1 minute read

19 September, 12:15pm CDT:

The first movers in the second wave have been uniquely positioned to face these challenges. It's unlikely that others will be able to replicate these approaches.

- Cheniere’s reputation and use of CMI as a tool enabled it to capture sales momentum when the market picked up in 2018

- The partners in Golden Pass and LNG Canada are taking the arbitrage risk, and can do so because they are equity financing

- Venture Global offered low-cost LNG by saving money with EPC contractors and taking more of the execution risk

19 September, 12:00pm CDT:

US LNG developers limited exposure to major risks in the first wave. This approach is lender-friendly, and their counterparties were comfortable taking more risk.

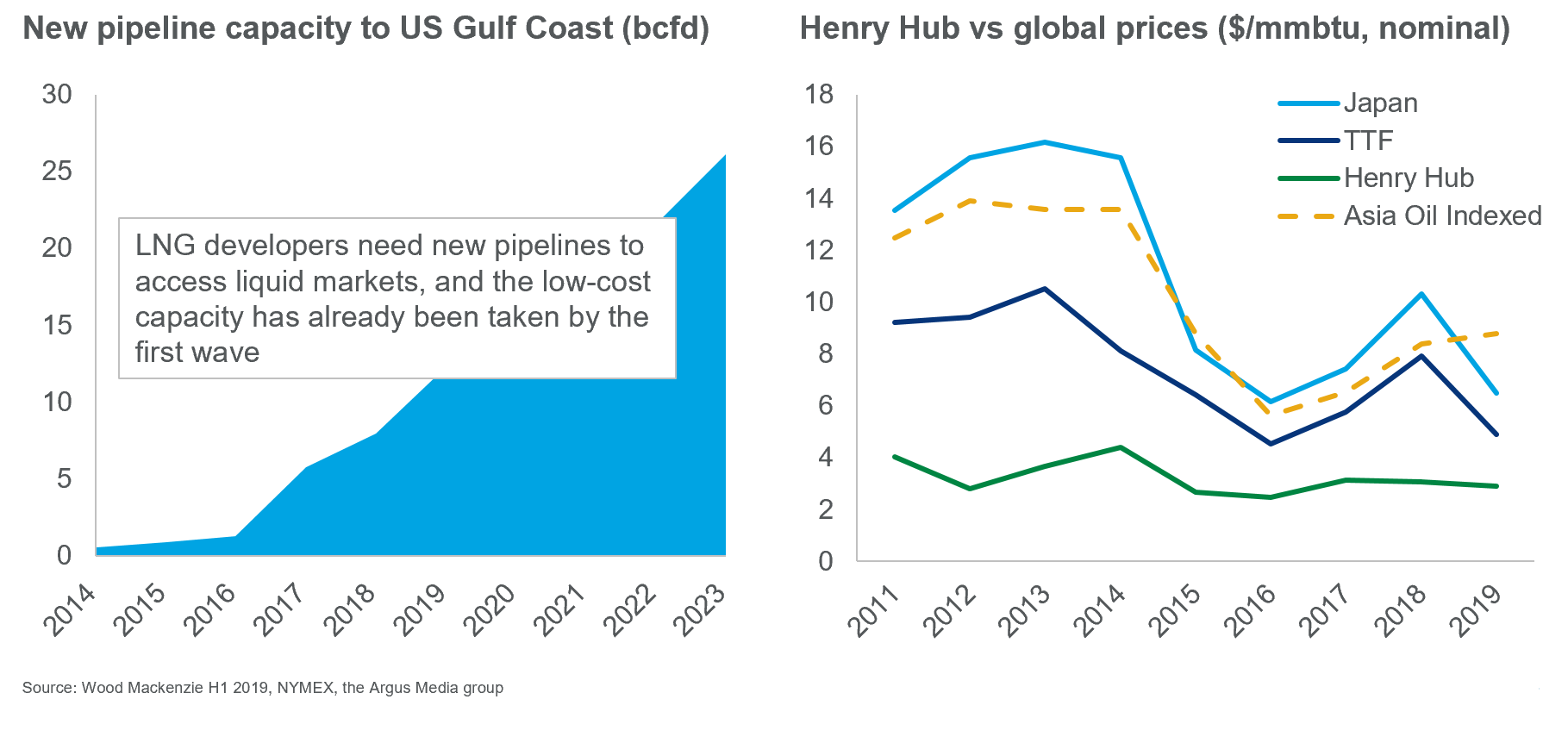

Second wave project developers face a different market environment… Mitigating gas supply risks is getting harder, and buyers want less exposure to spreads.

Kristy Kramer presents at Gastech 2019.

19 September, 10am CDT:

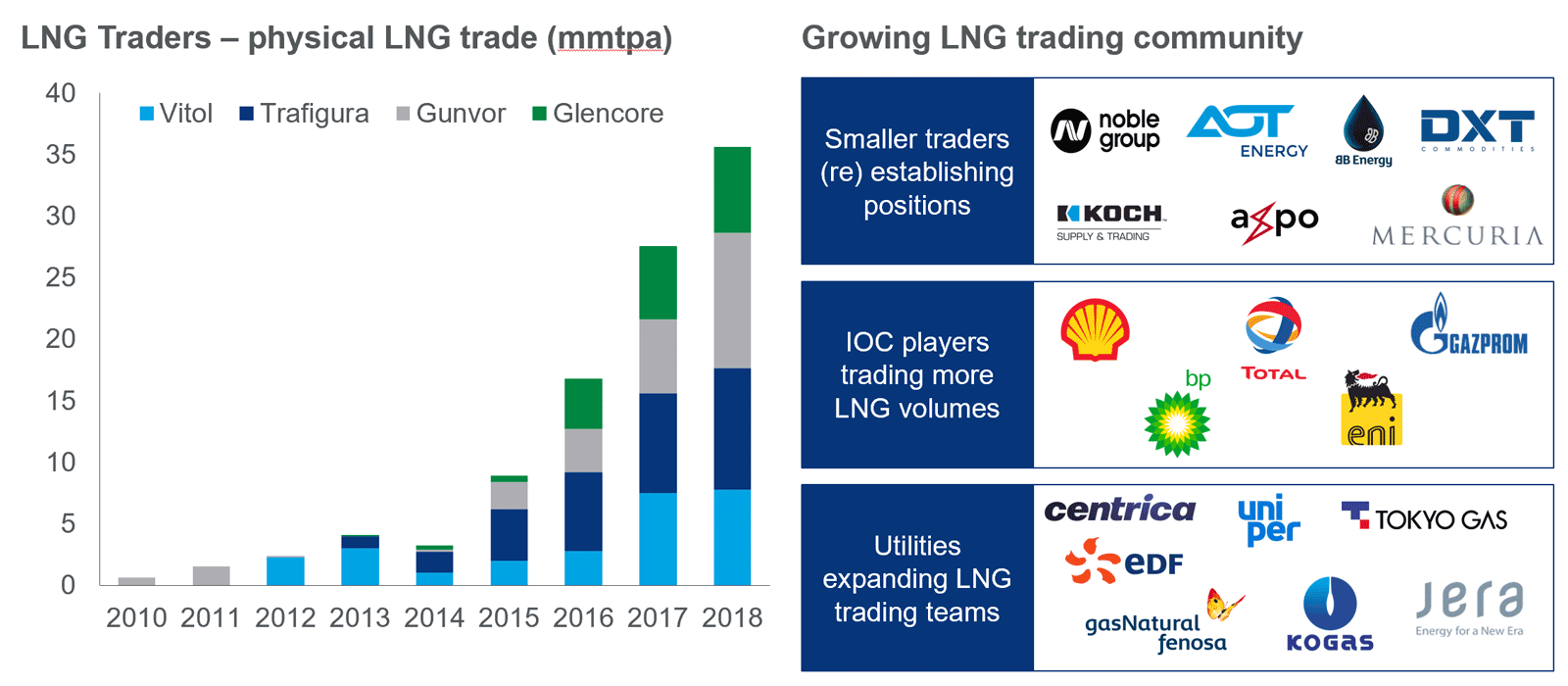

Here are some of the commodity traders' key differentiators:

-

Wider market familiarity – in both new and existing markets gained from trading and selling other commodities. Gives them a thorough understanding of counterparties, regulatory challenges and port specific operations

-

Logistical and infrastructure expertise - vast experience in conducting ship deliveries & optimisation and using storage to capture value

-

No incumbent positions to defend – has often meant that they have been able to offer counterparties better deals

-

Devolved decision making – allows fast deal execution

- Risk Management - Traders have an ability to manage risk via hedging, and can therefore take positions that others would deem too risky

Giles Farrer presents at Gastech 2019.

19 September, 9:30am CDT:

Over the last five years, commodity traders have grown their LNG books exponentially.

Trade from the four main trading houses reached 36 mmtpa in 2018, equivalent to 10% of global demand and we have also seen others establish significant trading operations.

Giles Farrer presents at Gastech 2019.

18 September, 3:00pm CDT:

The South Texas market is becoming one of the most dynamic gas markets in North America as growing Permian and Eagle Ford production meet robust Mexican and LNG exports. What does this mean for basis?

Gas prices in the region – Katy, Agua Dulce (Agua), and Houston Ship Channel (HSC) – have historically traded close to one another. Now, these hubs may be set to diverge significantly in the future, principally driven by last-mile limitations to HSC.

The “last-mile” is the portion of the pipeline grid from Katy to HSC and Agua Dulce to HSC that will play a crucial role in determining the direction of gas basis in South Texas.

Mason McLean presents at Gastech booth K330.

18 September, 1:45pm CDT:

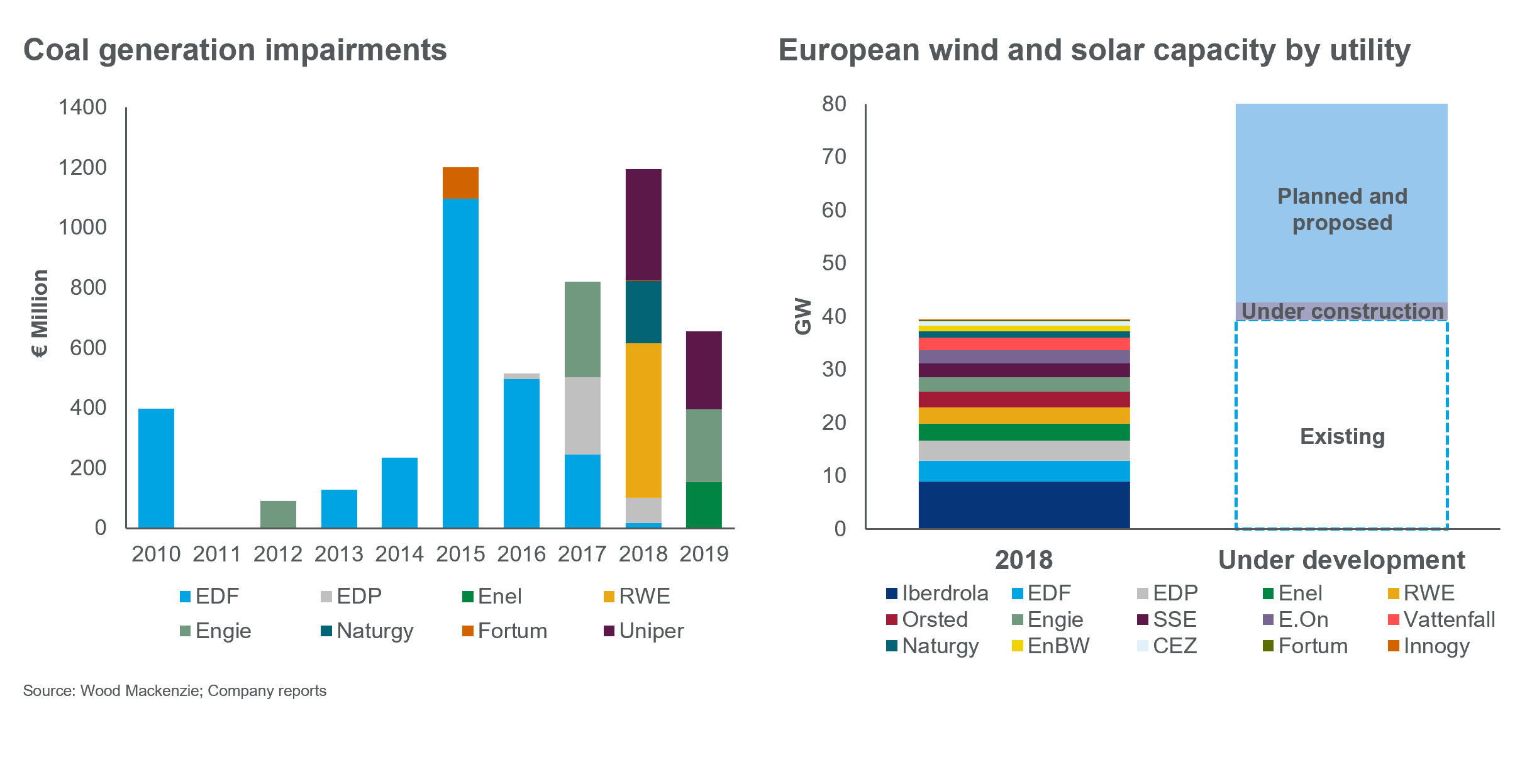

Decarbonisation ambitions have also challenged the legacy generation positions of European utilities -- reinforcing the focus on renewable generation growth.

Murray Douglas presents at Gastech booth K330.

18 September, 1:30pm CDT:

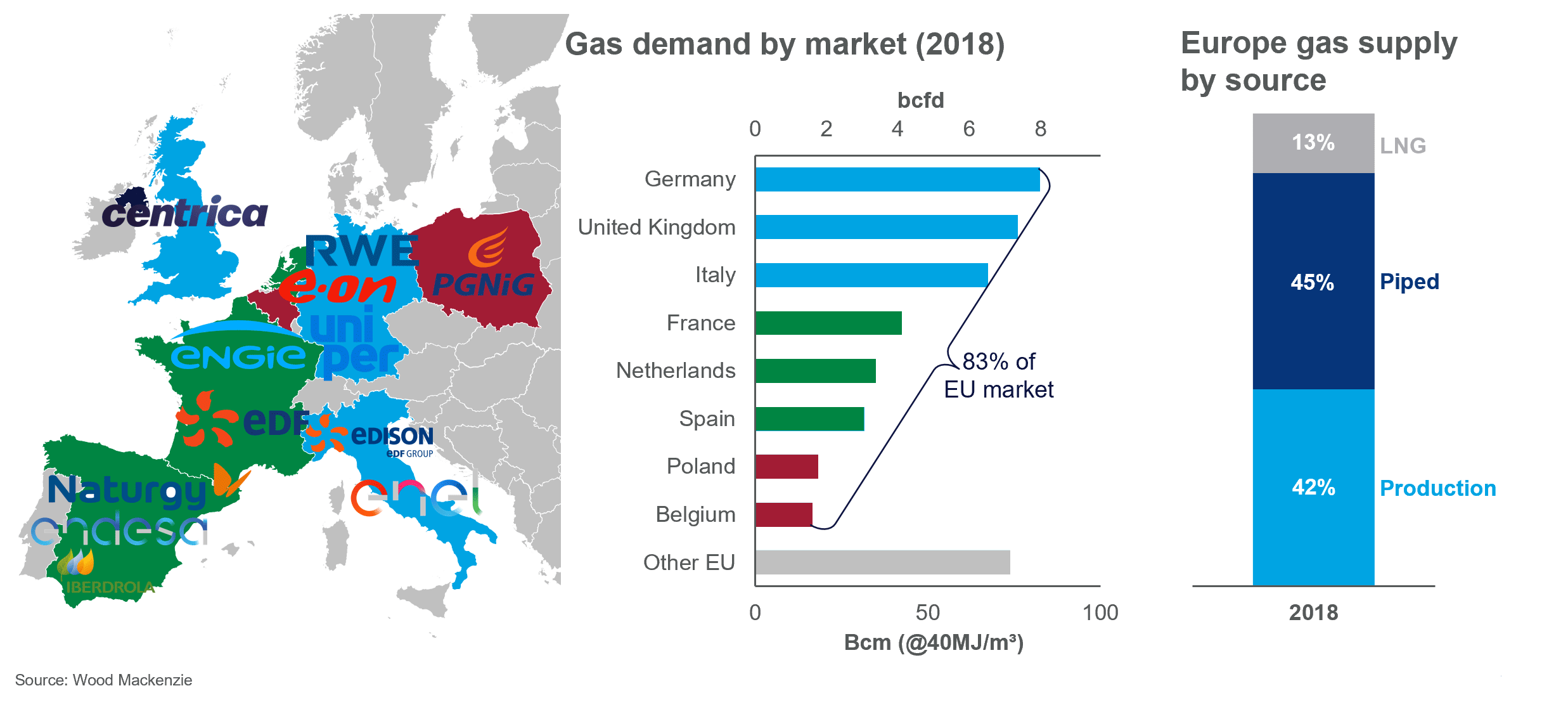

Utilities dominate the wholesale and retail sectors across Europe’s largest gas markets. Supplies are underpinned by long-term, legacy pipeline contracts.

Utilities have had to adapt to an evolving regulatory framework – which has heightened competition across the gas value chain. Challenges to utility business models continue to build – all of which are critical in determining exposure to LNG.

Murray Douglas presents at Gastech booth K330.

18 September, 11:00am CDT:

Our team of gas and LNG analyst, led by Chief Analyst and Chairman Simon Flowers, discussed the biggest trends emerging at Gastech 2019 at our fireside chat.

17 September, 4:10pm CDT:

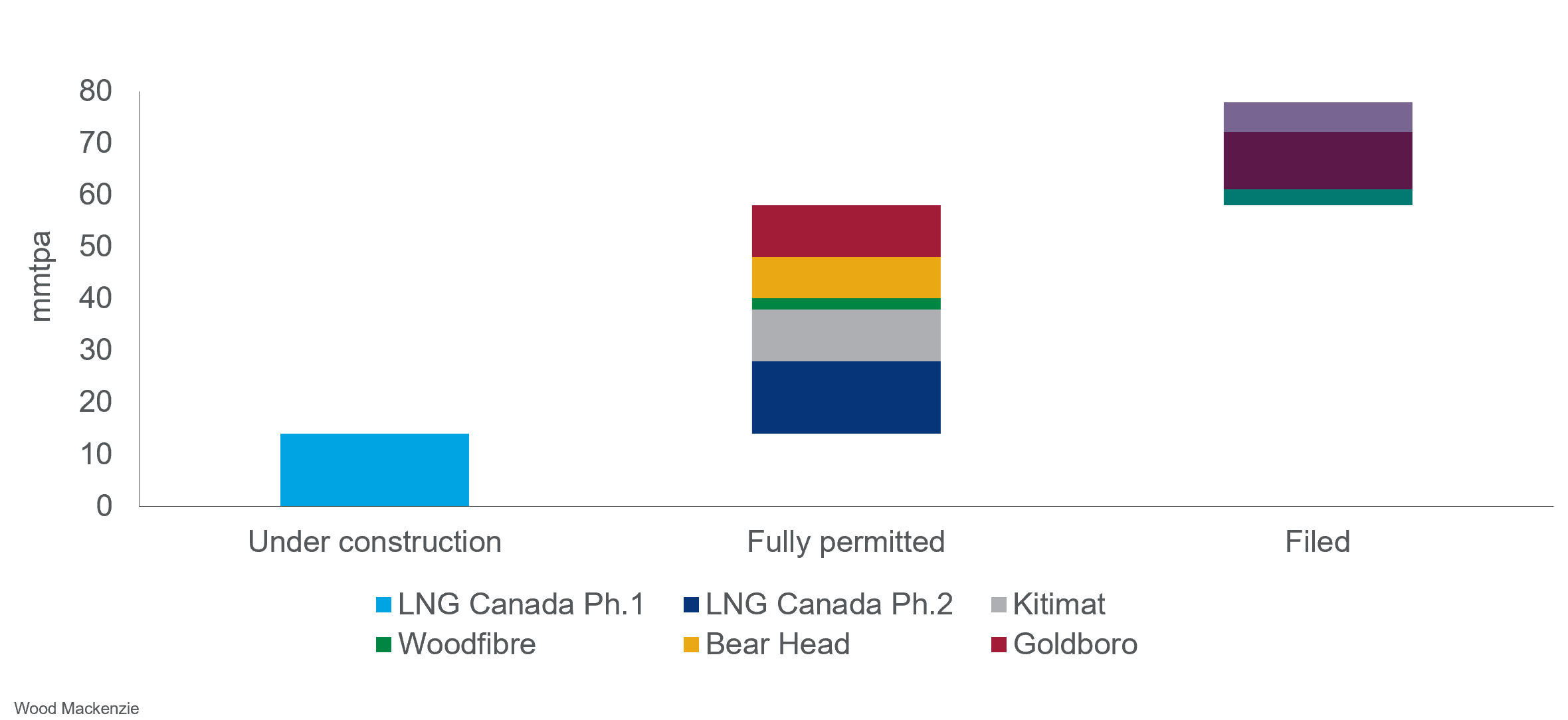

How are the chances of a Canadian FID looking? Woodfibre and Goldboro LNG are the only realistic near-term possible FIDs in Canada. A second phase at LNG Canada could be the next large-scale development in west Canada.

Overall, we see some 70 mmtpa of North America LNG capacity will start up over the next 4-5 years.

US LNG capacity will rise to more than 100 mmtpa; a further 14 mmtpa in Canada.

Alex Munton presents at Gastech booth K330.

17 September, 4:00pm CDT:

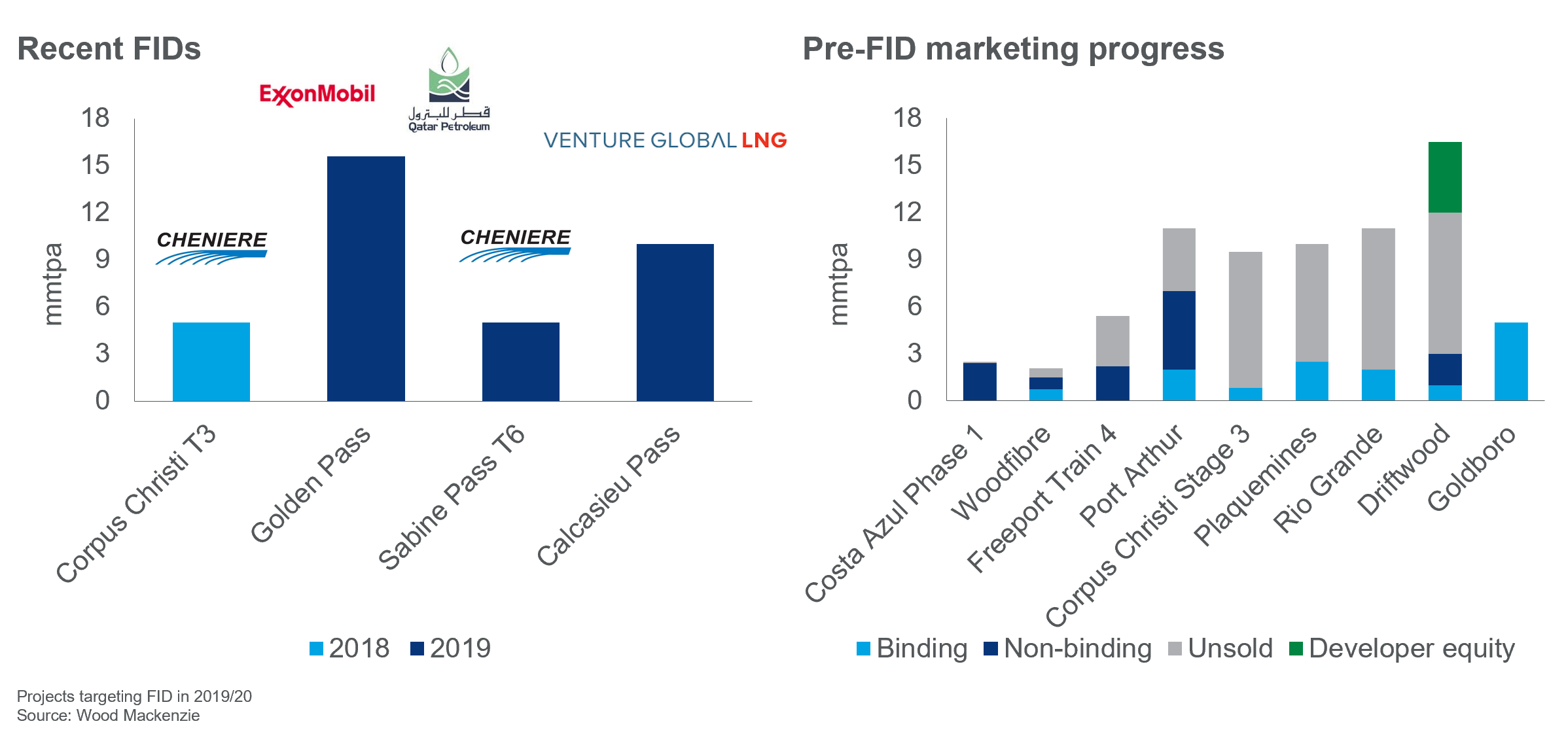

Some 30 mmtpa of new US liquefaction capacity has now been sanctioned in 2019. A number of North America projects targeting FID by year end offer potential upside.

Proposed new capacity is heavily concentrated in the US Gulf Coast... but Asian LNG buyers like the idea of a West Coast port in Canada or Mexico.

Alex Munton presents at Gastech booth K330.

17 September, 1:45pm CDT:

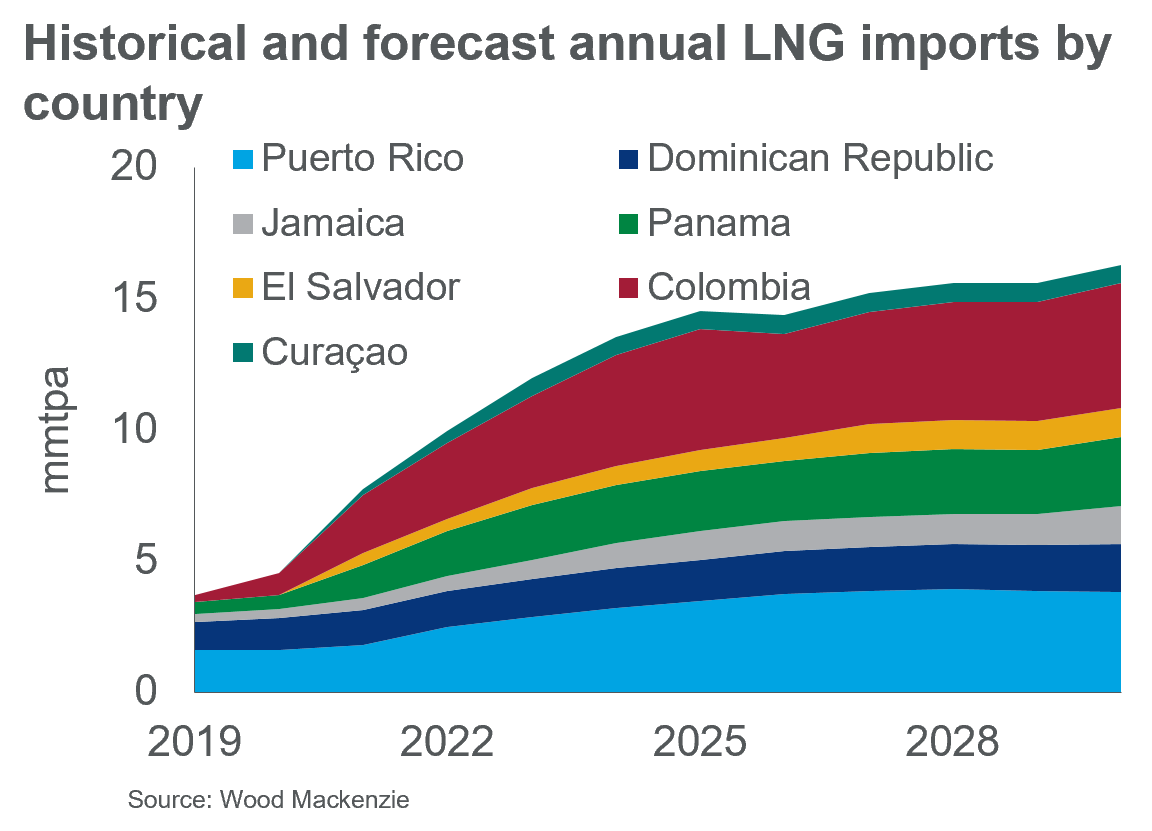

Fortunes will be mixed for LNG demand in Latin America and the Caribbean.

In the Caribbean and Central America, we expect LNG growth from 4 mmtpa in 2019 to 15 mmtpa in 2025. But in the Southern Cone, we expect LNG to shrink from 5 mmtpa to 2 mmtpa (under regular hydro conditions) in the same period, driven by Vaca Muerta and pre-salt gas.

In the Southern Cone, existing regas terminals are enough to cope with the future LNG demand.

Chile and Argentina will require LNG during the southern hemisphere winter. Whereas in Brazil and Colombia, interruptible LNG solutions will be needed to deal with adverse hydro conditions. This flexibility will have a premium price.

Mauro Chavez Rodriguez presents at Gastech booth K330.

17 September, 1:30pm CDT:

Most power generation in Central America and the Caribbean

relies heavily on oil.

However, even when oil dominates power generation, LNG-to-power looks promising, due to high uncontracted LNG needs and the low flexibility required by most of the countries.

The expansion in LNG demand is explained by LNG-to-power projects arising from environmental policies and cost-saving efforts. Most of the countries in the region have plans to diversify their energy mix, focusing on the development of renewables and new gas-fired power plant projects.

Mauro Chavez Rodriguez presents in booth K330 at Gastech 2019.

17 September, 11:40am CDT:

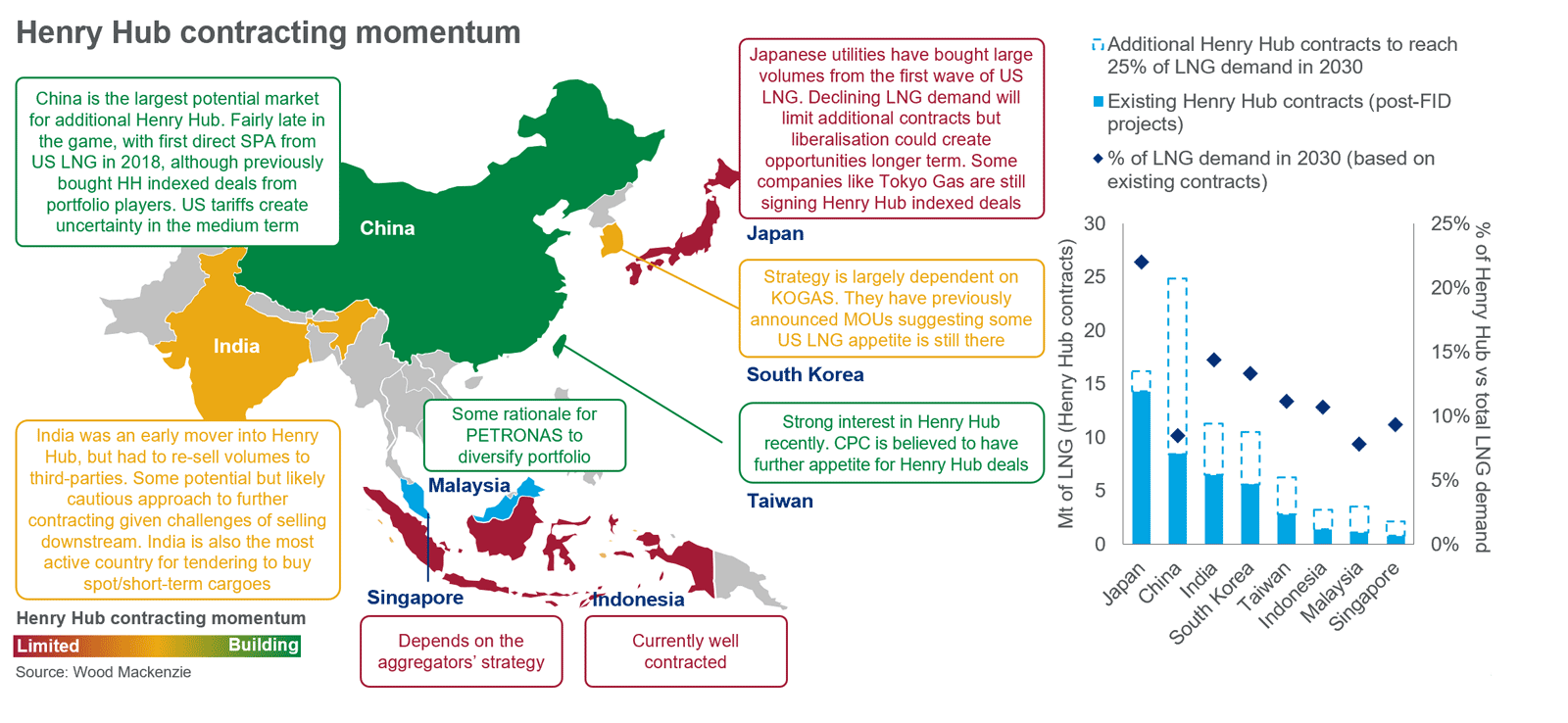

The availability of Henry Hub Indexed LNG creates competition with oil indexed LNG contracts. This sets a soft ceiling for oil slopes.

But there is also a question around how much appetite for additional HH+ indexed LNG amongst buyers...

Giles Farrer presents at Gastech booth K330.

17 September, 11:30am CDT:

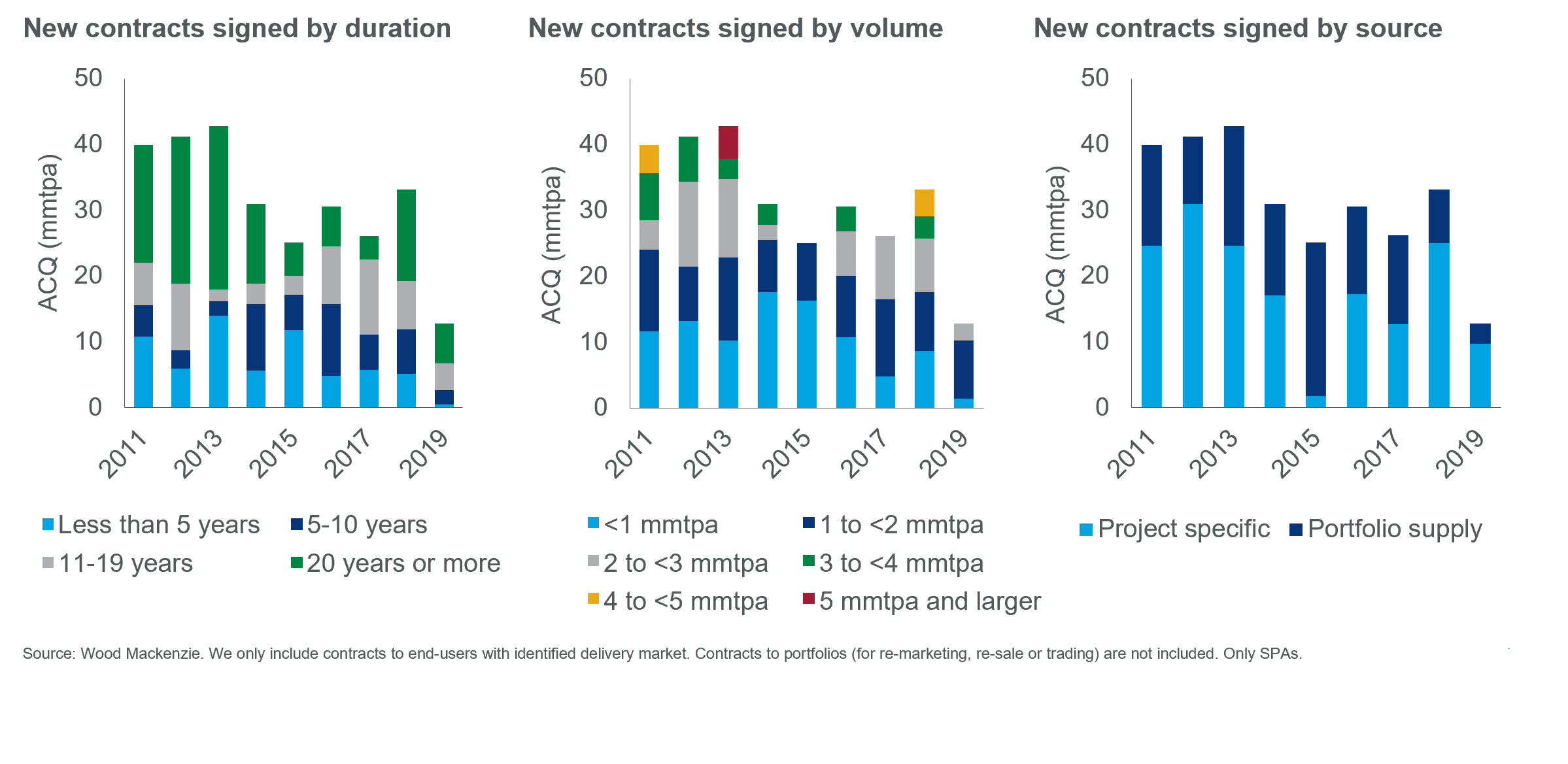

The LNG contracting market picked up in 2018 – with large and long-term deals coming back.

Companies with pre-FID projects have been very active marketing volumes since then. Oil indexed contract prices recovered in 2018 driven by big deals out of Mozambique and Qatar into Asia.

Medium term five-year deals also edged up (for example PNG) and Henry Hub linked LNG contracts also increased driven by new US deals.

Giles Farrer presents at our Gastech booth K330.

17 September, 7:15am CDT:

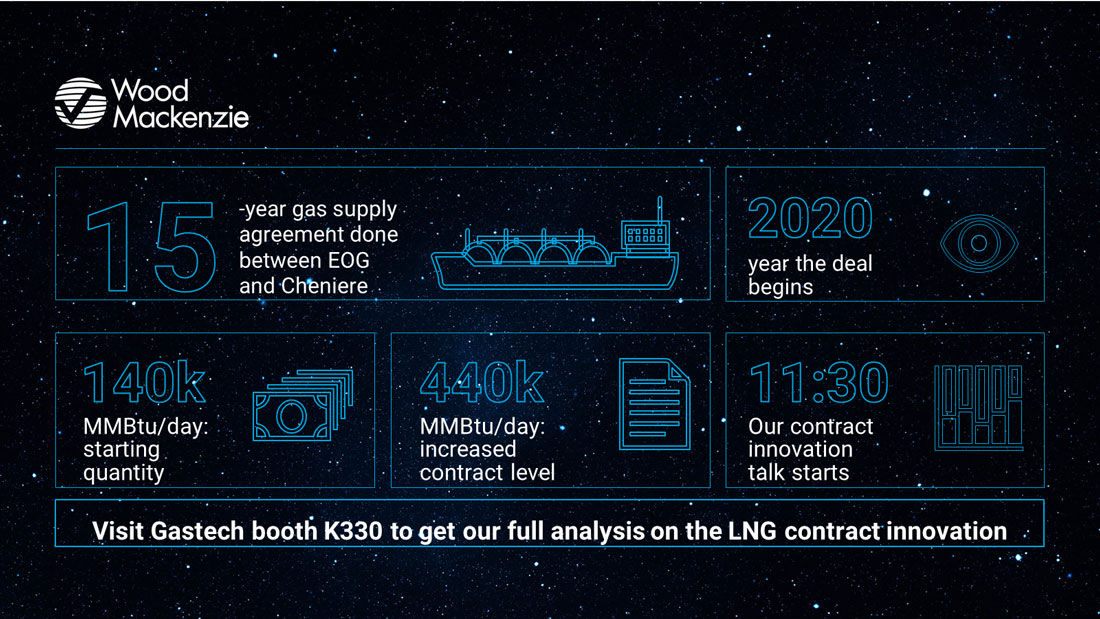

US LNG exporter Cheniere announced its latest gas sales agreement at day 1 of Gastech. Cheniere inked a 15-year deal to purchase gas from producer EOG. The pricing mechanism for the exchanged volumes is two-pronged; part will be indexed to the Platts Japan Korea Marker (JKM), while the rest sold by EOG to Cheniere will be marked against the US Henry Hub basis.

Join me at the Wood Mackenzie booth K330 at 11:30am today to hear my thoughts on this deal as I dive into the latest trends in LNG contract innovation.

Giles Farrer presents on LNG contract innovation at booth K330.

16 September, 4:00pm CDT:

Three natural gas price hubs in South Texas – Katy, Agua Dulce and Houston Ship Channel (HSC) – have historically traded in a tight range of one another.

As North American gas production booms in the Permian and Eagle Ford, this dynamic will shift. Before long, the pricing trends in Katy and Agua Dulce will peel away from the values at the Houston Ship Channel.

The reasons for the forthcoming divergence are complex and principally driven by the ‘last-mile’ limitations of the pipeline grid between Katy to HSC, and Agua Dulce to HSC. Much of the future story will depend on future takeaway pipeline buildout and destination of Permian projects. The production growth spurred by these new pipelines will also play a role.

Stop by booth K330 on Wednesday afternoon as I dive into the details about South Texas pricing trends. My presentation will start at 3:00pm.

16 September, 12:15pm CDT:

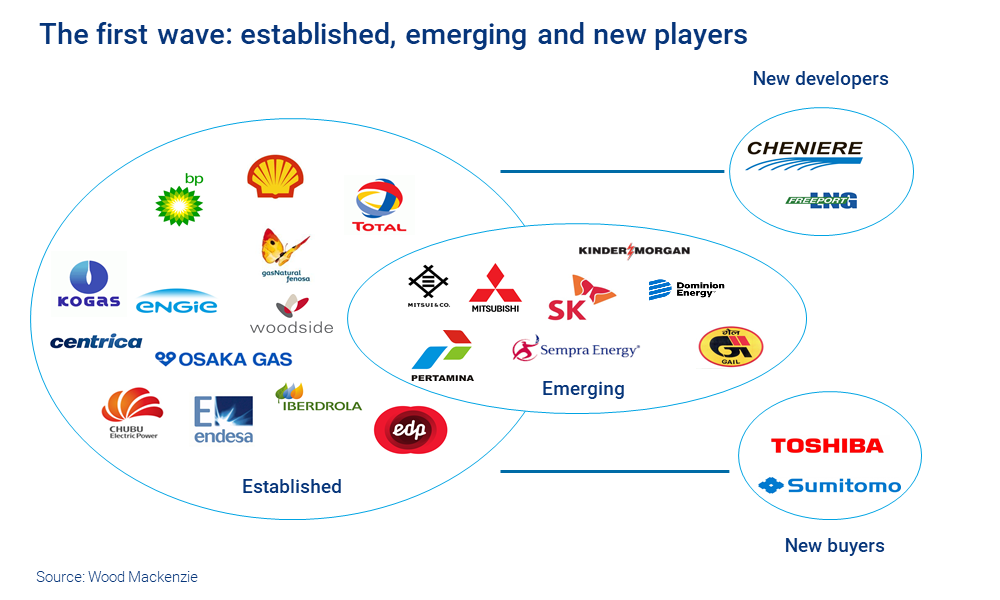

US LNG projects have made significant commercial progress in the last year. There is no longer any question about whether there will be a second wave – it is a reality. Some 30 mmtpa of US LNG has taken FID in 2019, as part of what will be a record year for LNG FIDs globally.

Developing this new wave will be different from the first. Getting to FID will require a deeper focus on gas sourcing within a transitioning US market, where the opportunity to optimise idle regas facilities and repurpose brownfield pipelines is quickly disappearing.

As market participants position themselves to catch the second wave, commercial structures are changing. Join me at Gastech on Thursday, 19 September at 11:30am CDT. I'll discuss my ideas on how to make money on the second wave of US LNG.

Kristy Kramer presents at Gastech on Thursday, 19 September.

13 September, 11:30am CDT:

The European gas landscape continues to evolve. LNG oversupply has finally materialised – flooding European markets. And as Russian pipe exports persist, hub prices have crashed. Our latest figures show that these low prices are set to continue.

Meanwhile, resilient demand and declining indigenous production mean Europe’s import dependency is growing. And the global emphasis on a low-carbon future is a driving force of industry-wide change.

European utilities retain several incumbency advantages. They hold long-term contracts, established customer relationships and access to infrastructure. And an inherent understanding of Europe's complex regulatory environment.

However, they also have the most to lose. Join me at 2pm Tuesday, 17 September, at Room 206 & 207 at Gastech. I'll present on European Utilities' LNG buying appetite.

Murray Douglas presents at Gastech on 17 September.

12 September, 8am CDT:

The rising influence of four commodity trading houses is shaking up the global LNG market.

Within just a few years, Trafigura, Vitol, Glencore and Gunvor – some of the most influential traders in the oil market – have played a part in transforming waterborne LNG trade. Changes in the market, such as growing flexible supply, short term shipping availability and buyer fragmentation have facilitated their rise. Allowing the players to move from exchanging the occasional spot cargo to controlling nearly 10% of worldwide trade.

What’s their secret? High risk tolerance, ability to execute trades quickly and experience from other commodities.

Giles Farrer speaks on the LNG trade dynamics panel at Gastech on 19 September.

10 September, 8:15am CDT:

US LNG wasn’t always an exports story. The first construction boom was aimed at imports. Six new LNG regas terminals started between 2008 and 2011, including five large facilities in the Gulf Coast region. However, even before the last of these projects came online it became evident that the rise of domestic unconventional gas production meant that there was little incentive to bring LNG to the US.

As the US shale revolution took hold and the spread between US and international gas prices continued to widen, proposals for US LNG export projects increased. By the end of 2012, export permit applications filed with the US Department of Energy reached 243 mmtpa (32 bcfd), encompassing both brownfield redevelopments of existing regas terminals and greenfield proposals.

Stop by booth K330 at Gastech next week to hear my insights on how we're tracking the 2nd wave of US LNG.

9 September, 9:45am CDT:

The US shale revolution is one of the gas industry’s most remarkable stories. As well productivity and gas-to-oil ratios dramatically increased, the US emerged as the largest gas producer in the world – now comprising 24% of total global production.

And as the US low-cost resource base expands and production growth continues, it’s also helping to spur demand and create LNG opportunities, further strengthening North America’s market position. Read my post here for more details.