Discuss your challenges with our solutions experts

Can conventional oil projects compete with L48 oil?

1 minute read

Harry Paton

Senior Research Analyst, Oil Supply

Harry Paton

Senior Research Analyst, Oil Supply

Harry is a member of four oil supply research team. His focus is developing oil price models and benchmarking assets.

Latest articles by Harry

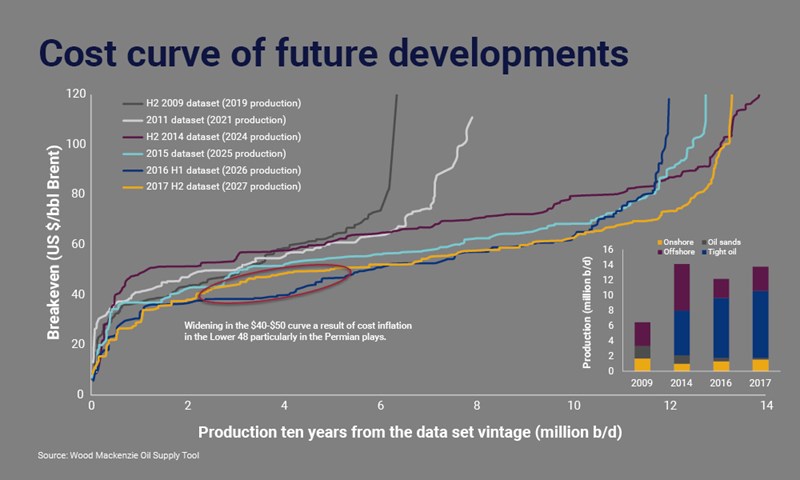

View Harry Paton's full profileUS tight oil has arrived with a bang over the last few years, disrupting the oil market. Many conventional greenfield projects were high cost and swept aside when oil prices crashed. But recently we have seen encouraging signs of improvement in conventional project breakevens. Costs have come down. With a flurry of deepwater Final Investment Decisions (FIDs) at the end of 2017, there is a mood of quiet optimism in the upstream sector.

Can conventional oil projects really compete with US tight oil?

Yes, some already do. World class discoveries in countries such as Brazil and Guyana with giant reserves and high quality reservoirs have project breakevens lower even than most tight oil plays. In other more mature sectors like the US Gulf of Mexico or the North Sea, operators have made great progress in bringing costs down and lowering break evens - but there’s still work to be done for many conventional projects around the world before they truly compete with the core tight oil plays.

US tight oil dominates

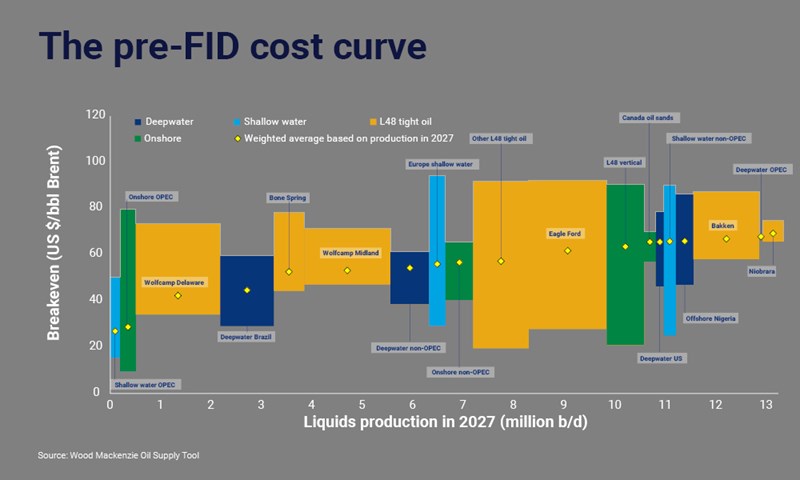

In 2014 we forecast the split of new production to be made up of 50% conventional projects and 50% US Lower 48. Now it’s closer to 30% conventional, 70% US Lower 48.

And the split could have been even more weighted to tight oil. Since 2016 we have seen offshore pre-FID production volumes increase by 0.6 million b/d – a good part down to the exploration success story in Guyana and Senegal.

Production from conventional pre-FID projects today is considerably lower than what we forecast pre-price crash. That's because of the large number of projects which have fallen completely out of the picture because they are uneconomic and have been delayed or cancelled. Most projects now in the mix have been changed in scope since first conception, often subject to a total reworking of development plans. Operator mentality has shifted to ‘value over volume’. This brings significant cost savings but takes a chunk out of production for many assets.

Why do we need new sources of supply?

To fill a supply gap caused by declining legacy field production and projected growth in demand.

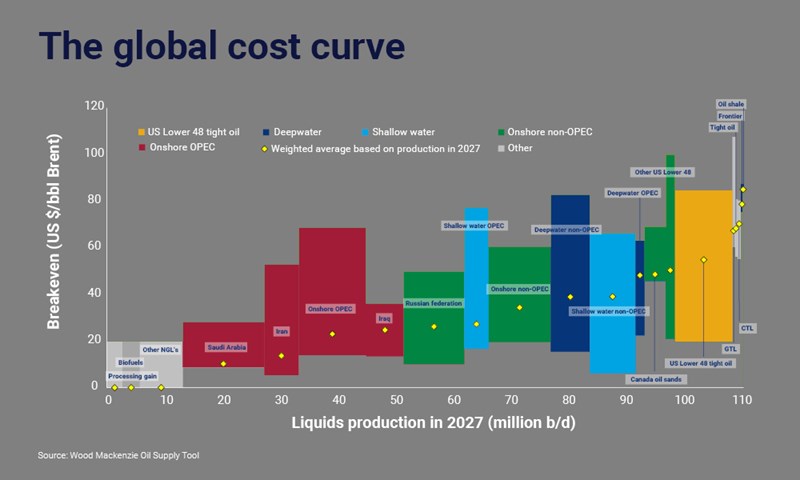

In our insight on decline rates, we calculated that non-OPEC conventional onstream declines stabilised at around 5% in 2016. We believe they'll stay at this level through 2020 before increasing to historic norms of 6%. Combine this with demand growth of around 8 million b/d and the resultant supply gap is around 23 million b/d in 2027.

So how will we fill the supply gap?

- US Lower 48 new drilling and pre-FID conventional projects

- Reserves growth (higher recovery from legacy fields through brownfield development and technological advances)

- Yet-to-find reserves from exploration

- Contingent resources (discovered fields with no current development plan).

The largest source by far is US Lower 48 future drilling and pre-FID projects. These are the future marginal cost barrels which will play a key role in setting the price in the next decade.

On a global perspective where does the US Lower 48 sit on the cost curve?

US Lower 48 is one of the most expensive sources of supply in 2027.

This may seem surprising given tight oil’s current competitiveness. But higher cost new drilling is required to offset declines from legacy production as core, ‘sweet spot’ acreage is drilled out. This contrasts with conventional resource themes which benefit from longer life assets providing a relatively cheap, stable base of production.

So is there hope for conventional greenfield projects?

Yes with a big caveat. The first wave of post-oil crash projects have either taken FID or will look to achieve FID in the next few years. Most of these projects have had significant work to bring costs down. Operators will now be turning an eye to the next wave of projects – the projects which don’t have firm development plans, and need more work to make them commercial. Meanwhile US tight oil continues to dominate the ‘new supply’ mix and is the one to beat.