Asia’s frozen upstream M&A sector begins to thaw

Regional players are showing that deals can get done as recovery gathers momentum

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

Global upstream M&A is bouncing back. The recent increase in asset acquisitions saw North American deal flow hit its highest level since 2019, while across the rest of the world M&A activity is showing signs of a gradual – if uneven - recovery from the abyss of 2020. This isn’t a huge surprise, given the horrendous challenges companies faced last year as lockdowns and crashing oil prices paralysed the market. But with recovery in prices and demand, and success with ongoing vaccine rollouts, optimism is creeping back into the market.

Asia Pacific is playing a key part in this story. Following a miserable 2020, in recent weeks both Shell and Repsol have sold assets across Southeast Asia, clear evidence that there’s business to be done in the region. WoodMac’s upstream team now identify almost US$14 billion (NPV10, 2021) worth of assets up for grabs across Asia Pacific – with almost the same again in the speculative bucket. The Majors and large independents as the key sellers, as portfolio high grading and the energy transition continue to drive further non-core divestments as strategies adapt.

Two key challenges remain: finding enough buyers and securing finance to close the level of opportunities coming to market. But there are reasons for optimism, with several serious buyers emerging, even if not all yet have access to enough capital. With the ice starting to melt on the region’s frozen upstream M&A market, I spoke with Alay Patel and Andrew Harwood from our APAC upstream research team to hear how much further the rebound could go.

How strong is the recovery in Asia’s upstream M&A market?

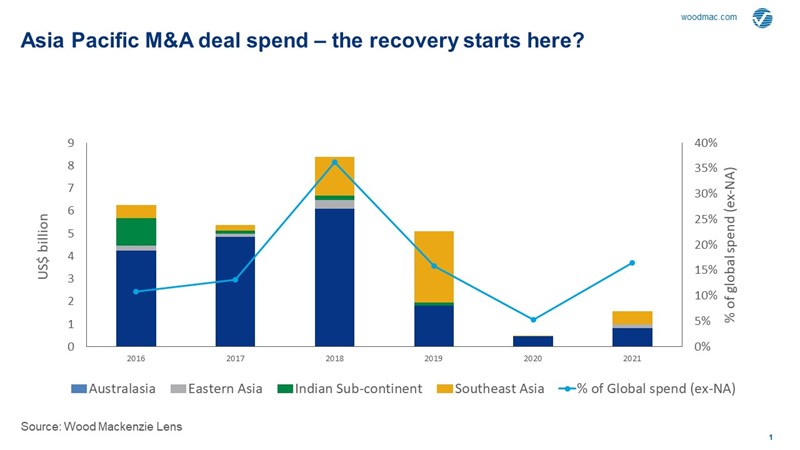

Given the shocker that was 2020 then even a modest uptick will be a classified strong recovery. Asia Pacific upstream deal spend collapsed last year, with only a sliver over US$400 million of assets sold. To put this in context, the region accounted for less than 5% of global upstream M&A spend, excluding North America: In 2018, Asia’s share was above 35%.

But we’re off to a much stronger start in 2021. Local conglomerate Udenna acquired Shell’s stake in the Malampaya project in the Philippines as Shell continues to sharpen focus on core upstream areas, while Repsol has divested assets in Malaysia and Vietnam to late-life specialist Hibiscus Petroleum. Year-to-date disclosed regional deal spend of US$1.6 billion is already over three times that of 2020.

US$14 billion of assets potentially coming to market – what, where and by whom?

The assets we highlight are either announced or strongly rumoured to be available for prospective buyers, including farm down opportunities. Of these, LNG projects account for more than half, with conventional shelf and onshore making up almost all other opportunities. In terms of project status, pre-FID assets dominate, with less than a third of the US$14 billion of assets up for sale currently onstream.

The Majors dominate the selling pool. This include ExxonMobil’s Malaysia portfolio and Ca Voi Xanh in Vietnam, Chevron looking to sell its stake in Indonesia’s IDD and the North West Shelf in Australia and Shell putting its positions in mature, shallow water oil and gas fields in Sarawak up for sale. The Large Cap IOCs are also active, with ConocoPhillips potentially looking to exit the Corridor PSC in Indonesia as it further streamlines its global portfolio and BHP looking to offload its position in the Bass Strait and Kipper fields.

Other sellers include PERTAMINA farming-down in the Rokan PSC in Indonesia and Santos looking to do the same at the pre-FID Dorado project in Australia. Meanwhile there have been recent smaller scale deals such as Jadestone entering Malaysia and Cue Energy/NZOG taking a position in Australia. Eni has now exited Pakistan

And it doesn’t end there. We categorise a further US$13 billion of assets as potential farm-downs or speculative candidates for divestment as portfolio rationalisation, balance sheet rebuilding and decarbonisation encourage future divestments.

Read also:

Are regional players capable of picking up these opportunities?

Quite possibly yes. Looking at two of the most high-profile recent deals, it has been smaller, local companies that have agreed deals. Firstly, Shell signed an agreement with Udenna Corporation to sell its 45% stake in the Malampaya Service Contract 38 (SC38), offshore Philippines. Udenna will pay a base consideration of US$380 million, plus up to a further US$80 million contingent on achieving license extension and certain commodity prices.

The acquisition takes Udenna’s interest in Malampaya to 90%, having bought Chevron's 45% stake in March 2020. And while it’s expected Udenna will face challenges managing a mature and depleting deepwater gas asset, and will need to secure a contract extension to sustain cash flow from the asset beyond 2024, it has shown the appetite for local players to enter the market and to agree terms with the Majors.

It's a similar story with Repsol’s agreement to sell a package of Malaysian and Vietnamese assets to KLSE-listed player Hibiscus Petroleum for an upfront cash consideration of US$212 million. In doing so, Repsol will progress plans to reduce its global carbon footprint, something Hibiscus Petroleum is likely to feel less immediate pressure to achieve.

More regional divestments to come from Big Oil?

Almost certainly, with several additional assets rumoured to be on the market, including Shell’s stake in the Masela PSC and ExxonMobil’s operated stake in the Cepu PSC, both in Indonesia. As last week’s events showed, stakeholders are intensifying pressure on Big Oil to speed up action on climate change, increasing the prospect of all the Majors selling significant chunks of their upstream portfolios in the future and assets in Asia Pacific will inevitably be a part of this.

Attention will continue to focus on who could buy these assets. But as we’ve seen this year, regional players are already making a splash and are likely to be the key target buyers for future disposals. In addition, private equity-backed buyers may also make moves as they adapt their strategies to a rapidly evolving upstream outlook. Divesting in Asia Pacific was never going to be easy, but there are clear signs the region’s upstream M&A sector is coming out of hibernation.

APAC Energy Buzz is a weekly blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.

Some US$14 billion of assets potentially coming to market – what, where and by whom?

The assets we highlight are either confirmed as on the market or strongly rumoured to be available for prospective buyers, including farm down opportunities. Of these, LNG projects account for more than half, with conventional shelf and onshore making up almost all other opportunities. In terms of project status, pre-FID assets dominate, with less than a third of the 6.4 bnboe of resource up for sale currently onstream.

The Majors dominate the selling pool. This includes ExxonMobil’s Malaysia portfolio and Ca Voi Xanh in Vietnam, Chevron’s stakes in Indonesia’s IDD and the North West Shelf JV in Australia and Shell’s non-operated mature, shallow water oil and gas fields in Sarawak all up for sale. The Large Cap IOCs are also active, with BHP looking to offload its mature Bass Strait position in Australia, Woodside searching for partners for its flagship Scarborough LNG development and ConocoPhillips considering an exit from the Corridor PSC in Indonesia as it further streamlines its global portfolio.

Other sellers include PERTAMINA farming-down in the Rokan PSC in Indonesia and Santos looking to do the same at the pre-FID Dorado project in Australia. Meanwhile there have been recent smaller scale deals such as Jadestone Energy entering Malaysia and Cue Energy/NZOG taking a position in Australia. Eni exited Pakistan after selling its stakes to a local entity.

And it doesn’t end there. We categorise a further US$13 billion of assets as potential farm-downs or speculative candidates for divestment as portfolio rationalisation, balance sheet rebuilding and decarbonisation encourage future divestments.

Are regional players capable of picking up these opportunities?

Quite possibly yes. Looking at two of the most high-profile recent deals, it has been smaller, local companies that have agreed deals. Firstly, Shell signed an agreement with Udenna Corporation to sell its 45% stake in the Malampaya Service Contract 38 (SC38), offshore Philippines. Udenna will pay a base consideration of US$380 million, plus up to a further US$80 million contingent on achieving license extension and certain commodity prices.

The acquisition takes Udenna’s interest in Malampaya to 90%, having bought Chevron's 45% stake in March 2020. Taking on Shell’s organisation and staff will enable Udenna to manage and extend the life of the mature and depleting deepwater gas asset. And with existing midstream and downstream interests in the Philippines, Udenna typifies the type of local player that can find new value in an ageing asset. Local connections should also help in securing a contract extension to sustain cash flow from the asset beyond 2024.

It's a similar story with Repsol’s agreement to sell a package of Malaysian and Vietnamese assets to KLSE-listed player Hibiscus Petroleum for an upfront cash consideration of US$212 million. In doing so, Repsol will progress plans to reduce its global carbon footprint, something Hibiscus Petroleum is likely to feel less immediate pressure to achieve. For Hibiscus, the opportunity to add near-term production as prices strengthen is a compelling story for local investors.

And it’s a good thing for the region’s upstream sector, as these new owners bring new investment and a greater focus on recovering additional resources, stimulating activity and providing much-needed tax revenues for host governments.

More regional divestments to come from Big Oil?

Almost certainly, with several additional assets expected to come to market in the next 12 months, including Shell’s stake in the Masela PSC and ExxonMobil’s operated stake in the Cepu PSC, both in Indonesia. As last month’s events showed, stakeholders are intensifying pressure on Big Oil to accelerate action on climate change, increasing the prospect of all the Majors selling significant chunks of their upstream portfolios in the future - assets in Asia Pacific will be inevitably be a part of this.

Attention will continue to focus on who could buy these assets. So far this year, regional E&P players are making a splash, but we also anticipate a role for private-equity and infrastructure investors, targeting steady cash flow from low-risk, producing portfolios. Divesting in Asia Pacific was never going to be easy, but there are clear signs the region’s upstream M&A sector is coming out of hibernation.

Read more: Asia Pacific Upstream M&A watchlist - , what, where, who and why?

APAC Energy Buzz is a weekly blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.