Are power markets helping or hindering the energy transition?

The rise of renewables and dispatchable demand is putting power markets to the test. A redesign is vital.

1 minute read

The power sector has been a cornerstone of the energy transition so far. But as net-zero emissions goals become commonplace, the pace of change is increasing. Getting the design and timing of market solutions wrong could have serious consequences.

So what needs to change – and is it achievable? Peter Osbaldstone, Research Director, Europe Power & Renewables considers the path ahead.

Power market models are always evolving – but not always quickly

The essential function of electricity markets is to balance the affordability, security and sustainability of supply. In this context, sustainability applies to both environmental performance and commercial conditions of the system.

A range of market models exist to serve this cause, although many share common basic features. Centralised markets with prices set by the cost of marginal dispatch, most often from fossil-fuelled generation, are the bedrock of most major power systems today.

Market arrangements are not static. They routinely adapt to changing regulatory and commercial forces. However, due to their complexity and scale, it is typical for there to be a lag between these changes and the market response.

Centralised markets with prices set by the cost of marginal dispatch, most often from fossil-fuelled generation, are the bedrock of most major power systems today.

Market evolution is often a reaction to perceived short-comings in a market. In Europe, for example, national markets have been challenged by commodity price trends, weak electricity demand, nuclear and coal phase-outs and the increasing contribution of wind and solar. This is not to say the markets have failed. But it does mean that many companies have had to adapt their business models, and there have been both winners and losers.

What’s different now? The pace of change is increasing. Failure to keep up would impede the progress of both the power sector and the wider energy transition.

Decarbonisation is driving global change

At a global level, deep decarbonisation will dictate unprecedented change. Renewables are central to regional and national energy policies. And the ambition is increasing, with targets for 100% renewable energy and net-zero emissions taking centre stage.

As renewables become more competitive there is both an economic and environmental case for their deployment. Growth expectations are high. In Europe, the transformation is well underway, and renewables could dominate power supply within a decade.

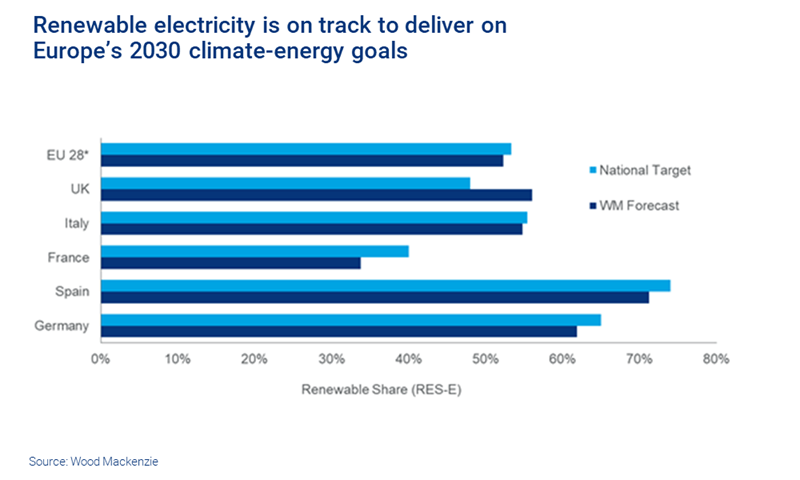

If European member states deliver their individual National Energy and Climate Plans, renewables will account for around 53% of power supply in 2030.

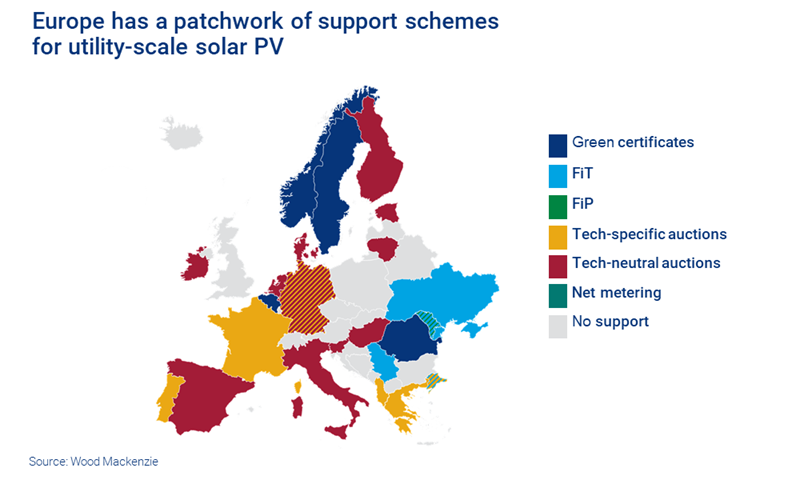

Renewables have required support to drive deployment and technological maturity. Tax-breaks, feed-in tariffs and auctions have helped to lower costs and support integration.

It has also been necessary to recognise that renewables are different from conventional sources of power. They’re smaller in scale and more fragmented, with variable production profiles. And they produce electricity with near-zero short-run marginal costs.

So what effect has this had? Lower levels of wind and solar contribution are not proving disruptive. Supply shares of 20-30% don’t appear to cause any sustained stress in well-established markets, such as the US or Europe. But as penetration levels increase, it becomes more difficult to manage volatility, peak demand and other grid services. The value of flexibility increases.

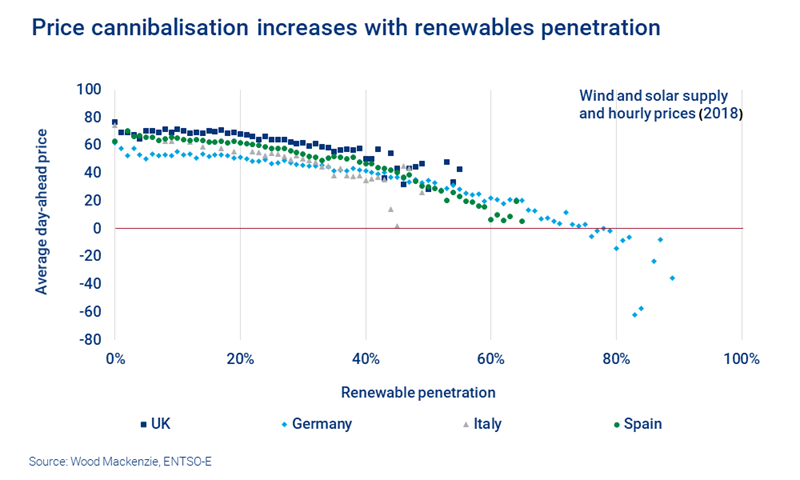

Importantly, at higher penetrations, wind and solar generators suffer increasing levels of price cannibalisation.

Growth in renewable power supply has two significant effects on market price formation.

1. Low or even negative power pricing, typically at peak generation times for renewables

This creates market uncertainty and impacts the viability of investment in renewables. This is particularly challenging for projects with exposure to wholesale market prices.

2. Lack of price signals to incentivise investment

Insufficient investment in flexible supply, transmission and distribution capacity threatens security of supply and grid resilience.

At higher penetrations, renewables could, therefore, undermine the system, while also weakening their own business case.

This is not just a supply-side story

As the power sector decarbonises, systems are becoming more decentralised. Declining costs, developing technologies and new business models are allowing grid-edge markets to emerge.

At the core of power sector transformation is a move from systems of dispatchable supply and non-dispatchable demand to non-dispatchable supply and dispatchable demand. This shift will be key to the market response.

But despite increased investment in new technologies and the blurring of traditional roles, the grid edge remains nascent in many geographies. And as a result the outlook for dispatchable demand is uncertain. Government and regulatory engagement is growing, but remains cautious.

What needs to be done?

The real test of power markets has only just begun. No large power market in the world currently gets more than 30% of its annual supply from wind and solar. The rise of the grid edge is also still in its infancy. But that will change. And when it does a timely response will be critical.

In the short-term, flexibility and dispatchability must attract appropriate value. Capacity remuneration arrangements, or similar incentives, are likely to be required intra-day. Balancing mechanisms must be effective. Correct market function, including locational signals, should support investment in transmission and distribution infrastructure, energy storage and dispatchable demand.

The risk of price cannibalisation destroying the value of merchant-exposed renewables must be managed.

Long-term markets must deliver an appropriate technology mix, and support emissions targets. The risk of price cannibalisation destroying the value of merchant-exposed renewables must be managed. Market instruments, such as competitive auctions or power purchase agreements (PPAs), will continue to feature.

There is still a role for central administration of power markets, which will continue to shape commercial frameworks and ensure that market objectives are met. The rise of renewables and dispatchable demand will require changes to grid development and operation. A more holistic approach, that encourages companies to invest in infrastructure and technology, is needed.

Are power markets being redesigned to meet new market realities?

In short, no – not yet. Development continues to be the result of piecemeal tinkering in policy and regulation. Examples include national capacity market arrangements in Europe, Clean Peak Standards in the US and changes to “embedded benefits” in the UK. (You can read more about the dynamics of the US market in: The carbon-free clause and the next stage of power sector transformation.)

Such measures are typically focused on near-term shortcomings and are often fraught with unintended consequences. Managing the complex interrelation of market instruments is no easy task.

Inadequate or poorly implemented market change is a risk to the energy transition. Successfully navigating the regulatory trilemma of affordability, security of supply and sustainability will be paramount.

The wider sector must take notice

Zero emissions power systems are not possible under current market arrangements. Power markets must respond to this challenge. That calls for the integration of multiple, interoperable market elements – and corporate strategies and business models must also adapt.

The playing field will continue to transform. Market decision-makers – governments and regulators – will drive incremental change that must be closely monitored by all players. Companies that are positioned to respond to uncertainty and unfolding market dynamics will have a distinct competitive advantage.

Want a closer look at the European power markets? Complimentary research highlights

The latest report from our new Europe Power & Renewables Service includes:

- European power market transformation

- A summary of our long-term outlook to 2040.

Fill in the form on this page for a copy of the highlights.