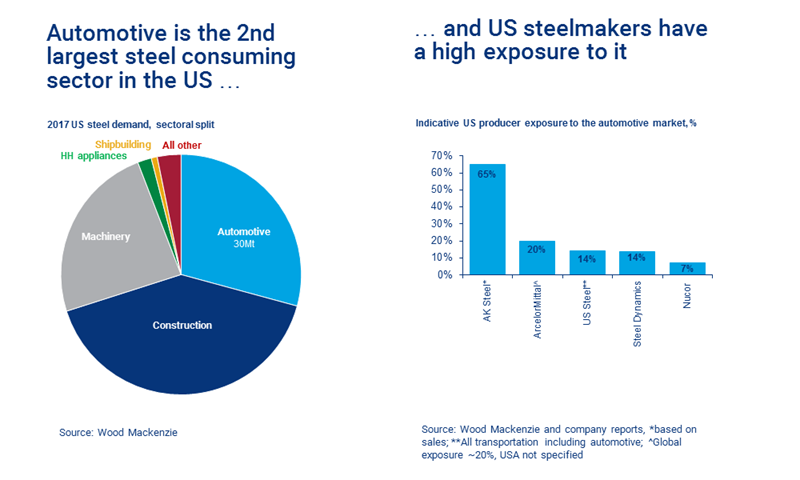

Wood Mackenzie estimates that 30 Mt of steel were consumed in the US automotive sector in 2017. This is around 30% of the US’ total steel demand. This sector is not only large, it is also the sector where margins are high, due to material complexity. Therefore, over the last five years, this is where most US steelmakers have focused their investment.

Theoretically, restricting vehicle imports could force up domestic vehicle production and eventually benefit US steelmakers, but such an outcome relies on a major leap of faith. In the meantime, the policy turmoil is already strangling the US domestic market.

Global steel short-term outlook May 2018

The American Iron and Steel Institute reports automotive steel shipments down 2.8% in Q1 and light vehicle assembly is down 1.4% year-on-year year-to-April, while domestic sales are down by 1.7% over the same period. In light of these developments, we have now lowered 2018 automotive steel demand growth to 1.1%, from 2.6% previously. This, combined with a small downwards revision in machinery and further destocking, will see 2018 steel demand rising only 4.2%. It was 7% previously.

Nevertheless, steel prices remain high at around US$1000/tonne of hot-rolled coil. The regional price spreads have remained broadly unchanged between US$300 and $330/tonne and this has continued to attract imports.

Wood Mackenzie continues to forecast easing imports in the remainder of the year. Steel imports will come in at 29.5 Mt in 2018, down 6 Mt on 2017 levels. This moderate decline in imports relies on tighter import policy in H2 2018, as well as easing steel prices due to weakening demand outlook. Hot-rolled coil should remain at US$900/tonne in H2 2018.