Sign up today to get the best of our expert insight in your inbox.

What’s driving the upstream revival in Southeast Asia?

Four reasons the industry has started to invest again

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

What comes after the Permian for IOCs?

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

Global upstream update: diverging development strategies in Latin America, investment at risk in Africa, and Kazakhstan supply tensions explained

-

Opinion

Is oil price volatility a threat to upstream production, investment and supply chains?

-

Opinion

Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

The Edge

Why upstream companies might break their capital discipline rules

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus leads our benchmark analysis of global Pre-FID delays, and deep water developments.

Latest articles by Angus

-

The Edge

Why upstream companies might break their capital discipline rules

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

How to make upstream licensing work

-

The Edge

What’s driving the upstream revival in Southeast Asia?

-

Opinion

A two-decade decline in exploration is driving the need for carbon neutral investment in Australia’s upstream sector

-

Opinion

Asia Pacific upstream: 5 things to look for in 2024

Joshua Ngu

Vice Chairman – Asia Pacific

Joshua Ngu

Vice Chairman – Asia Pacific

Joshua advises clients across upstream, gas, LNG, downstream, petrochemicals and energy transition.

Latest articles by Joshua

-

Opinion

Is Indonesia’s domestic gas supply in crisis?

-

The Edge

Walking Japan’s energy tightrope

-

The Edge

Five themes shaping the energy world in 2025

-

The Edge

What’s driving the upstream revival in Southeast Asia?

Southeast Asia’s mature upstream sector appeared to be in terminal decline for the best part of the last decade. New investment and discoveries were dwindling, with the Majors heading for the exit. But over the past year or two, the industry mood and flow of capital have both swung to the positive.

Angus Rodger and Joshua Ngu, our Singapore-based regional experts, identify four main drivers behind the revival and how it might be sustained.

First, governments across the region recognised they needed to bolster energy security and affordability in the wake of the pandemic and Russia’s war with Ukraine.

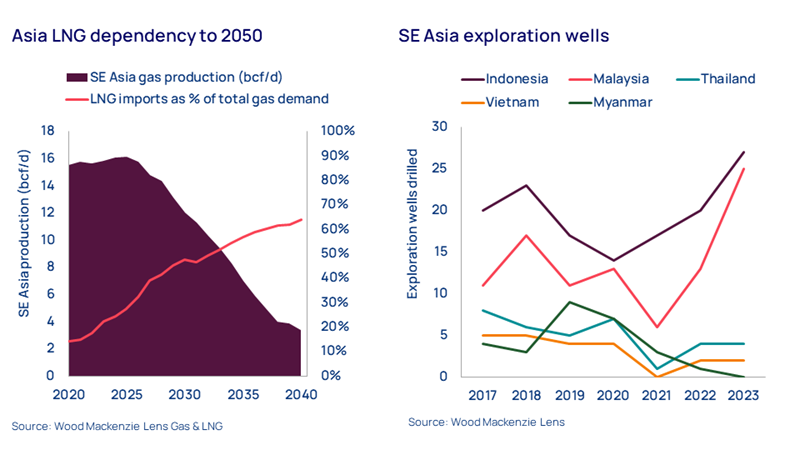

Gas demand growth is a given in Southeast Asia, due to its central role in delivering economic growth and decarbonisation. But with domestic gas production declining, imported LNG volumes are rising sharply. Thailand is a prime example – imported LNG is set to rise from 15% of total gas supply in 2021 to over 50% by 2030. Good news for LNG marketers but bad news for a domestic market facing higher prices and volatility.

Second, rising LNG imports have refocused attention on Southeast Asia’s domestic upstream sectors. Governments have set their sights on attracting investment and rebooting exploration – fiscal terms have been improved and exploration acreage aggressively marketed. This more progressive approach in some countries includes targeting carbon capture, advantaged barrels and infrastructure-led exploration.

Malaysia’s state NOC and regulator, PETRONAS, has been the most successful. Fiscal changes included the introduction of the shallow-water enhanced profitability terms and tweaks to existing terms for late-life and small-field assets. Malaysia marketed these enhanced fiscals to the upstream industry with spectacular results. A total of 41 blocks were awarded from 2021 to 2024 YTD, up from just 15 blocks between 2017 and 2020. The country’s most prospective areas are now fully licensed. Indonesia has followed its neighbour and enhanced its fiscal terms.

These bold moves are already paying off. The number of exploration wells in Indonesia and Malaysia has doubled since 2021, and 2023 delivered Southeast Asia’s best results in over a decade, including several significant finds.

Twenty discoveries in Malaysia from 25 wildcats is a remarkable success rate, adding over 1 billion boe of greenfield resource. Together with Eni’s 650-million boe Geng North and Harbour Energy’s 580-million boe Layaran gas finds in Indonesia, these discoveries catapulted the region’s deepwater sector towards the top of our global scoreboards, rubbing shoulders with elite global E&A hotspots like Guyana and Namibia.

Third, M&A is proving a further catalyst to growth. Deals like TotalEnergies’ US$1.4 billion acquisition of the highly contested Sapura OMV JV in Malaysia and Eni’s purchase of Chevron and Neptune’s Indonesian assets are key to unlocking growth opportunities. In both cases, exploration and optimisation will leverage the upside from established infrastructure and gas markets.

Fourth, substantial new projects are progressing. Last month Eni had four separate deepwater projects approved by the government of Indonesia, a record for both country and operator. We expect Eni will soon launch a process to sell down and monetise its high equity stake (about 80% on average). The opportunity to access net resources of over 1.5 billion boe with easy access to Indonesia’s LNG export infrastructure will be hotly contested among IOCs, NOCs and even other Majors.

But even all these positive steps won’t propel southeast Asia towards gas self-sufficiency. The ask is simply too big. However, if the sector’s cost, carbon and executional barriers can be removed, it can seek to close the gap.

What can regulators do?

Foster continued exploration and, crucially, nurture the project development pipeline. The industry’s eagerness to chase fresh opportunities will quickly wane if the latest batch of discoveries are left on the shelf to go stale.

It also means making bold decisions about legacy discoveries. Domestic price caps need reconsidering while approval processes need simplifying and expediting. In certain cases, fiscal incentives will be required to breathe life into mothballed assets.

After years in the doldrums, Southeast Asia’s upstream sector is finally enjoying a renaissance. So far so good. But for the region to make a significant dent on its rising LNG imports, that momentum must be maintained.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.