How power and renewables investors should navigate the Inflation Reduction Act and recent power market volatility

While the roadmap for power and renewables investing may not be straightforward, it’s worth understanding all the factors at play. Deciding where to play in the risk-reward spectrum is increasingly challenging, but the returns are set to be more rewarding than ever

5 minute read

Prashant Khorana

Director, Power & Renewables Consulting

Prashant Khorana

Director, Power & Renewables Consulting

Prashant is Director, Data Product Owner – Asset Valuations within Wood Mackenzie's research and data organisation.

Latest articles by Prashant

-

Opinion

What we learned from conversations with power and renewables investors in 2024

-

Opinion

Underwriting Battery Energy Storage Systems (BESS) as an asset class

-

Opinion

10 transaction themes for private equity and principal investors in 2024

-

Opinion

What we learned from conversations with power and renewables investors in 2023

-

Opinion

How power and renewables investors should navigate the Inflation Reduction Act and recent power market volatility

-

Opinion

Who will foot the bill for the energy transition in Asia-Pacific?

In 2023, capital allocation in the power and renewables sector is poised to play a crucial role in driving sustainable growth and maximising returns for investors. This is largely due to volatility around interest rates, inflation and treasury guidance around the Inflation Reduction Act (IRA).

Renewables and adjacent technologies provide for more than US$21 trillion in investment opportunities through to 2050, but it’s important to take every factor into account before investing.

Our recent insight, Capital Allocation Considerations for Power and Renewables Investors in 2023, takes a holistic look at global capex trends in the power and renewables space. The insight outlines the key considerations that capital allocators need to be aware of when choosing the right investments to make. All of the information in the insight is backed by the latest expert data and analysis from Wood Mackenzie’s power and renewable services, including our best-in-market energy transition platform, Lens Power.

Today, we’ll be breaking down just a couple of those valuable insights - the impact of the IRA and recent power market volatility on capital allocation decisions.

Understanding these transformative factors will enable investors to make informed decisions in 2023 and capitalise on the many emerging opportunities in the sector.

The impact of the IRA

Biden’s IRA contains US$500 billion in new spending and tax breaks that aim to boost clean energy, reduce healthcare costs and increase tax revenues. The IRA has significant implications for power and renewables investors – and is set to be even more impactful in 2023.

For example, before the introduction of the IRA, there were no major incentives for Original Equipment Manufacturers (OEMs) to relocate facilities across renewable energy. Now, there is a hard incentive for these OEMs to come to the US.

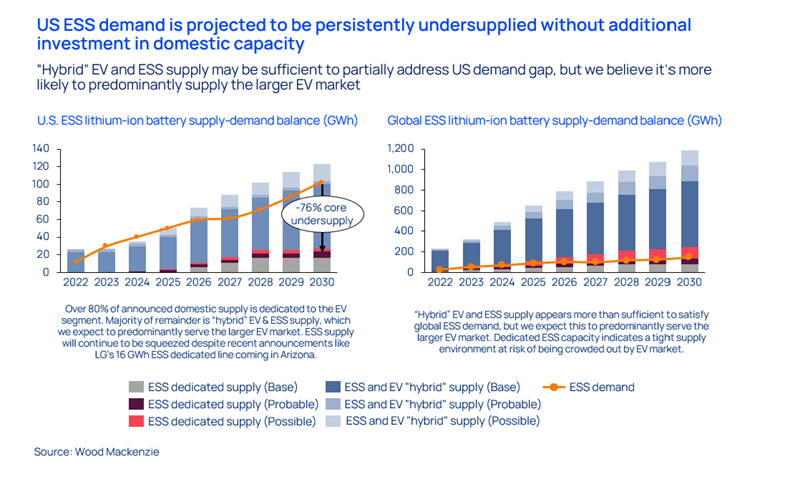

Current forecasts indicate that energy storage systems (ESS) demand in the US will increase steadily but will remain undersupplied due to a lack of manufacturing capacity in the West. On top of this, much of the US supply will not go towards standalone ESS but to the much larger electric vehicle (EV) market instead. The IRA provides some incentive for OEMs to build dedicated ESS-only manufacturing facilities in the US.

As a result, there is a significant opportunity for firms to take advantage of the battery manufacturing reshoring tax credits. Preliminary observations may indicate that vertically integrated firms can reap the rewards from this space. TESLA is a notable example of this type of manufacturer that was able to price up their megapack product by a staggering 70% over the past 2-3 years.

And while the IRA has turbocharged the green transition in manufacturing, we expect the total impact from the IRA to be upwards of three times the official amount allocated by the Congressional Budget Office based on GDP multiplier effects. The full dollar impact will be around US$2 trillion+.

The impact of power volatility on power and renewables investment

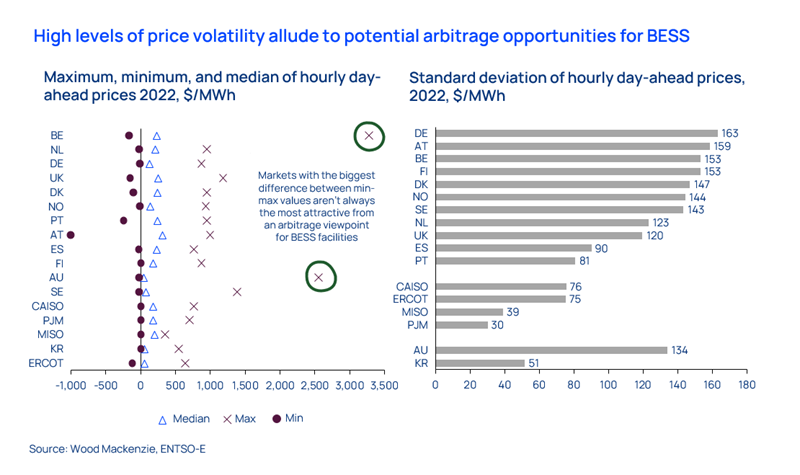

While it may be true that pricing volatility is typically associated with Battery Energy Storage System (BESS) revenue capture opportunities, it is not necessarily the case that the spread between maximum and minimum prices always will lead to a commercially viable BESS business case. Regulated revenue streams are also necessary to make BESS an investible asset class.

In fact, the standard deviation of day-ahead pricing is a better indicator of where attractive BESS markets lie. Germany, Austria, Texas, and Denmark are known potential markets for BESS siting, for example, as they do no register significant difference between maximum and minimum pricing compared to other markets.

Of course, interconnection and power volatility go hand in hand, and interconnection costs for recently completed projects in the US have doubled on average relative to 2009. Wood Mackenzie’s proprietary Levelised Cost of Energy (LCOE) analysis suggests that peaker gas might become easier to interconnect in the coming years, as the technology saw decreases in average interconnection costs. Still, gas could be an investment value trap if carbon taxes ramp up on a CO2/kWh basis.

However, renewable energy auctions conducted by several European countries are facing an under-subscription problem. This has been caused by a lack of available land suitable for new installations in many European nations and slow project permitting timelines. These unfavourable conditions for developers have slowed the achievement of long-term renewables targets in some large markets like Germany and the Netherlands.

Additionally, requirements to provide collateral in some Independent System Operators (ISOs) in the US have increased significantly in value. Some system operators have participation requirements that involve the submission of a surety bond or letter of credit of at least US$5 million, not including other fees. These growing financial requirements will likely prevent less credible developers from jamming the interconnection queues but could also be a barrier for new entrants in some jurisdictions.

And in the long-term? Looking ahead to 2050, we forecast installed capacity to grow faster than de-rated capacity. This mismatch in capacity indicates that the flexibility gap is growing, and raw GW (Gigawatt) addition is not a meaningful way of observing power sector decarbonisation. A lack of flexibility means that battery storage, demand response services, pumped-hydro storage, and non-wire alternatives, in general, will be necessary for a highly flexible and decarbonised power system.

Final thoughts

As power and renewables investors navigate the evolving landscape of capital allocation in 2023, understanding the impact of global capex trends such as the Inflation Reduction Act is paramount.

By leveraging these insights, investors can position themselves strategically to capitalise on emerging investment opportunities, drive sustainable growth and contribute to the global transition toward a low-carbon economy.

Learn more about capital allocation considerations for power and renewables investors in 2023

To learn more about the factors impacting power and renewables investments this year, fill out the form at the top of the page to download our full Capital Allocation Considerations for Power and Renewables Investors in 2023 insight.

Click here to read more about what our analysts have learned from recent conversations with power and renewables investors.

You can also learn more about how to assess the impact of the IRA and power market volatility – in both the long and the short term - using our wide range of power and renewables services, and our advanced energy transition platform Lens Power.

Our detailed coverage of power market fundamentals, solar, wind, energy storage and grid edge technologies make it easier to understand the rapidly evolving energy landscape, helping you make smarter, more profitable green investments.