Can the Middle East become a global hydrogen player?

A bp/Oman strategic partnership highlights the importance of location in green hydrogen project economics

1 minute read

The Middle East is positioning itself to retain a major energy provider seat in the energy transition. Across the region, countries are drafting visions and policies that vary greatly in scope and objectives. Some, such as the UAE and Oman, are targeting becoming major hydrogen hubs.

And for good reason. Once a niche market, hydrogen is becoming an increasingly attractive option to help achieve a zero-carbon future. Our forecasts show that global demand is set to increase two- to sixfold between now and 2050 under our Energy Transition Outlook and Accelerated Energy Transition scenarios.

Location matters in hydrogen economics

The recent agreement signed between the Sultanate of Oman and bp for the collection of data to evaluate renewable resource potential highlights the importance of location in green hydrogen project economics.

Location determines the consistency of power generation, a major driver of green hydrogen economics.

The resources to be developed are not below ground, but rather the best mix of wind and solar. However, the importance of capturing and analysing renewables data on a large scale is analogous to geological surveys aimed at identifying viable hydrocarbon reserves. Location determines the consistency of power generation, a major driver of green hydrogen economics. Based on our analysis, a more stable supply of clean energy results in lower project costs, as the requirements around energy and hydrogen storage can be optimised. The greater the level of variability of power supply, the greater the cost of buffer storage. The use of Renewable Energy Credits (REC), leveraging the grid as an energy storage buffer, is a short-term solution but becomes a problem if the proportion of renewables creates grid stability issues.

The entire green hydrogen value chain is nascent, so getting access to the best location for consistent renewable power has a significant impact on project values. The 8,000 km2 data collection area under consideration in the bp/Oman partnership will be analysed to identify the best spots for development.

By partnering with bp, a company well accustomed to performing large natural resource surveys, Oman is building strong foundations to meet its ambition to become a world-scale green hydrogen production and export hub. Our analysis indicates that Oman’s green hydrogen levelised costs could reach <2 USD/kg by 2030 – a very favourable position.

The best locations will give hydrogen project developers significant competitive advantages

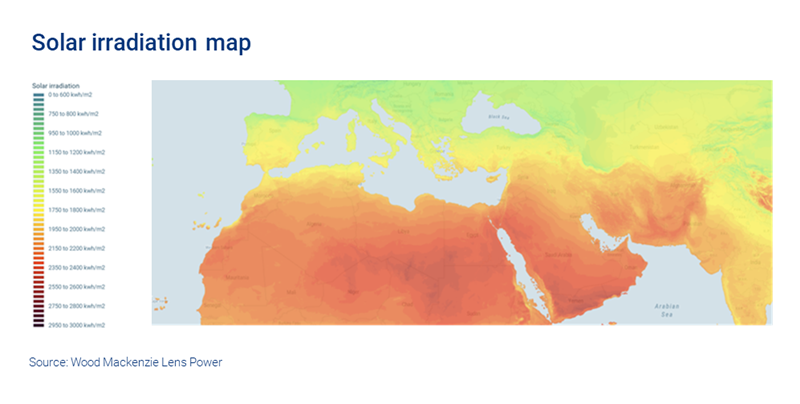

The Middle East does have plentiful access to renewable sources of energy. It sits in the top echelon for solar irradiance and its coasts are exposed to wind.

Globally, the threat of changes in weather patterns will trigger increased scrutiny of location choice for future green hydrogen developments. But will other countries with similar hydrogen ambitions open their renewable potential acreage for site surveying? If so, will they adopt a similar partnership model or look at alternate innovative approaches?

That remains to be seen. However, we do know the technical and economic project screening criteria of green hydrogen/ammonia projects are complex, and include factors such as access to water, proximity to export infrastructures and existing local hydrogen demand. But we also expect the ready availability of quality data to assess renewables resources to be a critical enabler. That data will facilitate the screening work of developers and provide confidence to potential investors.

Interested in the Middle East’s hydrogen ambitions?

We explored this topic in more detail in Can the Middle East become a global hydrogen player? Fill in the form at the top of the page for your complimentary report extract.