Biden, China and politics of energy

Climate change, jobs and US energy exports are all in focus

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

As is custom, following Sunday’s call by American news networks in favour of Joe Biden, governments around the world began offering their congratulations to the president-elect. Among the notable exceptions was China. At the Foreign Ministry’s press conference the next day, a spokesperson commented that China “noticed that Mr Biden has declared election victory”, but that any response would have to wait until a final result is determined by US law.

Correct, of course, but out of step with diplomatic protocol and perhaps setting the tone for relations with the Biden administration: formal, restrained and, after a tempestuous relationship with President Trump, notably less volatile. But talking tough on China is a rare bipartisan topic in Washington and it is unlikely Beijing expects any significant change from the president-elect.

As the two largest energy markets and carbon emitters, US-China relations have major implications for energy and climate change. Much remains unknown. As the new administration looks to take the US back into the Paris climate agreement, will the US and China work together on tackling global warming? Is the January 2020 Phase One trade deal, intended to see China purchasing an additional US$52.4 billion of energy exports, dead in the water? Or could US crude and LNG exports to China surprise to the upside?

Tackling climate change – collaboration or competition?

Addressing climate change was core to Joe Biden’s election manifesto. And while it remains to be seen how much can be achieved, particularly if faced with a hostile Senate, the future administration has pledged to rejoin the Paris Agreement and to set the country on a pathway to net-zero emissions by 2050.

Both goals immediately afford the US a much stronger position on climate change leadership. What is less clear is whether this will be a source of future conflict with China or an opportunity for greater collaboration.

Achieving net-zero is fundamentally about taking action at home, but at the same time the Biden administration’s broader goals on climate change will be harder to achieve without actively engaging with Beijing. Agreeing targets, measuring progress and penalising non-compliance will be more achievable through multilateral collaboration. China is critical to this, not only in terms of domestic policy but also the ability to help move other countries towards change.

Technology is an area of potential conflict. China dominates clean energy industries including solar PV manufacturing and the battery value chain. Much of its clean energy technology is already relatively free from American content, and drafts of the 14th five-year plan and the 2035 vision show China further strengthening R&D spending on key technologies to further debottleneck any US supply chain restrictions. I expect China will look to fast-track development of relevant technology to accelerate not only its own energy transition but to also dominate exports to other markets.

If this leads to a perception that the US is falling further behind in the race to lead in these technologies, pressure for increased government intervention is likely to grow. And as China ramps up investment, this could irk a Biden administration intent on protecting domestic jobs and ensuring that the country’s energy future is “made in all of America by all of America’s workers”.

Read also: The Edge - A Biden administration: implications for the energy industry

Oil imports and the ailing Phase One trade deal

Under the January 2020 Phase One trade deal, China agreed to spend an additional US$52.4 billion on US energy exports. US crude is the primary purchase, with China needing to import close to 1 million b/d in both 2020 and 2021 to meet the deal. Higher imports of LPG, propane, ethane and LNG are also required.

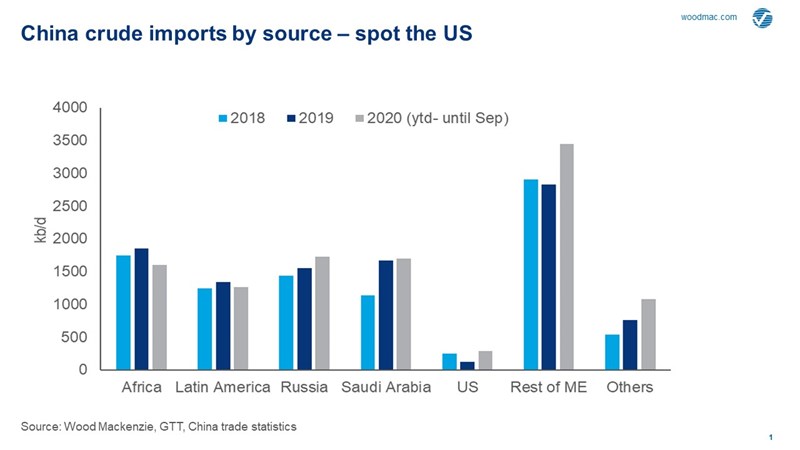

This clearly hasn’t happened and with the oil price collapse, US crude imports would now need to exceed 1.5 million b/d in 2020 and 2021 for the deal to remain intact. As the pandemic cratered demand through Q1, US crude import volumes in the first half of 2020 were a paltry 55,000 b/d. Imports have since recovered and during July-September rose to around 800,000 b/d. But I think it is unlikely China will increase imports much further – falling US crude output (and exports) as operators have slashed budgets and high crude and oil product stocks in China make this challenging. Lower oil prices also means even more barrels are required.

I think we can now expect efforts towards a renegotiated US-China trade deal. A greater emphasis on traditional diplomacy may accompany this, but a revised deal between China and the Biden administration will be no easier to agree and enact than under President Trump.

Positive momentum for US LNG

As China considers how it might increase US energy imports, LNG looks positive. To support this, China could further ease restrictions on US LNG. A relatively straightforward step would be to extend the current tariff exemption period, leading to a potential lowering of the import tariff in a future round of US-China trade talks and helping to meet demand which has remained resilient through the pandemic.

There is already noticeably reduced concern among Chinese buyers around resuming US LNG imports under both contract and spot deals. After an almost year-long hiatus, China resumed US LNG imports in April this year, and monthly volumes have since recovered to 2018 levels. Last week’s initial agreement between Foran Energy and Cheniere for 26 cargoes over the next five years is a further positive signal of Chinese buyer interest in US LNG.

A bumpy ride ahead

While the style of US-China relations is expected to improve under a Biden administration, the substance is likely to remain broadly unchanged. US political orthodoxy sees China as a threat, particularly to US jobs. Protectionism remains in play, even as the US looks to re-engage with the WTO, the EU and, potentially, the Trans-Pacific Partnership.

There are avenues for improvement. A significant increase in Chinese purchases of US energy would be a positive step. China’s imports of US crude are now rising, and US LNG into China is a compelling story given its inherent flexibility. Across the energy spectrum, collaboration on climate change offers enormous potential. But with strategic competition rising, the stakes are high.

Read also: Five consequences of a Biden administration for US energy

APAC Energy Buzz is a blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.