Can Spanish renewables avoid becoming a victim of their own success?

Demand loss is increasing price cannibalisation and curtailment risk, but asset owners are adapting

4 minute read

Brian Gaylord

Principal Analyst, Global Power & Renewables

Brian Gaylord

Principal Analyst, Global Power & Renewables

Brian produces analysis across power and renewables technologies and regions.

Latest articles by Brian

-

Opinion

Iberian blackout: let the finger pointing begin

-

Opinion

Are EU NECPs missing the mark on REPowerEU targets?

-

Opinion

European power and renewables: what to look for in 2024

-

Opinion

Can Spanish renewables avoid becoming a victim of their own success?

-

The Edge

Three lessons for decarbonising power markets

Peter Osbaldstone

Research Director, Europe Power

Peter Osbaldstone

Research Director, Europe Power

Peter is a research director with more than a decade’s experience in European power and renewables markets.

Latest articles by Peter

-

Opinion

Iberian blackout: let the finger pointing begin

-

Opinion

European power in 2025: the pace, opportunities and challenges of the transition

-

Opinion

European power and renewables: what to look for in 2025

-

Opinion

The outlook for European power and renewables

-

Opinion

Is European power rising to the challenge of decarbonisation?

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

Despite healthy EU ambitions for the energy transition and the decarbonisation of power, and substantial progress already made in the market, Spanish renewables face some strong short-term headwinds.

At our recent Madrid breakfast briefing, we presented insights based on the findings from Wood Mackenzie’s Iberian power markets analysis, exploring the issues facing the Spanish power market and assessing how renewable operators are adapting.

Fill out the form to download an extract from our presentation in Madrid, or read on for a summary of the key takeaways.

To find out even more about the state of European power, join us at Enlit Europe 2023 to meet our team of European power experts and listen to our presentation on investing in the decarbonisation of post-crisis markets.

Why is Spanish power demand falling?

Demand losses have defined the power market in Spain in 2023, with ‘on grid’ demand down 4% year-on-year. This and other factors are creating an increasingly complex market environment for the owners of renewable assets, characterised by curtailment and cannibalisation.

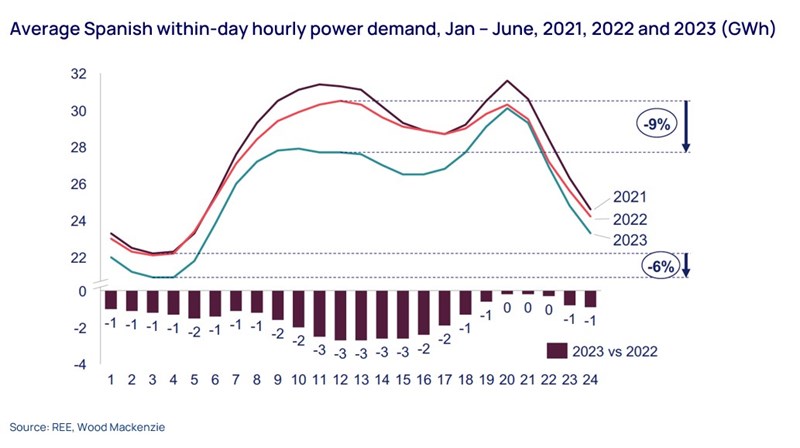

The chart below compares average hourly power demand in Spain for the January-to-June period in 2021, 2022 and 2023. In addition to daily demand having fallen 4% compared to 2022, demand during the midday hours – coinciding with the high point of production from solar – is up to 9% lower.

A variety of factors have combined to reduce demand. Firstly, the energy crisis led to high prices in 2022, along with the implementation of demand reduction policies aimed at deliberately reducing electricity use. Weather effects have also had an impact, reducing demand by around 0.7%.

A further, major factor is behind-the-meter generation. Distributed solar is increasingly being used as an alternative to grid-sourced power, further eroding the demand served by larger generators. A key driver of this change is the extraordinary growth in industrial, commercial and residential solar capacity over recent quarters, and the consequent leap in solar self-consumption.

An undesirable consequence of lower power demand is higher curtailment risk. Our analysis shows deviations between forecasted and actual renewable production that strongly suggest generation curtailment, effectively wasting usable energy. The issue is more frequently suffered by solar assets, but wind is not immune. Aside from anaemic demand, transmission system constraints create grid bottlenecks that also contribute to the problem.

What other issues are utility-scale renewable asset owners and developers facing?

While demand is falling, solar capacity in Spain is growing rapidly, with the peak in daily output up a whopping 48% in the last year. This is resulting in solar cannibalising its own capture price (the average price achieved for electricity produced) as generation capacity increases.

Spanish solar capture rates dropped to a new low of 65% of market average price in April 2023. By comparison, outside Iberia, solar capture prices have not fallen below 80% of market average price in any other market in 2023 – with the notable exception of Italy in March. With expected solar production growth in Spain of around 72% over the next five years, rates are likely to drop even lower in the future.

Increased price cannibalisation challenges the economics of existing assets and new investments, particularly – in the case of the latter – at a time when the ceiling prices of centralise auctions have not kept pace with rising project costs. Fortunately, asset owners and developers have other commercial and strategic options at their disposal.

How are asset owners adapting?

The good news is that asset owners are adopting a range of strategies to meet the challenges of curtailment and cannibalisation, although many have yet to reveal these in their financials.

- Project hybridisation: Creating hybrid wind-solar projects and/or adding onsite battery storage, which is ideally suited to solar but is also being paired with wind projects.

- Contractual agreements: Signing power purchase agreements (PPAs) with buyers to reduce market price risk – solar offtake agreements in Spain rebounded to the highest level of any major European market in 2023, although wind PPAs languished.

- Green hydrogen: Exploring opportunities to direct generation towards the production of clean hydrogen.

- Portfolio diversification: Investing in other locations internationally and/or diversifying into other generation technologies within the Spanish market.

- Negative pricing: Submitting bids with negative pricing in day-ahead markets to ensure dispatch.

- Lobbying: highlighting risks and concerns with policy makers to ensure that the essential need for grid investment and appropriate compensation for curtailed renewable power is properly understood and acted upon.

What’s more, despite the headwinds, favourable overall economics mean investing in Spanish renewables remains highly attractive. Our analysis indicates that both solar and wind developments in Spain will continue to enjoy clear merchant opportunities.

Learn more

Don’t forget to fill in the form at the top of the page to download an extract from the presentation. This includes a wide range of charts exploring current and future output, self-consumption capacity growth, forecast-versus-actual production, historic annual PPA contract volume and predicted 2030 levelized cost of electricity versus capture prices.

Wood Mackenzie is also proud to be sponsoring Enlit Europe 2023 this month. Peter Osbaldstone, our Research Director for European Power, will explore topics such as investing in the decarbonisation of post-crisis markets. Click here to find out more about how to attend Enlit Europe 2023 and meet our team of experts onsite.