10 transaction themes for private equity and principal investors in 2024

We break down the key themes emerging for investors next year; from increased activity in the PV value chain post-IRA to new geothermal opportunities and hotspots

6 minute read

Prashant Khorana

Director, Power & Renewables Consulting

Prashant Khorana

Director, Power & Renewables Consulting

Prashant is Director, Data Product Owner – Asset Valuations within Wood Mackenzie's research and data organisation.

Latest articles by Prashant

-

Opinion

What we learned from conversations with power and renewables investors in 2024

-

Opinion

Underwriting Battery Energy Storage Systems (BESS) as an asset class

-

Opinion

10 transaction themes for private equity and principal investors in 2024

-

Opinion

What we learned from conversations with power and renewables investors in 2023

-

Opinion

How power and renewables investors should navigate the Inflation Reduction Act and recent power market volatility

-

Opinion

Who will foot the bill for the energy transition in Asia-Pacific?

Gracie Guidotti

Consultant, Americas

Gracie Guidotti

Consultant, Americas

Gracie is a consultant within the Americas with a focus on power & renewables and the energy transition.

Latest articles by Gracie

-

Opinion

Underwriting Battery Energy Storage Systems (BESS) as an asset class

-

Opinion

10 transaction themes for private equity and principal investors in 2024

Rohan Shayi

Consultant, Power and Renewables

Rohan Shayi

Consultant, Power and Renewables

Rohan works in the power and renewables consulting division.

Latest articles by Rohan

View Rohan Shayi's full profileAlthough public market equities in the power and renewables space have seen a significant pullback this year, we see opportunities in the value chain for Private Equity and Principal Investors (PIPE) at every stage in 2024.

Fill in the form on the right of the page to download your complimentary copy of our whitepaper on ‘10 transaction themes for private equity and principal investors in 2024’. Or, read on for a summary of three of the key themes we’ve identified:

1. Racking infrastructure and inverter segments might offer more differentiation in solar supply chain plays for investors. UL3741 is a negative development for microinverter OEMs.

Beyond panel and poly, solar racking infrastructure offers unique opportunities for investors to consider. Going from one solar panel OEM to another panel or inverter OEM might be easy for the same-sized format products. However, going from one supplier for racking infrastructure to another is more challenging. Higher switching barriers are partially attributable to the installation costs associated with racking. In some cases, labour hours for installation can be 30% higher. Furthermore, not all modules are compatible with all racking infrastructure.

On the inverter front, UL 3741: Standard for Safety for Photovoltaic Hazard Control outlined within NEC.690.12 is an update included in the 2020 and 2023 versions of the National Electric Code (NEC), is intended to ensure firefighters are kept out of hazardous current paths when responding to emergencies. UL 3741 adds another way for PV systems to reach compliance.

Historically, only module-level power electronic (MLPE) PV systems were considered compliant, allowing for a 30% y-o-y growth within MLPEs as the residential sector grew 40% y-o-y. 7 | 10 transaction themes for private equity and principal investors in 2024.

However, UL 3741 adds another way for PV systems to reach compliance; any system meeting one or both requirements is deemed compliant. Projects meeting the PV hazard control system (PVHCS) requirements will now be UL-certified. The PVHCS certification relies on testing, demonstrating that firefighters will not be exposed to life[1]threatening shock hazards.

Since the release of UL 3741, numerous PV systems from companies such as Sungrow, SMA, Unirac, and PanelClaw have been approved as alternatives to MLPE systems. However, the NEC 2020 and 2023 versions are only in effect in 31 states, meaning the UL 3741 does not apply in the remaining 19 states.

Ultimately, in states where NEC 2020 or 2023 are in effect, UL 3741 opens the market from primarily MLPEs to certified string inverter systems for increased consumer choice.

As such, we anticipate that UL 3741 will have punitive impacts on the MLPE market. This regime poses a potential downside risk for growth narratives outlined by SolarEdge and Enphase. Both companies attribute these decreases in revenue to unexpected cancellations, new tariffs in Europe and slower-than-expected installation rates. We think increased competition resulting from UL 3741 has also contributed to the topline erosion.

Further, Enphase recently released a residential EV charger that integrates into its solar-plus-storage system. Enphase’s foray into the EV charging sector raises questions about the resilience of its core business, as this horizontal move may indicate a potential lack of confidence in the performance of its primary operations.

Before this regulatory update, the microinverter market experienced substantial growth, primarily due to the role of MLPEs as the singular solution for meeting rapid shutdown requirements.

The introduction of UL 3741’s expanded spectrum of technology choices will likely alter the market landscape and challenge MLPE technology. Further to this regime change, the growth of new entrants, such as AP systems, poses a significant threat to competitors within the residential inverter space. While, in 2022, Enphase held an 88% market share in the microinverter market and SolarEdge 76% in the DC optimiser market, AP Systems is a growing competitor, holding a 10% market share within the microinverter market. As such, we recommend investors to take a cautious approach before investing in the MLPE market.

2. On the supply chain front, there’s been a frenzy of activity in the PV value chain over the past year after the IRA. Separating commodity products from differentiated ones is an essential imperative for investors. Not all equipment will be able to command pricing power over the decades.

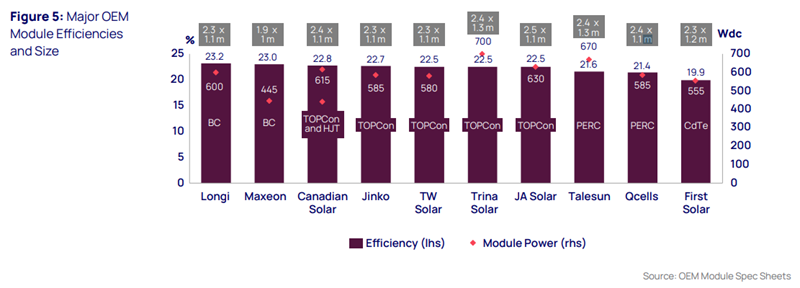

Solar module efficiency rates have increased from 16% to 23% in less than ten years. Given the potential of tandem and perovskite cells to far exceed 30% efficiency, historical negative sentiment around the lack of potential around solar output growth is no longer valid.

As of 2023, Back-Contact (BC) products have some of the highest on-market efficiency products, even beyond TOPcon and Heterojunction technology (HJT) panels. Even though BC products remain expensive for the general utility-scale market, higher output per square meter could make a difference in the residential solar market.

Physical sizing of modules currently varies across OEMs. As such, not all modules are interchangeable and physically mutable. Efforts are being made to standardise the sizing of medium-format modules at 2.38m by 1.13m, agreed to by several leading manufacturers such as Longi, Trina, Canadian Solar, and more.

As of 2023, the solar cell market share skews towards PERC cells 2023, but n-type cells will take most of the market share by 63% by 2025. It’s significantly more straightforward to retrofit PERC facilities for TOPCon modules. HJT and BC technology manufacturing require a steeper initial investment.

3. Geothermal opportunities will likely exist in hotspots where power contracts are falling off and in tandem with adjacent themes such as lithium extraction co-location.

We see geothermal as an optionality play for the next few years, as the required risk mitigation characteristics aren’t present, even for infrastructure investors targeting double-digit returns.

From a technology viewpoint, geothermal drilling looks like O&G regarding output growth trajectories. However, productivity growth per well hasn’t kept up in geothermal power plants over the past decade. Consequently, O&G wells today are ten times more productive than geothermal wells as of 2023.

Most developers agree that focusing on the flow rate is critical as the cost side of the equation is less relevant. Hot water is 100x less energy-dense than oil. As such, achieving a high and consistent throughput is the main driver for unit economics.

Although water used in geothermal facilities does not need to be drinking water, water loss is a concern. Developers who can build facilities that can control the loss of hot water are also advantaged, as the loss could be 1-2 litres per second in some facilities.

Thermal cooling is also an issue with geothermal wells. Unlike wind and solar, geothermal wells are designed for 15 years, with the potential for replenishment. But it’s highly plausible that the wells cool off before 15 years of use. As such, asset lifecycle modelling risks are a concern.

Transformers remain an issue on the cost front, but equipment issues are not the most significant when it comes to geothermal. Instead, the inability to model revenues with high levels of predictability is the core driver of why this asset class remains challenging to underwrite.

Like wind and solar, the permitting process requires six different National Environmental Protection Act (NEPA) reviews. Many permitting bodies remain understaffed, and full-cycle development takes around 8-10 years today. In comparison to O&G, geothermal requires several duplicative permits. Direct funding for regulatory bodies is also significantly lower compared to O&G.

Besides the challenges, we believe this space has some bright spots. In March 2023, Eavor and Sonoma Clean Power signed a long term PPA at a price point of US$70/ MWh. Eavor has stated that this price level is not economically viable for now, but with expected cost reductions, they can deliver commercially viable energy and capacity with a baseload profile in the US$70-80/MWh price range over time.

Lithium mining using geothermal power is another growth play that could emerge as a preferred business model for large mining operators. Due to the high brine content of lithium sites, geothermal sites often filter to the top. Colocating direct lithium extraction tech could unlock a significant amount of geothermal power. Such co-location would be significantly more straightforward since the resources are already developed, de-risked, and permitted for considerable seismic activity.

Learn more

To discover the rest of our 10 transaction themes for private equity and principal investors in 2024, please fill out the form on the right to download your free copy of the full whitepaper.